10 Things the GOP Doesn't Want You to Know for Tax Day

Tax Day 2016 arrives a few days late on Monday, April 18th. But the toxic talking points from the GOP are right on schedule. The usual Republican broadsides about "Gestapo-like tactics" from the Internal Revenue Service and its "armed personnel in flak jackets" have been joined by new sound bites from the GOP's best and brightest. At an Americans for Tax Reform conference hosted by Grover Norquist, Utah Senator Orrin Hatch warned that the Internal Revenue Service "is the most feared federal agency in the country." Rep. Bill Flores (R-Texas), the chairman of the conservative Republican Study Committee, declared the IRS is "ineffective, it's inept, it is crooked and it's vindictive." Meanwhile, Freedom Partners Chamber of Commerce apparently placed identical newspaper op-eds in all 50 states lamenting, "This year, Washington, D.C., is expected to rake in a record-breaking $3.36 trillion in tax revenue, $115 billion more than it did last year."

But while the Republicans are only too happy to remind you about the horrors of taxation in general and the IRS in particular, they'd prefer to stay silent on about their roles in gutting the agency, starving the U.S. Treasury of tax revenue and redirecting trillions of dollars to the very richest among us. Here, then, are 10 helpful Tax Day reminders the Republican Party want you to ignore.

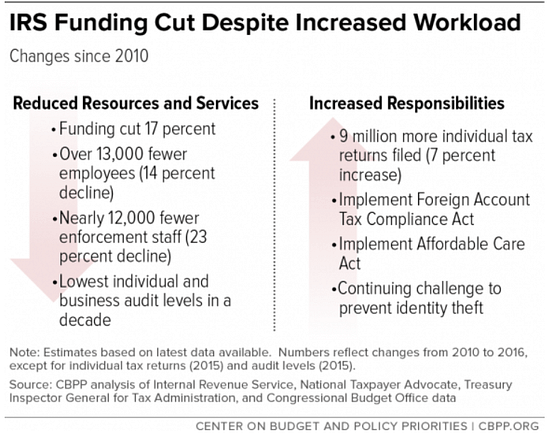

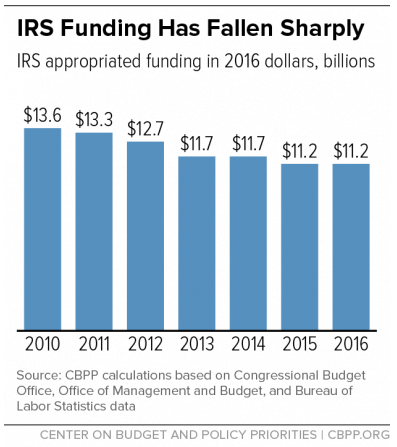

1. Congressional Republicans Slashed the IRS Budget by 17 Percent Since 2010...

Given the right-wing rhetoric, Americans could be forgiven for believing an out-of-control IRS is growing like crazy. But it's not. Thanks to the House Republican majority that swept into power in 2011, the agency has seen its budget slashed by 17 percent since fiscal year 2010. The result of the draconian reductions from $13.6 trillion in 2010 to $11.2 trillion in 2016? Full time staff has been reduced by 14 percent and enforcement staff has contracted by a staggering 23 percent, even as individual returns have jumped by 7 percent and new laws passed by Congress have added to the agency's work load.

2. ...Which is Why IRS Customer Service Has Collapsed...

Thanks to temporary hires for tax season, the telephone call answer rate this year has jumped to 70 percent, up from a shocking 38 percent in 2015. But for 2016 as a whole, IRS Commissioner John Koskinen expects the figure to slide to 47 percent. As the Washington Post recently reported, that constitutes a near-collapse over the past decade:

When more than six of 10 taxpayers were not getting their calls answered last year, it marked a stark drop in service for the agency people love to hate even in the best of times. The high point in recent years was 87 percent in 2004, and at no time since then has the percentage of answered calls fallen below 50 percent -- until 2015.

"Unless we are able to correct this," National Taxpayer Advocate Nina Olson warned in November 2014, "very bad things will happen to taxpayers."

3. ...and the "Tax Gap" Will Continue to Grow.

Very bad things won't just happen to taxpayers, but to Uncle Sam's bottom line. In 2010, the Brookings Institution estimated that the "tax gap"--the difference between what taxpayers owe the federal government and what they actually pay--had reached $500 billion a year. That's not just an increase of two and a half times since 1998's tax gap of $195 billion annually; it represents the equivalent of the entire federal budget for the last fiscal year.

