A Modest Proposal to Rescue the States

During the debate over the stimulus program in early 2009, Senate Minority Leader Mitch McConnell proposed, "If the money were lent rather than just granted, states would, I think, spend it wisely and the states that didn't need it at all wouldn't take any." Now would be a good time to take him up on his offer.

After all, state and local governments have already slashed hundreds of thousands of jobs, and facing a staggering $175 billion budget gap over the next two and a half years, are certain to shed hundreds of thousands more. Last week, the Commerce Department revised down its fourth quarter GDP estimate, confirming once again that draconian state budget cuts are putting the U.S. economic recovery at risk.

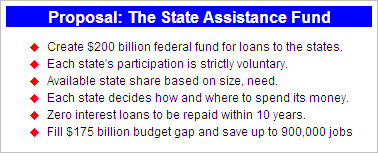

So here is a modest proposal to rescue the states and protect the fragile American economy. Establish a $200 billion, two-year federal fund providing loans to those states desiring them to prevent further layoffs and to help pay for the rising, recession-induced costs of Medicaid, unemployment and other essential services. Call it the State Assistance Fund (SAF).

How Would the State Assistance Fund Work?

As the Congressional Budget Office (CBO) and Moody's economist and former John McCain adviser Mark Zandi each documented last year, aid to state and local government provides among the biggest "bangs for the buck" of any federal stimulus spending. While the CBO estimated "transfer payments to state and local governments" provides a multiplier as high as 1.8 (that is, delivers $1.80 in economic returns for each dollar spent), Zandi's model showed a 1.41 multiplier. As he put it last July:

Federal aid to strapped state and local governments also is providing significant economic benefits, lessening their need to slash programs and jobs or to hike taxes and fees.

Unlike the American Recovery and Reinvestment Act (ARRA), the State Assistance Fund would not offer grants, but instead low (or no) interest loans to state governments. With the approval of their legislatures and governors, states could apply for their share of the $200 billion pool of emergency assistance funds. While the formula for divvying up funds would have to address the relative size and need of the states, they themselves would control how the money is spent.

Keeping police, teachers and firefighters on payroll, bolstering depleted unemployment insurance funds, funding the increased costs of Medicaid for swollen ranks of the jobless, distributing aid to counties and municipalities or even addressing shortfalls in public employee pension funds, state capitals would make those decisions. The only requirement is to repay the U.S. Treasury within 10 years.

Participation in the program is entirely voluntary. If states for fiscal - or ideological reasons - did not need or want the help from Washington, they need not ask for it. So while cash-strapped California, New York and Illinois might take that deal, similarly situated states like Rick Perry's Texas, Chris Christie's New Jersey or Scott Walker's Wisconsin might take a pass.

Why Now?

Forty-nine of 50 states are required by law to balance their budgets. Mercifully, to fight wars and economic calamities like the Bush recession, the federal government is not.

As the Washington Post, the New York Times, Reuters, Bloomberg and the Wall Street Journal among others recently detailed, state and local governments are fiscal facing a fiscal triple-whammy. Even with spending now well below 2008 levels, the downturn-induced drop in revenues and increased demand for social services coupled with the looming end of the American Recovery and Reinvestment Act (ARRA) is producing yawning gaps in state budgets. And the states, all but one of which must balance its budget each year, are responding with sharp spending cuts, massive layoffs, deferred payments to state employee pension funds and, in some cases, tax hikes.

The numbers are staggering. By November, the Economic Policy Institute estimated that state and local governments had shed 407,000 jobs since their August 2008 peak. With state budget shortfalls estimated to approach $100 billion for each of the next two years, analysts including Moody's Economics and the Center on Budget and Policy Priorities have forecast more state and local job losses reaching between 400,000 and 900,000.

Last week, the AP explained the impact on the American economic recovery:

Deeper spending cuts by state and local governments slowed U.S. economic growth in the final three months of last year. The government's revised estimate for the October-December quarter illustrates how growing state budget crises could hold back the economic recovery...

State and local governments, wrestling with budget shortfalls, cut spending at a 2.4 percent pace. That was much deeper than the 0.9 percent annualized cut first estimated and was the most since the start of 2010.

