Died of a Theory

As the South teetered on the edge of calamity near the end of the Civil War, the Confederate Congress refused pleas to arm the slaves. "If the Confederacy fails," CSA President Jefferson Davis lamented, "there should be written on its tombstone: Died of a Theory." Almost 150 years later and with Davis' political heirs having moved en masse to the Republican Party, the same might be said of the American economy. Despite the repeated warnings of economists, think tanks, international financial bodies and even Republican-friendly business groups that failure to raise the U.S. debt ceiling would surely result in economic catastrophe, GOP leaders Mitch McConnell and John Boehner would welcome that prospect rather than agree to any tax increases for "those in our country who create jobs."

As the two sides met with President Obama at the White House Thursday in search of a debt ceiling compromise, it's clear, as Abraham Lincoln famously put it, "one of them would make war rather than let the nation survive."

Heading into the meeting, House Majority Leader Eric Cantor parroted Paul Ryan in demanding, "We're not for any proposal that increases taxes, and any type of discussion should be coupled with offsetting tax cuts somewhere else." For weeks, Senate Minority Leader McConnell has branded tax hikes "politically impossible." With President Obama now said to be offering a stunning $4 trillion deficit reduction package, Speaker John Boehner insisted any proposal to boost tax rates or close loopholes "will be fruitless until the president recognizes economic and legislative reality."

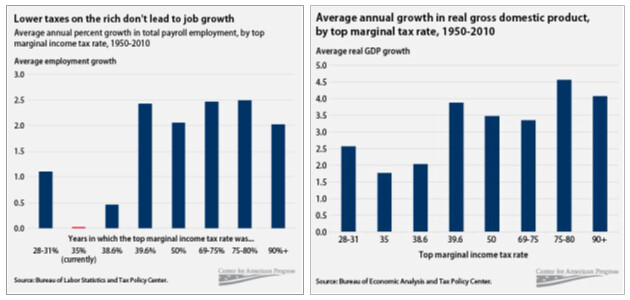

Sadly for Americans, the cruel experience of the last decade shows that only in the Republican version of economic reality do "tax cuts pay for themselves" or fuel an upper-class job creation engine. As Boehner explained the first pillar of Republican faith last summer, "It's not the marginal tax rates ... that's not what led to the budget deficit," adding, "We've seen over the last 30 years that lower marginal tax rates have led to a growing economy, more employment and more people paying taxes." In May, Boehner decreed the second, that "the mere threat of tax hikes causes uncertainty for job creators -- uncertainty that results in less risk-taking and fewer jobs." As he told Harry Smith of CBS News two months ago:

"The top one percent of wage earners in the United States...pay forty percent of the income taxes...The people he's [President Obama] is talking about taxing are the very people that we expect to reinvest in our economy."

If so, those expectations were sadly unmet under George W. Bush. After all, the last time the top tax rate was 39.6% during the Clinton administration, the United States enjoyed rising incomes, 23 million new jobs and budget surpluses. Under Bush? Not so much.

On January 9, 2009, the Republican-friendly Wall Street Journal summed it up with an article titled simply, "Bush on Jobs: the Worst Track Record on Record." (The Journal's interactive table quantifies his staggering failure relative to every post-World War II president.) The dismal 3 million jobs created under President Bush didn't merely pale in comparison to the 23 million produced during Bill Clinton's tenure. In September 2009, the Congressional Joint Economic Committee charted Bush's job creation disaster, the worst since Hoover:

That dismal performance prompted David Leonhardt of the New York Times to ask last fall, "Why should we believe that extending the Bush tax cuts will provide a big lift to growth?" His answer was unambiguous:

Those tax cuts passed in 2001 amid big promises about what they would do for the economy. What followed? The decade with the slowest average annual growth since World War II. Amazingly, that statement is true even if you forget about the Great Recession and simply look at 2001-7...

Is there good evidence the tax cuts persuaded more people to join the work force (because they would be able to keep more of their income)? Not really. The labor-force participation rate fell in the years after 2001 and has never again approached its record in the year 2000.

Is there evidence that the tax cuts led to a lot of entrepreneurship and innovation? Again, no. The rate at which start-up businesses created jobs fell during the past decade.

It's no wonder Leonhardt followed his first question with another. "I mean this as a serious question, not a rhetorical one," he asked, "Given this history, why should we believe that the Bush tax cuts were pro-growth?" Or as Mark Shields asked and answered in April:

"Do tax cuts help 'job creators' or 'robber barons'?"

