The Resurrection and Immaculate Deception of Paul Ryan

Wisconsin Representative Paul Ryan has become the perfect Republican Easter story. Each spring, Ryan reemerges with a new version of his draconian "Roadmap for America's Future." Despite being crucified each time by most Democrats, much of the press and even some members of his own party, Ryan nevertheless rises again, earning more followers (like Mitt Romney) each time. But at the heart of his budget plan - one that guts domestic spending, delivers a massive tax cut windfall to the rich and ends Medicare as a guaranteed health insurance program for the elderly - is a miraculous fraud, an immaculate deception. By refusing to name a single tax deduction or loophole he would close, Ryan's holy book produces not a balanced budget but trillions more in new national debt.

The Gospel of Paul begins on April 1, 2009. As it turned out, April Fool's Day was a fitting launch date for what Ryan touted as the "GOP's Alternative Budget." Short on details beyond steep cuts for the rich and privatizing Medicare, Ryan admitted his was merely a "marketing document."

But the glossy pamphlet Ryan and then House Minority Leader John Boehner waived around created the template for the annual spring ritual to come. While the Center for American Progress concluded the Boehner-Ryan giveaway would hand an annual tax bonanza of $1.5 million to the average CEO, an analysis from the Center for Tax Justice last week concluded that by 2011, the GOP scheme would drain the Treasury to the tune of $300 billion more than the Obama plan. And as is par for the course for the Republicans, the usual upper-income suspects benefit the most:

Over a fourth of taxpayers, mostly low-income families, would pay more in taxes under the House GOP plan than they would under the President's plan.

The richest one percent of taxpayers would pay $100,000 less, on average, under the House GOP plan than they would under the President's plan.

Despite the failure of Ryan's proposal in the Democratic-controlled House, in April 2009 137 House Republicans voted to convert the Medicare program that provides 46 million Americans with health insurance into a system of vouchers.

In February 2010, Congressman Ryan unveiled the unabridged version of his new testament, the Roadmap for America's Future. In addition to another gilded-class payday courtesy of the United States Treasury, Ryan proposed privatizing Social Security, Medicare and Medicaid, all while implementing cost controls that would dramatically shift the burden onto beneficiaries. As Ezra Klein explained at the time:

To move us to surpluses, Ryan's budget proposes reforms that are nothing short of violent. Medicare is privatized. Seniors get a voucher to buy private insurance, and the voucher's growth is far slower than the expected growth of health-care costs. Medicaid is also privatized. The employer tax exclusion is fully eliminated, replaced by a tax credit that grows more slowly than medical costs. And beyond health care, Social Security gets guaranteed, private accounts that CBO says will actually cost more than the present arrangement, further underscoring how ancillary the program is to our budget problem.

As Klein, Matthew Yglesias and TPM all noted, to reach balanced budget heaven, the poor and the elderly would have to go through hell. Especially, Klein explained, when it came to the de facto rationing of Medicare:

The proposal would shift risk from the federal government to seniors themselves. The money seniors would get to buy their own policies would grow more slowly than their health-care costs, and more slowly than their expected Medicare benefits, which means that they'd need to either cut back on how comprehensive their insurance is or how much health-care they purchase. Exacerbating the situation -- and this is important -- Medicare currently pays providers less and works more efficiently than private insurers, so seniors trying to purchase a plan equivalent to Medicare would pay more for it on the private market

It's hard, given the constraints of our current debate, to call something "rationing" without being accused of slurring it. But this is rationing, and that's not a slur. This is the government capping its payments and moderating their growth in such a way that many seniors will not get the care they need.

Which is why Republican leaders ran away from Paul Ryan in the run-up to the November 2010 mid-term elections.

As the Washington Post reported in the summer of 2010, "Many Republican colleagues, who, even as they praise Ryan for his doggedness, privately consider the Roadmap a path to electoral disaster." Among those fearing its toxic mix of cruel spending cuts, Medicare rationing, tax cuts for the rich and Social Security privatization was John Boehner. "There are parts of it that are well done," Boehner said that June, adding, "Other parts I have some doubts about, in terms of how good the policy is." That might explained why Ryan's roadmap secured only 13 co-sponsors.

Even Ryan's closest political allies feared the blowback from his ideas. In 2010, GOP representatives Eric Cantor (R-VA) and Kevin McCarthy (R-CA) joined in Ryan in publishing Young Guns. But even Ryan's co-authors were afraid to back his draconian plans. As ThinkProgress reported, Cantor repeatedly refused to endorse Ryan's Roadmap. (As late as January 2011, he could only muster, "I'm hopeful that we can get elements of what Paul is aiming for incorporated.") As for his other co-author, in September McCarthy lied about what was in Ryan's plan - and their book, pretending, "No one has a proposal up to cut Social Security. It's about protecting it."

But the overwhelming Republican victory in the 2010 midterms brought even greater confidence that the American electorate was now ready to back the new GOP messiah, Paul Ryan. In April 2011, now House Speaker John Boehner offered his ringing endorsement:

"I fully support Paul Ryan's budget, including his efforts on Medicare."

And so it was in the spring of 2011 that 235 House Republicans and 40 GOP Senators voted for the Ryan budget that would privatize Medicare (though not Social Security), slash Medicaid by a third and make the rich much richer. (By 2022, a 65 year-old's health care expenditures would double; by 2030, the CBO estimated seniors would be responsible for 68 percent of their health care costs.)