Even with tax revenue finally starting to rebound, for the states the future looks bleaker still:

Economists predict they will slash their budgets by up to 2.5 percent this year - potentially the sharpest reduction since 1943. The deepest cuts are expected to occur in the first six months of this year... Most economists think the cutbacks this year will exert an even bigger economic drag than last year.

It doesn't have to be that way, unless John Boehner again decides, "So be it."

Why Would Republicans Support It?

In a nutshell, they won't. But they should. Because as the record shows, when it comes to taking taxpayer dollars from Washington, Republicans mouths aren't where Uncle Sam's money is.

During last summer's GOP filibuster of a much smaller aid package for the states, then House Minority Leader John Boehner led the Republican attack in labeling the Medicaid and jobs assistance a "bailout" for Democratic "special interests." Hoping to punish Democratic-voting states and their public employee unions, some GOP leaders have urged legislation to enable state and local governments to declare bankruptcy. As House Budget Committee chairman Paul Ryan put it, "We are not interested in a bailout."

In the states, too, Republican leaders offered tough talk, if not solutions, for their fiscal crises. Texas Governor Ricky Perry initially rejected some federal stimulus funds in grandstanding fashion, announcing, "This was pretty simple for us...We can take care of ourselves." On her last day in office, half-term Governor Sarah Palin warned "Be wary of accepting government largesse." In December, she demanded reform of state employee pension systems, declaring on Facebook:

So, let's not continue to reward irresponsible political behavior. Instead of handing out more federal dollars, let's give the governors of these debt-ridden states some free advice. Shake off the pressure from public sector unions to cave on this issue.

But despite their tough talk, when showed the money, these red state hypocrites took it.

As ThinkProgress documented a year ago, after voting against the Obama recovery program, 110 Republican Congressmen asked for more stimulus money for their districts. And as it turns out, Governor Palin was one of the leading practitioners of "red state socialism," that one-way flow of taxpayer dollars from Washington to reliably Republican states. Alaska led the nation in earmark dollars received per capita in the omnibus spending bill passed in the spring of 2009, while ranking third in the federal gravy train by taking in $1.84 from Washington for each dollar sent there. Meanwhile, Rick Perry was only able to put off addressing Texas' $25 plus billion deficit for a year thanks to federal government:

Turns out Texas was the state that depended the most on those very stimulus funds to plug nearly 97% of its shortfall for fiscal 2010, according to the National Conference of State Legislatures. Texas, which crafts a budget every two years, was facing a $6.6 billion shortfall for its 2010-2011 fiscal years. It plugged nearly all of that deficit with $6.4 billion in Recovery Act money, allowing it to leave its $9.1 billion rainy day fund untouched.

Despite bragging about their supposed fiscal discipline, Republicans in Congress and in the states have no problem when it comes to taking free money from Uncle Sam. With hundreds of thousands of jobs on the line in their states, they should do it again.

(If that's not enough to get Republicans to back the State Assistance Fund, perhaps a name change would help. How about "Recovery and Economic Assistance for Governments Around the Nation" - REAGAN.)

How Will It Be Paid For?

For the states, the assistance funds from Washington wouldn't be free, but they would be cheap. The no-interest SAF loans would just have to be paid back within ten years.

The price tag for the federal government is another matter. While Washington would over the next decade ultimately be paid back the $200 billion principal, yet more interest would accrue on the national debt in the interim.

Sadly, the two-year tax cut compromise inked by President Obama and Congress in December will drain over $800 billion from the United States Treasury over the next two year. (That's why the projected deficit for this fiscal year jumped last month by $400 billion to $1.5 trillion.) But when those budget-busting tax cuts expire at the end of 2012, there are myriad ways to recoup, say, $40 billion in interest payments. Returning the top tax rate to Clinton-era levels, increasing the estate tax to its 2009 level (45% beginning at $3,500,000 per person), or capping the charitable deduction rate would all produce more than enough revenue.

That's a small price to pay for saving as many as 900,000 jobs - and the American economic recovery with it.