Silicon Valley is Still Getting It Wrong on Income Inequality

Back in my days as a denizen of Silicon Valley, we start-up types used to joke that Sand Hill Road in Menlo Park, California was the single most important street in the world. After all, for almost five decades that one-mile mecca of the venture capital world has helped fund every high-tech transformation of the global economy, from semiconductors, desktop computers and software to the dot com boom and the mobile revolution.

But just because many in the promised land between San Francisco and San Jose believe the sun shines out of its collective ass doesn't mean they are shedding any light on the questions of the day. And on no issue is that clearer than the causes and implications of America's record-high income inequality. That yawning gap between the rich and everyone else resulting from the stagnation of workers' wages, the erosion of the middle class and the winner-take-all earnings going to capital is putting the American Dream and American democracy itself at risk. And addressing those challenges does not constitute an attack on entrepreneurship or a genocidal war on the rich.

But to hear some of the Tech sector's best and brightest, that is exactly what it going on. Two years ago, legendary venture capitalist Tom Perkins warned that the critical spotlight being shone on the top 1 percent could be a precursor to a new Holocaust. As he put it in his Wall Street Journal screed titled, "Progressive Kristallnacht Coming?":

I would call attention to the parallels of Nazi Germany to its war on its "one percent," namely its Jews, to the progressive war on the American one percent, namely the "rich."

Now, just in time for New Year's Day 2016, the outspoken Paul Graham celebrated economic inequality in a piece by the same name. In it, Graham offered both advice and a warning to the poors. Boasting that "I've become an expert on how to increase economic inequality, and I've spent the past decade working hard to do it," Graham argued:

Since the 1970s, economic inequality in the US has increased dramatically. And in particular, the rich have gotten a lot richer. Some worry this is a sign the country is broken.

I'm interested in the topic because I am a manufacturer of economic inequality. I was one of the founders of a company called Y Combinator that helps people start startups. Almost by definition, if a startup succeeds its founders become rich. And while getting rich is not the only goal of most startup founders, few would do it if one couldn't...

So when I hear people saying that economic inequality is bad and should be decreased, I feel rather like a wild animal overhearing a conversation between hunters. But the thing that strikes me most about the conversations I overhear is how confused they are. They don't even seem clear whether they want to kill me or not.

Graham need not worry, in large part because he's giving himself far too much credit. As it turns out, he and fellow start-up entrepreneurs didn't have much of role in expanding income inequality in the United States. But to be sure, they do have a role in narrowing it.

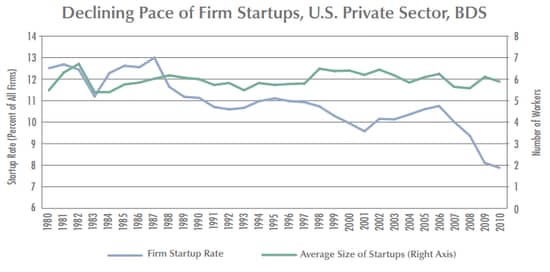

As Ezra Klein thoroughly documented for Vox, "Graham's focus on startups as a cause and consequence of inequality is also empirically wrong." It's not just that the vast majority of start-ups produce not riches but failure for their founders. Start-up formation has been declining over the past 30 years, precisely the period (as we'll see below) during which income inequality has been widening:

When it comes to their contribution to overall employment, the U.S. Census Bureau reported in 2012, start-ups share dropped from around 20 percent in 1980 to about 12 percent by 2010. Just as disturbing, start-ups share of new jobs created plummeted from about 40 percent to around 30 percent in recent years.

Even more important, it is the financial sector--and not tech--which is fueling the rise of the richest of the rich. Manufacturing and agriculture employed one in three workers just after World War II," The Atlantic reported in 2012, "Today, those sectors employ only one in eight." During that same time frame, the finance, insurance and real estate sector doubled from 10 to 21 percent of the workforce. The data on the occupations of the top 0.1 percent show that "the incomes of executives, managers, supervisors, and financial professionals can account for 60 percent of the increase in the share of national income going to the top percentile of the income distribution between 1979 and 2005." As Klein summed it up:

Some of that is certainly Silicon Valley executives. But it's the financial professionals that this conversation is really about.

You can see that in the timing. The debate over inequality doesn't coincide with either the rise of Silicon Valley (late '90s, and then again in the early 2000s) or even the rise of income inequality (1980s). It coincides with the aftermath of the Great Recession -- a time when finance professionals crashed the global economy, immiserated millions of people, and managed to remain incredibly, infuriatingly rich. There's a reason it was called Occupy Wall Street rather than Occupy Google.

