GOP Tax plan is the Worst Jobs Bill Ever

With apologies to Benjamin Disraeli, there are three kinds of lies Republicans are telling about their tax plan: lies, damned lies, and f**king lies.

Constraints of space and time preclude listing them all, but here is a handful of the GOP's most farfetched falsehoods. For example, earlier this month House Speaker Paul Ryan (R-WI) repeatedly promised "it's a tax cut for everybody ... every single person, every rate payer, every bracket person gets a rate cut." When the Washington Post Fact Checker published a Four Pinocchio beat-down of this bunk, Ryan and Senate Majority Leader Mitch McConnell (R-KY) beat a hasty retreat. Despite the hemorrhage of red ink produced by the Reagan and Bush tax cuts, Trump White House economic adviser Gary Cohn bragged, We think we can pay for the entire tax cut through growth over the cycle," a point echoed by Treasury Secretary Steve Mnuchin on November 13. The 10-year, $1.5 trillion windfall for the wealthy will "not only ... pay for itself," Mnuchin boasted, "but it will pay down debt" as well. Unfortunately, analyses from the Congressional Budget Office (CBO), Joint Committee on Taxation (JCT), the Wharton School, the Tax Policy Center (TPC) and even the conservative friendly Tax Foundation (TF) concluded otherwise. And even without seeing the president's past tax returns, we know that Donald Trump was lying through his teeth when he said the GOP tax plan was "going to cost me a fortune" and that his own finances were "going to get killed in this bill."

So, neither the House nor the Senate versions of the GOP's "Tax Cuts and Jobs Act" (TCJA) does a very good job of actually delivering tax cuts, except to corporations and the wealthiest people in America. But as it turns out, the TCJA doesn't do much to create jobs, either.

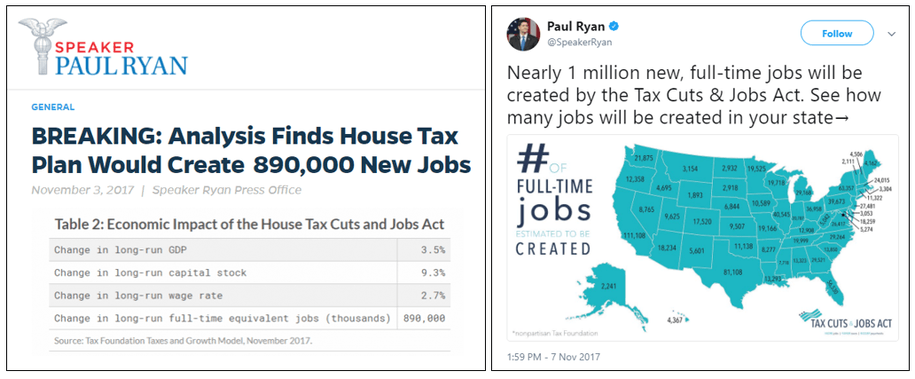

Of course, you'd never know it listening to Paul Ryan. On November 3, the speaker's website issued this update: "BREAKING: Analysis Finds House Tax Plan Would Create 890,000 New Jobs." Citing the analysis by the reliably right-leaning Tax Foundation, Team Ryan crowed that over the ensuing decade, the Tax Cuts and Jobs Act would result in "890,000 more full-time equivalent jobs, 3.5 percent increase in size of the U.S. Economy [and] 2.7 percent higher wages for workers. (The Tax Foundation's assessment of the Senate bill put the employment gain at 925,000 over 10 years.) On November 7, Ryan excitedly tweeted the jobs number again, this time conveniently rounding up:

Nearly 1 million new, full-time jobs will be created by the Tax Cuts & Jobs Act. See how many jobs will be created in your state.

Then on November 16, the same day the House of Representatives narrowly passed his Tax Cuts and Jobs Act, Speaker Ryan took to the floor to declare:

"Let me just break it down in simple numbers. The nonpartisan tax foundation ran the numbers. They said with this bill, we'll get faster growth, about 3.5 percent faster economic growth, 890,000 new jobs. They estimate that in New York state alone, 57,834 new jobs. Wisconsin: 17,999 new jobs. California: 101,422 new jobs. Texas: 74,037 new jobs."

Now, if you are experiencing a queasy sensation (or feeling, as James Comey might describe it, "mildly nauseous") because that jobs number seems pathetically low, that's because it is.

Continue reading at Daily Kos.