Last year, IRS officials raised the alarm that they simply didn't have the manpower to chase down tax cheats who owe the U.S. Treasury less than a million dollars even as the percentage of audits plunged to a 10-year low. And that was before the explosion of corporate "tax inversions" and the Panama Papers revelations put tax evasion on the front pages. As IRS Commissioner Koskinen put during 2013 Congressional testimony:

"I have not figured out either philosophically or psychologically why nobody seems to care whether we collect the revenue or not."

Especially when more funding the IRS is like free money for Uncle Sam. For years, analysts have explained that each extra dollar spent by the IRS on enforcement produces between six and 10 dollars in additional revenue collected. As Ezra Klein pointed out when House Republicans first slashed the IRS budget in 2011:

Converting dollar bills into $10 bills is an excellent way to pay off your credit card. Except, it seems, if you're a House Republican.

In 2014, Rep. Paul Gosar (R-AZ) made Klein's point for him. Bragging about his role in helping House Republicans gut the IRS budget, Gosar crowed, "I am ecstatic that the House of Representatives supported my efforts today to pass a vitally important amendment which will save hundreds of millions of taxpayer dollars."

It's no wonder Jonathan Cohn calls the GOP the "pro-deficits, pro-tax evasion" party.

4. New GOP Tax Plans Will Cost Uncle Sam Trillions...

Uncle Sam's coffers aren't at risk just because, as RNC Chairman Reince Priebus put it two years ago, "We're done playing footsie here with the IRS." Following in the footsteps of John McCain and Mitt Romney, the 2016 GOP presidential field is promising gigantic tax cuts that lead to a hemorrhage of red ink from the United States Treasury.

As Howard Gleickman of the Tax Policy Center documented in February, the price tags of the tax plans for the top Republican contenders are mind-boggling. TPC estimated Donald Trump's proposals would drain roughly $9.5 trillion in tax revenue over a decade, with Ted Cruz ($8.6 trillion), Marco Rubio ($6.8 trillion) and Jeb Bush ($6.8 trillion) not far behind:

To put those numbers in historical context, consider the tax cuts as a percentage as the total U.S. economy. Compared to the 2016 field, the budget-busting tax cuts of Ronald Reagan and George W. Bush were small potatoes.

5. ...While Delivering a Massive Tax Cut Windfall for the Wealthy...

The Republican White House hopefuls aren't just out-Reaganing Reagan with their gargantuan tax cuts. The size of their windfalls for the gilded-class make Reagan and Bush look like Marx and Engels in comparison:

6. ...and Requiring the Debt Ceiling to Be Raised Repeatedly...

Here's a funny story. Despite the fact that Ronald Reagan tripled the national debt and George W. Bush nearly doubled it again, Republicans love to hate budget deficits. All of the 2016 GOP candidates support a balanced budget amendment to the U.S. Constitution and some, like Ted Cruz and Marco Rubio, said they will refuse to raise the debt ceiling.

Sadly for them, the next President, regardless of party, will have to raise the debt ceiling repeatedly. Over the next 10 years, the Congressional Budget Office forecasts Uncle Sam will run up $9.3 trillion in new debt on $51 trillion in new spending. (That's on top of the current $19 trillion in debt.) All of the GOP candidates will increase that by trillions more. That means Ted Cruz, Donald Trump and John Kasich will have to increase Uncle Sam's borrowing authority and slash tens of trillions in federal spending. Put another way, to keep their promises the GOP's next standard-bearer would have to either trigger a default by the U.S. or a global economic collapse, or both.

7. ...Because Tax Cuts Don't Pay for Themselves...

Now, Republicans could avoid all of these horrible--and inescapable--consequences of their tax plans if it was true that "tax cuts pay for themselves." But four decades of experience have completely debunked the supply-side myth that tax cuts trigger so much additional economic growth that tax collections will be higher than they otherwise would have been. As President Bush put it in 2004, "You cut taxes and the tax revenues increase." Several years later, then Senate Minority Leader Mitch McConnell agreed, agreeing with Jon Kyl's jaw-dropping proclamation that "you should never have to offset cost of a deliberate decision to reduce tax rates on Americans."

"There's no evidence whatsoever that the Bush tax cuts actually diminished revenue. They increased revenue because of the vibrancy of these tax cuts in the economy. So I think what Senator Kyl was expressing was the view of virtually every Republican on that subject."

Repetition of that point by Republicans didn't make it any truer. The history of the Reagan and Bush years belie Arthur Laffer's supply-side fantasy. That's why a 2012 study found that not a single one of the economists surveyed agreed that "a cut in federal income tax rates in the US right now would raise taxable income enough so that the annual total tax revenue would be higher within five years than without the tax cut." As the University of Chicago's Austan Goolsbee put it:

"Moon landing was real. Evolution exists. Tax cuts lose revenue. The research has shown this a thousand times. Enough already."