The "financialization" of the U.S. economy--that is, the transformation from one in which Americans built things to instead shuffling paper around--has had dire consequences for the distance between rich and poor, and even between the fantastically rich and the merely well-off.

That chasm was illustrated in new research presented at this week's American Economic Association conference in San Francisco. In their new work, inequality experts Emmanuel Saez, Gabriel Zucman and Thomas Piketty analyzed inequality trends using a new combination of tax, survey and national accounts data. (Ben Casselman explained why: "Individual tax data misses a quarter of labor income, two-thirds of capital income.") To the degree there was good news, as ThinkProgress summed it up this way:

The new analysis disputes previous findings that the bottom 90 percent of Americans have seen a slight decline in income since the late 1970s. Instead, the economists say, their income actually increased slightly, by 0.7 percent annually. But the data still corroborates the story of increasing inequality between most Americans and the richest. The incomes of the wealthiest 10 percent grew faster than everyone since 1980, they found. Worse, incomes for the top 1 percent grew about four times as fast as the bottom 90 percent in the same time period.

As co-author Zucman summed it up, the small income gains for the 90 percent "does make a little difference" in the inequality debate, "but not a lot." At the end of the day:

"The bottom line," he said, "is an economy where the income for the bottom 90 percent grows only 0.7 percent, is not doing very well."

Especially at a time when the same economy is enabling the top 10 percent to do very well and the top 1 percent outrageously well. And that dynamic isn't just a function of the changing economy, but of public policy.

As Jim Tankersley documented for the Washington Post, Piketty et al found that by 2012, "more than half the income in America went to the top 10 percent of earners."

The share for the top 10 percent in 2012 is higher than any other recorded year, dating back to 1917. In recent years, the economists find, that is largely attributable to a spike in income for the very rich from capital gains, dividends and other capital income sources, as opposed to wages paid for labor.

But the rich didn't just get richer because they made much more of their money from investment income. They got a lot of help from Uncle Sam, too. Capital gains and dividend tax rates are much lower now than 40 years ago.

In September 2011, the Washington Post illustrated how plummeting capital gains and dividend tax rates helped bring about an income gap and wealth concentration not seen since before the Great Depression.

As part of the Post's series on the widening chasm between the super-rich and everyone else titled "Breaking Away," the Post concluded that "capital gains tax rates benefiting wealthy feed [the] growing gap between rich and poor." As the Post explained, for the very richest Americans the successive capital gains tax cuts from Presidents Clinton (from 28 to 20 percent in 1998) and Bush (from 20 to 15 percent in 2003) have been "better than any Christmas gift":

While it's true that many middle-class Americans own stocks or bonds, they tend to stash them in tax-sheltered retirement accounts, where the capital gains rate does not apply. By contrast, the richest Americans reap huge benefits. Over the past 20 years, more than 80 percent of the capital gains income realized in the United States has gone to 5 percent of the people; about half of all the capital gains have gone to the wealthiest 0.1 percent.

While the 2013 "fiscal cliff" tax deal boosted the top capital gains tax rate back to 23.8 percent (the Affordable Care Act added a 3.8 percent tax for upper income earners on top of the new 20 percent top rate), the dynamic remains essentially unchanged. Not only are America's wealthy rapidly pulling away from the rest of their countrymen, the stratospherically rich are leaving the merely rich in the dust, too.

The impact of the nation's tax policies on income inequality has hardly been a secret on Capitol Hill. In December 2011, Thomas Hungerford of the Congressional Research Service (CRS) authored an analysis which concluded:

Capital gains and dividends were a larger share of total income in 2006 than in 1996 (especially for high-income taxpayers) and were more unequally distributed in 2006 than in 1996. Changes in capital gains and dividends were the largest contributor to the increase in the overall income inequality. Taxes were less progressive in 2006 than in 1996, and consequently, tax policy also contributed to the increase in income inequality between 1996 and 2006.

In January 2013, the CRS's Hungerford published another study which once again confirmed that historically low capital gains tax rates are "by far the largest contributor" to America's historically high income inequality. As ThinkProgress explained Hungerford's findings, the upward spiral of income inequality (as measured by the Gini coefficient) between 1991 and 2006 is mostly due to federal tax policy that slashed rates on capital gains and dividend income, income which flows almost exclusively to the rich:

By far, the largest contributor to this increase was changes in income from capital gains and dividends. Changes in wages had an equalizing effect over this period as did changes in taxes. Most of the equalizing effect of taxes took place after the 1993 tax hike; most of the equalizing effect, however, was reversed after the 2001 and 2003 Bush-era tax cuts. [...]

The large increase in the contribution of capital gains and dividends to the Gini coefficient, however, is due to the large increase in the share of after-tax income from capital gains and dividends, and to the increase in the correlation of this income source with after-tax income.