Just days after the Washington Post documented that George W. Bush presided over the worst eight-year economic performance in the modern American presidency, the New York Times in January 2009 featured an analysis comparing presidential performance going back to Eisenhower. As the Times showed, George W. Bush, the first MBA president, was a historic failure when it came to expanding GDP, producing jobs and even fueling stock market growth. The data are clear: lower taxes for America's so called job-creators don't mean either faster economic growth or more jobs for Americans.

Despite that proven record of failure, Republicans would sooner bring the U.S. economy to its knees that take one dime from the pockets of Americans wealthiest individuals or most profitable corporations.

Last week, John Boehner joined the ranks of Tim Pawlenty, Michele Bachmann, Pat Toomey, RNC Chairman Reince Preibus and other GOP "default deniers" by proclaiming the Treasury Department's early August deadline to raise the nation's $14.3 trillion debt ceiling "artificial." That's a far cry from January, when newly installed Speaker Boehner fretted about failure to raise the federal government's borrowing authority:

"That would be a financial disaster, not only for our country but for the worldwide economy. Remember, the American people on Election Day said, 'we want to cut spending and we want to create jobs.' And you can't create jobs if you default on the federal debt."

Just in case Boehner forgot his earlier statement, a chorus of voices quickly chimed in to remind him. A new analysis by the Bipartisan Policy Center concluded that failure to boost the debt ceiling by the August drop-dead window would force the U.S. Treasury to immediately slash spending by 44%. As The Hill reported, "On an annualized basis, the cut in spending alone is a 10 percent cut in GDP, BPC scholar Jay Powell told reporters." The IMF similarly cautioned that "the debt ceiling should be raised as soon as possible to avoid damage to the economy and world financial markets." 235 economists - including six Nobel Prize winners - signed an open letter to Congressional leaders urging them to raise the ceiling, and to do so "without attaching drastic and potentially dangerous reductions in federal spending." Failure to do so, they warned, "could push the United States back into recession."

Echoing that message is former McCain economic adviser Mark Zandi who last week painted a grim portrait of just what that damage would look like. Even a brief default, as TPM reported, would be cataclysmic:

If Congress fails to raise the national debt limit by early August, the Obama Treasury Department will have to choose between defaulting on obligations to the country's creditors -- triggering higher interest rates and perhaps damaging the country's credit rating for months and years to come -- or freezing outlays to contractors, entitlement beneficiaries and others who are also expecting prompt payment as well. In either case, the macroeconomic impact will be staggering, according to Zandi.

"I think we go into recession and my forecast would be blown out of the water," he said. "I think if we get to August 2nd and there is no debt ceiling [increase] and there has to be significant spending cuts, I think even if Congress and the administration reverse themselves days later, I think the damage will have been serious and we'll probably be thrown into a recession."

Yet the default deniers like freshman Pennsylvania Senator Pat Toomey insist "there is no danger of a shortage of cash to pay the interest on our debt and to avoid a default" and claim it is "irresponsible for the administration to even implicitly threaten the possibility of a default." Pretending that with a little budgetary sleight of hand, the cataclysm that would be a U.S. default need not be so, well, cataclysmic, Toomey criticized Geithner for "doomsday predictions that could only materialize at his own hand." Instead, Toomey claims, the Obama administration should back his bill which "would require the Treasury to prioritize payments on our debt in the event the debt ceiling is not raised, thus ensuring the U.S. government does not default." White House hopeful Michele Bachmann (R-MN) similarly declared we don't raise the debt ceiling, but we use the revenue still coming in to pay off creditors first and whatever we think most important second. That way, we "don't violate our credit rating" and "prioritize our spending." Later, Bachmann accused Secretary Geithner of "outright blatant lies" and "scare tactics."

Ezra Klein described Bachmann's fantasy as "the scariest thing I've ever heard on television."

It makes perfect sense unless you, like me, had spent the previous few days talking to economists, investors and economic policymakers about what could happen if we start playing games with the debt ceiling. Their answers were across-the-board apocalyptic. If the U.S. government is so incapable of solving its political problems that it can't come to an agreement on the debt ceiling, they said, that's basically the end of the United States as the world's reserve currency. We won't be considered safe enough to serve as the investment of last resort. We would lose the most important advantage our economy has in the global financial system -- and we'd probably lose it forever. Skyrocketing interest rates would slow our economy and, in real terms, make it even harder to pay back our debt, which would in turn send interest rates going even higher. It's an economic death spiral we associate with third-world countries, not with the United States.

