Hillary Clinton Pays a Lot in Taxes. She's Proposing to Pay Even More.

As his presidency neared its end, George W. Bush unveiled his plans for life after the White House. "I'll give some speeches, just to replenish the ol' coffers," the multi-millionaire told Robert Draper, adding, "I don't know what my dad gets - it's more than 50-75" thousand dollars a speech, and "Clinton's making a lot of money."

As it turns out, both Bill and Hillary Clinton have been making a lot money. But while Bush gets up to $175,000 for his behind-closed-doors speeches to groups like the Bowling Proprietors' Association of America, the similarities end there. As a share of their earnings, the Clintons give much more to charity and pay much more in taxes. And if candidate Hillary Clinton gets her way, she and Bill will be paying even more.

As the issue of Secretary Clinton's speaking fees heated up after this week's Democratic debate with Vermont Senator Bernie Sanders, CNN documented the windfall:

Hillary Clinton and her husband, former President Bill Clinton, combined to earn more than $153 million in paid speeches from 2001 until Hillary Clinton launched her presidential campaign last spring, a CNN analysis shows.

In total, the two gave 729 speeches from February 2001 until May, receiving an average payday of $210,795 for each address. The two also reported at least $7.7 million for at least 39 speeches to big banks, including Goldman Sachs and UBS, with Hillary Clinton, the Democratic 2016 front-runner, collecting at least $1.8 million for at least eight speeches to big banks.

To be sure, those audiences and those dollar figures don't present the greatest optics for Hillary Clinton. But more context, which CNN itself reported last year, tells a somewhat different story. Unlike most wealthy Americans (and wealthy presidential candidates, "she and her husband paid an effective federal tax rate of 35.7 percent and a combined federal, state, and local effective rate of 45.8 percent last year."

In a lengthy statement and on her campaign website, Clinton detailed that she and her husband, former President Bill Clinton, paid more than $43 million in federal taxes from 2007 to 2014, over $13 million in state taxes and donated nearly $15 million to charity over the same period.

As it turns out, the Clintons have now released 38 years of tax returns going back to Bill's first campaigns in Arkansas. And the contrast with the GOP's last presidential nominee, Mitt Romney, is quite stark. Romney released just two years of returns. Romney, who fortune was valued a quarter-billion dollars back in 2008, summed up his last decade of payment to Uncle Sam this way four years ago:

"Every year, I've paid at least 13 percent, and if you add, in addition, the amount that goes to charity, why the number gets well above 20 percent."

Remember, too, that Romney and every one of the 2016 Republican candidates would dramatically cut the Clintons' tax bill. One person who wouldn't is Hillary Clinton herself. While the GOP field promises to slash the top income tax rates, eliminate the estate tax and even (like Marco Rubio) end capital gains and dividend taxes, Clinton would increase them all.

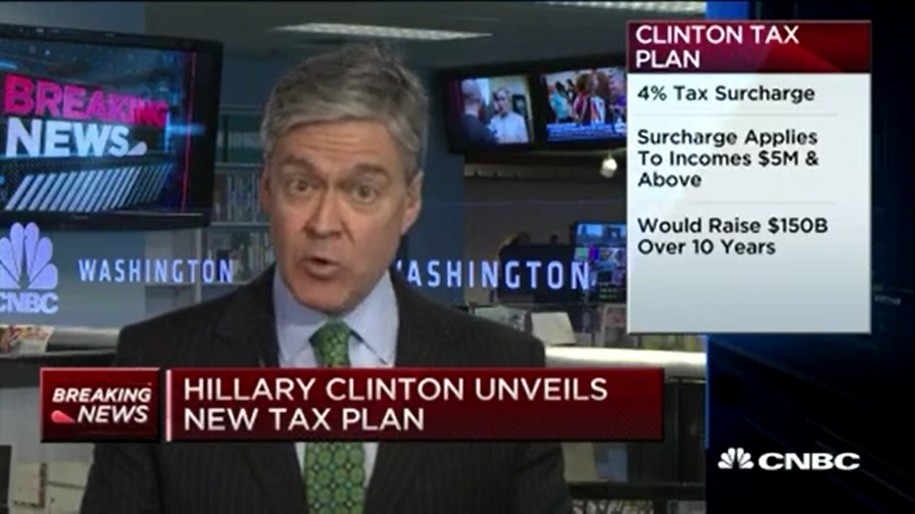

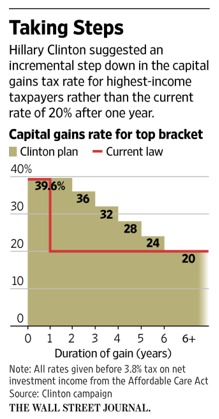

For starters, Hillary has proposed a 4 percent surcharge on incomes (including investment income) over $5 million a year. She backs the Buffett Rule, which requires those earning above $1 million a year to pay at least 30 percent to Uncle Sam. Like Bernie Sanders, Clinton has long supported ending the "carried interest exemption" that allows hedge fund managers and private equity investors (like Mitt Romney) to pay the much lower capitals gains rate (20 percent) rather than the income tax rate (as high as 39.6 percent) on their annual earnings. Just as important for those on Wall Street, Hillary would change the treatment of capital gains, where still-low tax rates are one of the biggest factors behind America's record-high levels of income inequality. For individuals earning over $411,500 a year ($464,850 for families), capital gains on investment income would be taxed at the same rate as earned income (39.6 percent). For this top 0.5 percent of taxpayers, rates would decline each year, until reaching 20 percent for investments held six years or longer.

Candidate Hillary Clinton, it is clear, is determined to raise President Hillary Clinton's tax bill to the IRS.

Now, you can argue that Hillary's practice of extracting large sums of cash from the financial sector is indefensible. (At best, as Paul Waldman suggests, Hillary could make the boastful claim that "I'm worth it.) But if nothing else, she might start by borrowing from Bill's script. As he put it in 2004:

"You might remember that when I was in office, on occasion, the Republicans were kind of mean to me. But soon as I got out and made money, I began part of the most important group in the world to them. It was amazing. I never thought I'd be so well cared for by the president and the Republicans in Congress. I almost sent them a thank-you note for my tax cuts - until I realized that the rest of you were paying for the bill for it, and then I thought better of it."

As her tax proposals show, Hillary Clinton is willing to put her money where her mouth is.