The GOP's use of so-called "dynamic scoring" now required of the CBO to show the macroeconomic feedback of tax and budget legislation doesn't change the two certainties of life for Republicans: debt and tax cuts.

8. ...and the House GOP Refuses to Say Which Tax Loopholes It Would Close.

Another way the GOP can limit the oceans of red ink its massive tax cuts would inevitably produce is to close many of the tax loopholes, credits and other breaks that now cost Uncle Sam almost $1.5 trillion a year. But once again, the House budget resolution doesn't say which ones.

It's no surprise why. Many of the biggest tax breaks--the home mortgage interest deduction, the Earned Income Tax Credit, the deduction for charitable giving, etc.--are very popular. So while every House budget blueprint since 2010 repeals Obamacare, moves to two, lower income tax brackets, slashes safety net spending and guts Medicaid, not one has listed a single tax break Republicans would end. As its architect and then House Budget Committee chairman Paul Ryan put it in 2012 when asked "which of those loopholes do you eliminate":

"We want to do this in the light of day and in front of everybody. So the Ways and Means Committee, which is in charge of the tax system, sent us the plan here, which is a 10 and 25 percent bracket for individuals and small businesses, and then they want to have hearings and, in light of day, show how they would go about doing this."

In the intervening four years, Paul Ryan became House Ways and Means Committee Chairman and then Speaker of the House. And we're still waiting to see how he "would go about doing this."

9. Meanwhile, Tax Revenue is Obviously at a Record High...

In his copy-and-paste op-eds that appeared in papers across the country, conservative Andy Koehnig lamented that "Tax Freedom Day" comes later this year because the federal government "rake in a record-breaking $3.36 trillion in tax revenue, $115 billion more than it did last year."

Of course federal tax revenue is at a record high. The U.S. population and GDP are both growing, and so are at record highs, too. It's not just that the revenue losses from the Bush tax cuts and the deep recession which began in late 2007 are now over, as the historical tables produced by the Office of Management and Budget (OMB) show. But the end of the Bush upper-income tax cuts, along with increases to capital gains tax rates for the wealthy, have helped refill Uncle Sam's coffers, too. And as the nonpartisan Congressional Budget Office (CBO) predicted, these tax hikes had virtually no negative impact on U.S. economic growth or job creation.

As for those who complain that Americans are "taxed enough already" by Uncle Sam, a little history lesson is in order. In the wake of the Bush tax cuts of 2001 and 2003 and the devastating recession, total federal tax revenue as a percentage of the U.S. economy plunged to its lowest level since 1950. And even with the recovery and increases in upper-income tax rates, Uncle Sam's take is still only about 18.2 percent of GDP. That's a less than the 20 percent level reached in 2000 during the Clinton boom--the last time the federal government produced budget surpluses.

10. ...and Federal Spending is Lower Than When Bush Left the White House.

All of which brings us to one final point Republicans would prefer you overlook. Despite all of their claims about "tax and spend" Democrats and "out-of-control" spending by President Obama, through 7-plus years of his tenure federal outlays are lower now than when George W. Bush mercifully ambled out of the White House in January 2009.

In its latest assessment, CBO predicted fiscal year 2016 spending would rise to $3.90 trillion dollars. In FY 2017 which starts on October 1, spending during President Obama's final days in office will increase to $4.07 trillion. But taking inflation into account by using constant FY 2009 dollars (see OMB historical table 1.3) shows a different picture. At, $3.51 trillion, Inflation-adjusted FY 2016 spending will still be lower than on Barack Obama's first inauguration day. As I noted previously:

On January 7, 2009, CNN reported on the latest long-term budget forecast from the CBO. Two weeks before President Bush ambled out of the Oval Office, CNN explained "the U.S. budget deficit in 2009 is projected to spike to a record $1.2 trillion, or 8.3% of gross domestic product." With the recession in full swing and the massive TARP program passed the previous fall, CBO predicted in January 2009 that federal spending would spike to $3.543 trillion dollars while tax revenue would plummet to an anemic to $2,357 trillion. As it turned out, the final deficit figure for the 2009 fiscal year which ended on September 30, 2009 reached $1.413 trillion because of worse-than-expected tax collections ($2,105 trillion.)

Sadly, America's real problem isn't that the public sector spent too much after the onset of the great recession in late 2007, but that it didn't spend enough. Draconian spending reductions by state and local governments more than offset the $800 billion federal stimulus, creating an "anti-stimulus" that held back economic growth and job creation. By May 2013, the Hamilton Institute estimated those austerity policies cost 2.2 American million jobs and resulted in the slowest recovery since World War II.