CBO Highlights Republican Deficit Posturing

The Congressional Budget Office (CBO) estimates for the final health care bill are bringing smiles to Democratic faces. Over 10 years, the $940 billion package will cover 32 million more Americans while ending insurance abuses including rescission and the use of pre-existing conditions to deny coverage.

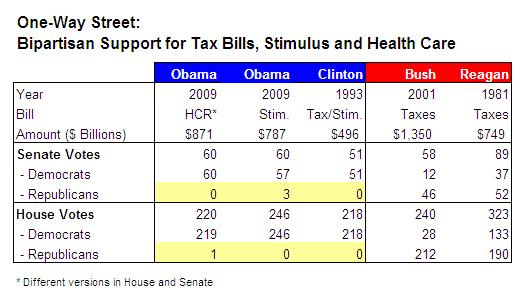

But the ersatz deficit hawks of the Republican Party should be happy, too. For less than half the cost of the 2001 and 2003 Bush tax cuts, the CBO forecasts the final health care bill will trim the deficit by $130 billion over the first decade and $1.3 trillion over 20 years. As Steny Hoyer (D-MD) put it, "We think it will post the largest deficit reduction of any bill that we've adopted in the Congress since 1993."

Of course, every single Republican in the House and Senate voted against the Clinton deficit reduction legislation of 1993.

That $496 billion package not only included economic stimulus spending, but a bump in top-tier income tax rates to 39.6%. Determined then as now to torpedo a new Democratic president, all Republicans in Congress opposed the bill that helped produce the budget surpluses and booming economy of the 1990's:

(The chart above reflects the December 2009 health care votes.)

As I documented previously ("Born Again Deficit Virgins"), Republicans were blissfully unconcerned as the U.S. national debt tripled under Ronald Reagan and doubled again under George W. Bush.

As the Center for American Progress noted, the Bush tax cuts delivered a third of their total benefits to the wealthiest 1% of Americans. And to be sure, their payday was staggering. The Center on Budget and Policy Priorities detailed that by 2007, millionaires on average pocketed $120,000 from the Bush tax cuts of 2001 and 2003. Those in the top 1% stashed an extra $45,000 a year. As a result, millionaires saw their after-tax incomes rise by 7.6%, while the gains for the middle quintile and bottom 20% of Americans were a paltry 2.3% and 0.4%, respectively. (Other CBPP studies demonstrated that the Bush tax cuts accounted for half of the mushrooming deficits during his tenure in the White House and will continue to do so over the next decade.)

By 2007, the upward redistribution of wealth was complete. Income inequality reached record levels not seen since 1929. And it's no surprise that the 400 richest Americans saw their incomes double and their tax rates halved.

Apparently, those are the only numbers that matter to the Republican minority in Congress. And as John Boehner (R-OH) made clear in promising to "do everything we can do to make sure this bill never, ever passes," certainly not these:

Numbers like 50 million uninsured, 25 million more uninsured, 98,000 deaths annually from medical errors, 45,000 deaths to lack of insurance, 62% of personal bankruptcies due to medical costs, 1 in 5 Americans postponing needed medical care and 94% of health insurance markets nationwide are already virtually monopolized. Or that employer-provided insurance now covers less than 60% of Americans while the average annual cost of family health insurance premiums will rise from $13,000 now to $22,000 by 2019. Not the $1.3 trillion in deficit reductions delivered by President Obama and the Congressional Democrats. Or that Republican red states have the worst the health care systems and the unhealthiest residents.

There is, of course, one number the GOP cares about when it comes to health care: 0. That's the number of Republican votes it will receive.