Health Insurers' Stocks, Earnings Surge

"When I say if you have your plan and you like it," President Obama explained about the Affordable Care Act during a June 2009 press conference, "what I'm saying is the government is not going to make you change plans under health reform." Employers and insurers, unfortunately, are another matter. After all, the share of the nonelderly Americans covered by employer-provided health insurance (now 156 million people) dropped from 69 to 54 percent between 2001 and 2010 even as their premiums doubled and deductibles skyrocketed. Meanwhile, hundreds of thousands of the 14 million who purchased coverage in the individual market are facing steep premium hikes and even policy cancellations from their insurers even as industry stock prices and earnings are on the rise.

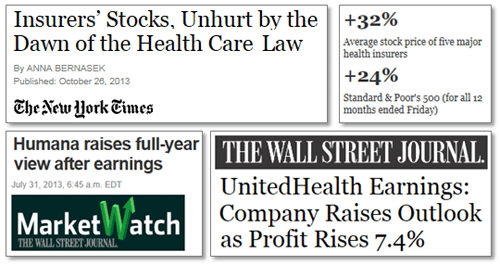

Earlier this week, the New York Times explained the sunny outlook for insurers even in the face of the ACA's "10 essential requirements" for new policies and the 80/20 rule on "medical loss ratios" that some fretted would limit profits:

Because they face new regulations intended to broaden coverage and limit profit-taking, some analysts have been concerned that profits will suffer. But in the run-up to the Affordable Care Act, stock market prices have told a different story.

Over the last 12 months, shares of the top five publicly traded health insurance companies -- Aetna, WellPoint, UnitedHealth Group, Humana and Cigna -- have increased by an average of 32 percent, while the Standard & Poor's 500-stock index has risen by just 24 percent.

Recent headlines in the business news tell the tale. In August, MarketWatch reported that earnings for Cigna "rise 33% on increased membership," while the Wall Street Journal noted in July that UnitedHealth "raises outlook as profit rises 7.4%." Last week, Wellpoint profits beat analyst expectation and the company boosted its outlook for the rest of the year. Humana similarly raised its earnings forecast while Aetna announced Tuesday that its third quarter profits jumped by 4 percent. Importantly, this strong performance came even as the growth in U.S. health care spending slowed dramatically in the wake of the recession that began in late 2007.

If this story sounds familiar, it should.

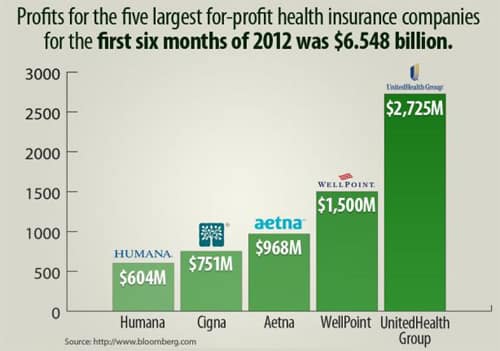

As Bloomberg reported in January 2012, "Insurers Profit From Health Law They Fought Against":

Insurance companies spent millions of dollars trying to defeat the U.S. health-care overhaul, saying it would raise costs and disrupt coverage. Instead, profit margins at the companies widened to levels not seen since before the recession, a Bloomberg Government study shows.

Insurers led by WellPoint Inc. (WLP), the biggest by membership, recorded their highest combined quarterly net income of the past decade after the law was signed in 2010, said Peter Gosselin, the study author and senior health-care analyst for Bloomberg Government. The Standard & Poor's 500 Managed Health-Care Index rose 36 percent in the period, four times more than the S&P 500.

As Gosselin summed it up, "The industry that was the loudest, most persistent critic of this law, the industry whose analysts and executives predicted it would suffer immensely because of the law, has thrived."

But that isn't necessarily the case for their policyholders. As Jonathan Cohn documented in The New Republic, some of their current customers are facing "rate shock" as their bargain basement, non-ACA compliant "grandfathered" policies come to an end. Others are experiencing "premium joy" as the Obamacare exchanges offer the prospect of lower rates and federal subsidies that will bring down their premiums and out-of-pocket costs. (Cohn omitted a third group, the millions undergoing "access ecstasy" as they obtain insurance they previously could not obtain at all.) While some insurers like Florida Blue stressed that they are "transitioning" their customers (some automatically) to new policies in 2014, others have used to opportunity to jack up premiums or drop their less profitable accounts all together. As Kaiser Health News explained last week:

Consumer advocates say such cancellations raise concerns that companies may be targeting their most costly enrollees.

They may be "doing this as an opportunity to push their populations into the exchange and purge their systems" of policyholders they no longer want, said Jerry Flanagan, an attorney with the advocacy group Consumer Watchdog in California.

Regardless, as Sarah Kliff explained in her excellent discussion of the cancellation notices so many Americans are now receiving, "Since the health-care law required insurance companies to change their plans, this is a direct result of the Affordable Care Act." But the ACA didn't require that major insurers refuse to participate in many of the state exchanges or limit what they can charge existing customers for new policies. The big five are not "sounding the alarm" about Obamacare, the Times reported this week, precisely because the future looks so bright:

Mark T. Bertolini, the Aetna chief executive, said recently: "We continue to believe that public exchanges can represent a longer-term upside opportunity."

And most health insurers are forecasting earnings growth after the health care law is fully in effect.

David Cordani, Cigna's chief executive, said his company's average annual earnings per share would grow 10 to 13 percent over the next three to five years.

If such projections are correct, someday we may look back and wonder what all the fuss was about.

More likely, we'll reach the same conclusion the Times' Eduardo Porter warned about last year when he lamented "health care and pursuit of profits make a poor mix."