Writing in Slate, Annie Lowrey paints a similarly disturbing picture of the aftermath of the Republicans' debt ceiling terrorism when the Treasury's borrowing options come to an end this summer:

Within 72 hours, Congress has a deal on President Obama's desk, raising the ceiling to $16 trillion in exchange for balanced budgets to take effect in fiscal-year 2015 and some serious cuts now. Treasury starts issuing new bonds and making all payments on existing ones. But the market panic requires the Federal Reserve to reboot its emergency programs, disrupts the housing market, permanently raises the United States' borrowing costs, reshapes the world bond market, and shaves more than a percentage point off GDP growth--enough to throw the economy back into recession. Globally, investors no longer consider the dollar the reserve currency of choice.

When it comes to the potential damage caused by the Republican economic suicide bombers, Americans don't need to take Annie Lowrey's or Ezra Klein's word for it. Over the past few weeks, the U.S. Chamber of Commerce, Wall Street executives, the National Association of Manufacturers and a host of the GOP's other big business allies have warned the Republican leadership that the party's grandstanding risks an economic calamity for the United States. As The Hill reported, the same business backers who bankrolled the GOP's overwhelming victories in November has had enough of the fear, uncertainty and doubt coming from Messrs.' McConnell, Boehner and Cantor.

Groups such as the National Association of Wholesaler-Distributors (NAW), the U.S. Chamber of Commerce and the National Association of Manufacturers (NAM) plan to step up their advocacy for a debt-limit increase as the deadline for congressional action draws closer.

Lobbyists for several major trade associations told The Hill that they have already had discussions with first-term House Republicans about the necessity of lifting the debt ceiling to avoid a default on U.S. debt.

As one Wall Street executive described the carnage Republicans are about to cause:

"They don't seem to understand that you can't put everything back in the box. Once that fear of default is in the markets, it doesn't just go away. We'll be paying the price for years in higher rates."

Last month, the Wall Street Journal highlighted the growing concern at the reliably Republican U.S. Chamber of Commerce:

The U.S. Chamber of Commerce waded into the fight over increasing the government's borrowing limit on Friday by urging members of Congress to raise the debt ceiling "as expeditiously as possible."

The business community's chief lobby in Washington made the case in a letter to lawmakers signed by Bruce Josten, the group's head of government affairs, arguing that failure to pass legislation authorizing an increase in borrowing by Aug. 4 "would create uncertainty and fear, and threaten the credit rating of the United States."

Despite their current posturing, John Boehner, Mitch McConnell and GOP Congressional majorities voted seven times to raise the debt ceiling under George W. Bush. During his tenure, the U.S. national debt doubled, fueled by the Bush tax cuts of 2001 and 2003, the Medicare prescription drug plan and the unfunded wars in Iraq and Afghanistan. McConnell and Boehner voted for all of it. But now that a Democrat is in the White House, they proclaim that the debt ceiling vote is a "great opportunity" to reduce U.S. deficits.

Writing last month in the Wall Street Journal, former Federal Reserve vice chairman Alan Blinder worried about the economic and political damage the Republicans' unprecedented debt ceiling gambit would cause:

[S]hould the view take hold that threats to default are now a permissible weapon of political combat in the world's greatest democracy, U.S. government debt will lose its exalted status as the safest asset money can buy--with unpleasant consequences for the dollar and interest rates.

Fights over the budget are normal and proper in a democracy, especially when the two parties hold dramatically different views. But threatening to default should not be a partisan issue. In view of all the hazards it entails, one wonders why any responsible person would even flirt with the idea.

Sadly, this is now standard operating procedure for a Republican Party whose leading lights freely admit their claims were "not intended to be a factual statement."

Now, Republicans are pushing the United States to the brink of default and economic perdition, all in the name of the theory. And that supply-side theory, which wrongly claims that "you cut taxes and tax revenues increase" and "overtaxing" job creators is "holding them back," was debunked and discredited long ago. The Republicans' cause may not be "one of the worst for which a people ever fought," as Ulysses Grant described slavery.

But it's close.

Frankly, I think the damage has already been done.

Even if the debt ceiling is raised, after the insane game of political chicken played by the Republicans, I think that this, along with other things, will convince the rest of the world that America is too crazy to be relied on any more, and I think there will be a move away from the U.S. dollar--with disastrous effects for us.

I don't know why the Republicans are so suicidally insane. And I don't know why Obama is so temporizing with these people, when what he needed to do was to take firm action to put a stop to this nonsense.

It may be that in 2012, Obama pays a steep price for always seeking "compromise," "consensus," and a "grand bargain," rather than standing up and fighting for principle....