Now, the new testament of Paul Ryan is complete and his status as the savior of the Republican Party is realized. Revealing his updated "Path to Prosperity" last month, Ryan quickly found disciples both among the priests of the church of the Very Serious People and within the GOP. Most prominent among them is that money-changer and certain Republican presidential nominee, Mitt Romney.

After the Republican controlled House passed Paul Ryan's latest budget plan by a 228-191 party line vote last week, Speaker John Boehner lauded his GOP colleagues for laying out "a real vision of what we were to do if we get more control here in this town." But Boehner's "we" isn't limited to Republicans in Congress. As it turns out, Mitt Romney is cooking up virtually the same disastrous "Pink Slime" recipe for America's future. Both Ryan and Romney would deliver a massive tax cut windfall for the rich, paying for it by gutting the social safety net each pretends to protect. Each would end Medicare as we know it with a premium support gambit that would dramatically shift health care costs to America's seniors. While increasing defense spending, the House Budget Chairman and the GOP frontrunner would repeal the Affordable Care and leave at least 30 million people without insurance. And despite their mutual pledges to end many tax loopholes and deductions to fund their gilded-class giveaway, neither Paul Ryan nor Mitt Romney has the courage to say which ones. As a result, these supposed deficit hawks would actually add trillions more in red ink to the national debt.

Here's how Paul Ryan's Immaculate Deception works.

As the numbers clearly show, budget chairman Paul Ryan would massively increase the U.S. national debt. That may seem like a surprising result, given Rep. Ryan's declaration that his mission is to "prevent an explosion of debt from crippling our nation and robbing our children of their future." But even with his draconian budget blueprint that cuts Medicaid by a third, ends Medicare as we know it, adds 48 million people to the ranks of the uninsured and by 2050 would result in ending all non-defense discretionary spending, over the next decade Ryan would unleash torrents of red ink from the U.S. Treasury. Ezra Klein explained how Paul Ryan came up $6.2 trillion short:

The Tax Policy Center looked into the revenue loss associated with House Budget Chairman Paul Ryan's plan to cut the tax code down to two rates of 10 percent and 25 percent. They estimate the changes would raise $31.1 trillion over 10 years, or 15.4 percent of GDP. That's $10 trillion less than the tax code would raise if the Bush tax cuts were allowed to expire, and $4.6 trillion less than it would raise if all of the Bush tax cuts were extended.

The Republican congressman says he'll "broaden the tax base to maintain revenue...consistent with historical norms of 18 to 19 percent." So let's say Ryan needs to find close-enough deductions and loopholes to hit 18.5 percent of GDP. That means he'd need to close about $6.2 trillion in tax deductions and loopholes over 10 years.

And so far, Ryan hasn't had the courage to name a single deduction he would end or loophole he would close. Those tax expenditures for workers, families and businesses cost Uncle Sam over $1 trillion a year. But as Matthew Yglesias pointed out, in Ryan's 13-page description of his tax reform vision, those politically tough choices are completely missing:

Thirteen pages dedicated to explaining his vision for revenue-neutral tax reform. And even so he manages to not name a single tax deduction that he's planning to eliminate. Home mortgage interest deduction? I dunno. Electric vehicle tax credit? I dunno. Deductibility of state and local income taxes? I dunno.

Call it Ryan's Book of Non-Revelations. And the result is a fiscal Armageddon.

Rolling out his plan, Ryan admitted as much. The responsibility for making the numbers work and taking the heat for ending popular deductions would go to House Ways and Means Committee, which Ryan claimed would "show how they would go about doing this." It's no wonder Greg Sargent said Ryan's "Path to Prosperity" plan simply "is not serious" while the New York Times called it "careless."

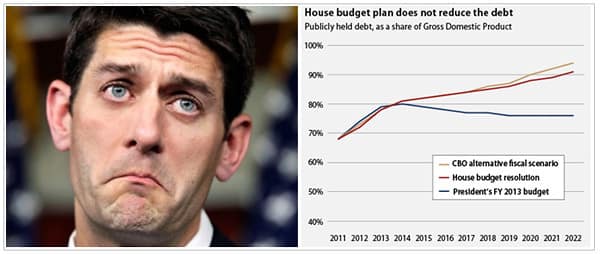

And one other thing. Over the next 10 years, the Ryan House budget would add substantially more to the national debt than President Obama's proposed 2013 plan.

As the Center for American Progress explained, the Congressional Budget Office (CBO) assessment of the Ryan budget "did not test Rep. Ryan's claims about how his policies would actually affect spending or revenue," but "merely showed what would happen to the debt if his claims were true." In a nutshell, they are not:

But the House budget's entire claim to deficit reduction is built on the foundation of those fantasy revenue levels. Without them, the debt goes up, not down. In fact, with all the House budget's tax cuts properly accounted for, revenue would average just 15.3 percent of GDP from 2013 through 2022, not 18.3 percent. The result: deficits would never drop below 4.4 percent of GDP, and would rise to more than 5 percent of GDP by 2022. The national debt, measured as a share of GDP, would never decline, surpassing 80 percent by 2014, and 90 percent by 2022. By comparison, President Barack Obama's budget proposal, released in February, would stabilize the debt by 2015, and bring it down to 76 percent by 2022.

(See chart above.)

Of course, by now Paul Ryan's economic apostasy is Republican orthodoxy. The only surprise is that it took so long: in the world according to the GOP (if no one else), tax cuts magically pay for themselves and enable so-called "job creators." Three years after he first brought them The Good News, the GOP faithful have embraced Paul Ryan's cruel vision, if not the meek and the least of these.