GOP Tax Plan Delivers Double Dose of Pain to Blue States

Thursday's release of the House GOP tax plan will be greeted with a flurry of "hot takes" about its "winners and losers." So, for everyone's sake, let's keep this simple. Unsurprisingly, the biggest winners from what the President called a "big, beautiful Christmas present" are people named Trump and those like them. Just as predictable, the real losers are the tens of millions of Americans who live in blue states generally governed by Democrats.

As I've documented previously, Donald Trump's 2015 boast that his tax plan would "cost me a fortune" was a lie from the moment it passed his lips. We know the abolition of the Alternative Minimum Tax (AMT) will be a huge windfall for Trump; it accounted for 82 percent of his $38 million tax bill in 2005, the only year for which we've seen even partial IRS records. Slashing the tax rate to 25 percent for "pass-through" businesses is another payday for the Trump Organization, which happens to be comprised of 500 of them. And the phase-out of the estate tax after six years means the Trump heirs will get to keep all the candy--and billions of dollars--after Donald Sr. passes from the scene.

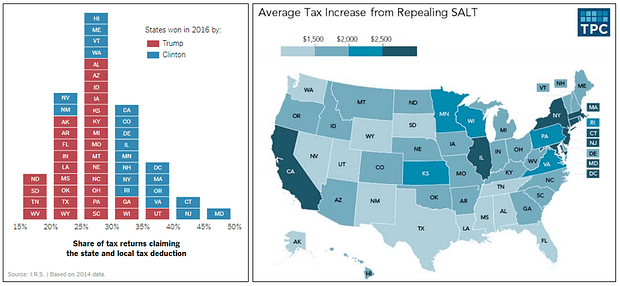

But if Donald Trump is smiling about his winnings, he and most Republicans in Congress are downright gleeful at the blue state bashing their tax bill will deliver. Halving the cap on the mortgage interest deduction from million-dollars homes to just $500,000 means taxpayers in high-cost housing markets generally found in affluent Democratic states like California, New York and Massachusetts will get hammered. Perhaps even more damaging, ending the federal deduction for state and local taxes means Republicans on Capitol Hill will force fiscal austerity on high-tax, high-service Democratic states.

Writing in New York Magazine, Ed Kilgore explained the brutal math for blue state homeowners:

According to the most recent (2012-2014) available data, here are the locales where over 30 percent of new mortgages are over $500,000: Marin, C.A. (47 percent), New York, N.Y. (46 percent), San Francisco, C.A. (46 percent), San Mateo, C.A. (43 percent), Falls Church City, V.A. (37 percent), Santa Clara, C.A. (36 percent), and Arlington, V.A. (32 percent). That's Manhattan plus metropolitan San Francisco and Washington.

But the damage to blue state budgets will be even greater if the pernicious GOP scheme to end the state and local tax deduction (SALT) comes to fruition. Even exempting property taxes up to $10,000 still means states from Oregon and California to New York, New Jersey and Connecticut will be pressured to cut taxes, reduce spending or both.