Now, these levels of income inequality not seen since the Great Depression might be more tolerable if they served to produce faster economic growth and accelerated job creation. But as Jared Bernstein along with Troy Kravitz and Len Burman of the Urban Institute have shown, lower capitals gains tax rates (contrary to the claims of conservative mythmakers) haven't fueled increased investment in the America economy.

As Bernstein demonstrated with the chart above, there's no evidence to support the persistent GOP claim that a low tax rate on capital spurs more investment in the U.S. economy, and thus benefits all Americans. Bernstein found that the business cycle, not acts of Congress, drives investment in the U.S.

Hard to see anything in the picture supporting the view that either the level or changes in cap gains taxes play a determinant role in investment decisions.

Remember, the ostensible reason for the favoritism in tax treatment here is to incentivize more investment and faster productivity growth. But that's not in the data and the reason it's not in the data is because investors aren't nearly as elastic to cap gains rates as their lobbyists say they are (more precisely, they'll carefully time their realizations to maximize their gains around rate changes, but that's not real economic activity--that's tax planning).

Reviewing other analyses in 2012, Brad Plumer of the Washington Post concurred with that assessment that low capital gains taxes don't necessarily jump-start investment in the economy:

The top tax rate on investment income has bounced up and down over the past 80 years--from as high as 39.9 percent in 1977 to just 15 percent today--yet investment just appears to grow with the cycle, seemingly unaffected. ...

Meanwhile, Troy Kravitz and Len Burman of the Urban Institute have shown that, over the past 50 years, there's no correlation between the top capital gains tax rate and U.S. economic growth--even if you allow for a lag of up to five years.

Billionaire Warren Buffett, the inspiration for the "Buffett Rule" advocated by President Obama and his Democratic allies, couldn't agree more. As he told the New York Times in 2011:

"I have worked with investors for 60 years and I have yet to see anyone--not even when capital gains rates were 39.9 percent in 1976-77--shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off."

That's right. Higher capital gains tax rates haven't scared off investors in the past. But despite their talk about income inequality, Republicans like Mitt Romney and Jeb Bush want to cut capital gains taxes. Marco Rubio wants to eliminate them altogether. The only other reform that could impact intergenerational dynastic wealth as profoundly would be to eliminate the estate tax (and its $25 billion a year in revenue to Uncle Sam), a levy that impacts less than a quarter of one percent of the richest families in America. Unsurprisingly, pretty much all of the 2016 GOP presidential candidates support doing precisely that.

All of which brings us full circle back to our friends in Silicon Valley and the American quandary over income inequality. By all means, the likes of Tom Perkins and Paul Graham should start as many new companies as they like and get richer still. But by all means, capital gains tax rates can and should be higher. After all, lowering them didn't spur extra investment in the U.S. economy; it only served as a tax cut windfall for the wealthy. And as we recently learned, despite Republican predictions of doom and gloom, the 2013 tax hikes on those earning over $400,000 a year ($450,000 for a family) didn't hurt either job creation or GDP growth.

As the record shows, the economy grew faster and produced more jobs when both marginal and capital gains tax rates on the rich were higher--even much higher.

To re-enable the American Dream, we certainly must, as George W. Bush might put it, "make the pie higher." But GDP growth and unemployment rates won't be a sufficient measure of success. To do that, the United States must make the investments in education, job skills and infrastructure that a 21st workforce and economy will require. And as the woes of the "Post-Ownership Generation" show, tackling the college debt crisis is essential. But as automation, robots and the "gig (or Secondhand) economy" continues to transform to the very notion of work, Americans will need their own 21st century safety net, too. As businesses large and small show no signs of ending their shift from "guaranteed benefits" to "defined contributions" to no health or retirement benefits at all, the likes of Airbnb, Uber, TaskRabbit and Lyft aren't going to fill that void on their own.

In response to that increasing anxiety and uncertainty for America's shrinking middle class, venture capitalist Nick Hanaeur and SEIU international vice president David Rolf propose a "21st century social contract." At the heart of that new American bargain are two pillars supporting the workforce of the new sharing economy:

We propose a new Shared Security System that endows every American worker with, first, a "Shared Security Account" in which to accrue the basic employment benefits necessary for a thriving middle class, and second, a new set of "Shared Security Standards" that complement and reinforce that account.

One can think of the Shared Security Account as analogous to Social Security, but encompassing all of the employment benefits traditionally provided by a full-time salaried job. Shared Security benefits would be earned and accrued via automatic payroll deductions, regardless of the employment relationship, and, like Social Security, these benefits would be fully prorated, portable, and universal.

After all, Paul Graham's start-ups aren't just going to need entrepreneurs and skilled workers. They'll need customers, too.