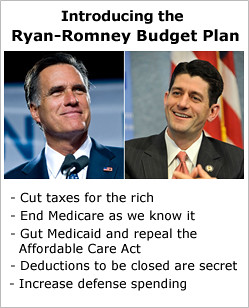

Introducing the Ryan-Romney Budget

If the new House GOP budget unveiled Tuesday by Paul Ryan sounds familiar, it should. And not just because Ryan's "Path to Prosperity" is essentially the same scheme he's been pushing for two years. As it turns out, Mitt Romney is offering the same disastrous recipe for America's future. Both Ryan and Romney would deliver a massive tax cut windfall for the rich, paying for it by gutting the social safety net each pretends to protect. Each would end Medicare as we know it with a premium support gambit that would dramatically shift health care costs to America's seniors. While increasing defense spending, the House Budget Chairman and the GOP frontrunner would repeal the Affordable Care and leave at least 30 million people without insurance. And despite their mutual pledges to end many tax loopholes and deductions to fund their gilded-class giveaway, neither Paul Ryan nor Mitt Romney has the courage to say which ones.

All of which means that in 2012, Republicans will be running on the Ryan-Romney plan.

Ezra Klein of the Washington Post summed up the Ryan plan in a single sentence. "Ryan's budget," Klein concluded, "funds trillions of dollars in tax cuts, defense spending and deficit reduction by cutting deeply into health-care programs and income supports for the poor." But as he asked elsewhere:

Does anything in this budget seriously conflict with Mitt Romney's plans?

In a nutshell, no. While they details may differ, the implications do not.

- Tax Cuts for the Wealthy and Corporations

- What Loopholes Get Closed? That's a Secret!

- Ending Medicare as We Know It

- Shredding the Safety Net

- Increased Defense Spending

(Click a link above to jump to the details for each.)

Tax Cuts for the Wealthy and Corporations

Both Mitt Romney and Paul Ryan would reduce corporate taxes from 35 to 25 percent. The top marginal income tax rate would be slashed from 35 percent to 25 percent (for Ryan) or 28 percent (for Romney). But while the former Massachusetts Governor is offering a 20 percent across-the-board cut to all of the current tax brackets, Ryan wants to move to only two: 10 and 25 percent. Ryan-Romney also ends the AMT and by repealing the Affordable Care, the taxes on higher-earners used to help pay for it. (Both men also want to eliminate the estate tax, a move which could theoretically deliver the Romney heirs an $80 million windfall.)

The result of the Ryan plan is predictable. As ThinkProgress explained:

In all, those tax breaks amount to a $3 trillion giveaway to the richest Americans and corporations, according to the Tax Policy Center. Repealing the repatriation tax would add roughly $130 billion to that.

At a time of record income inequality, the lowest federal tax burden in 60 years, Mitt Romney would produce a similar payday for those who need it least. Again, ThinkProgress:

Romney's claim that his plan would promote job and economic growth while reducing the deficit is also likely false. The Bush tax cuts were promoted under the same guise, only to blow a $2.5-trillion hole in the federal budget that was accompanied by worst performance of any post-war expansion" for growth in investment, GDP, and job creation. Romney's tax cuts are even more expensive, clocking in at a cost of more than $10.7 trillion over the next decade and reducing revenue to a paltry 15 percent of GDP, according to Linden. Balancing the budget on those terms, as Romney claims he will do, would be next to impossible.

(As it turns out, Romney would hand over 60 percent of the benefits from his tax cuts to the top one percent of earners. And that figure was before he announced his new 20 percent across-the-board tax cut scheme.)

What Loopholes Get Closed? That's a Secret!

Balancing the budget from Ryan-Romney is indeed impossible, unless the two-headed Republican beast is willing to make steep cuts to spending (more below) and eliminate tax deductions for workers, families and businesses that cost Uncle Sam over $1 trillion a year. But because ending, say, the Earned Income Tax Credit or the home mortgage deduction would be wildly unpopular, neither Ryan nor Romney will volunteer the information.

Appearing on MSNBC's "Morning Joe," Congressman Ryan declared he would "Get rid of the special interest loopholes, special deductions, lower everybody's tax rates, bring in at least as much revenue to the government but grow the economy and create jobs, and get spending under control so we can pay off this debt." But when host Joe Scarborough asked "Which one of those [loopholes] do you eliminate," Ryan said voters won't learn the answer until after the election:

"We want to do this in the light of day and in front of everybody. So the Ways and Means Committee, which is in charge of the tax system, sent us the plan here, which is a 10 and 25 percent bracket for individuals and small businesses, and then they want to have hearings and, in light of day, show how they would go about doing this."

As it turns out, that's the same dodge Mitt Romney used. Last month, His economic adviser Glenn Hubbard admitted Romney's cowardice, explaining "it is not his intention to take on any specific deduction or exclusion and eliminate it." As the New York Times reported:

"In order to limit any impact on the deficit, because I do not want to add to the deficit, and also to make sure we continue to have progressivity in our tax code, I'm going to limit the deductions and exemptions, particularly for high-income folks," Mr. Romney, a former governor of Massachusetts, said. "And by the way, I want to make sure that you understand, for middle-income families, the deductibility of home mortgage interest and charitable contributions, those things will continue," he said. "For high-income folks, we are going to cut back on that, so we make sure that the top 1 percent keeps paying the current share they're paying or more. We want middle-income Americans to be the place we focus our help, because it's middle-income Americans that have been hurt by this Obama economy."

But just two weeks later, Mitt Romney concluded discretion was the better part of valor and refused to reveal which deductions and tax breaks he would end:

"So I haven't laid out all of the details about how we're going to deal with each deduction, so I think it's kind of interesting for the groups to try and score it, because frankly it can't be scored, because those kinds of details will have to be worked out with Congress, and we have a wide array of options."

In response, the Post's Klein could only shake his head:

"Let's be clear on this: A tax plan that can't be scored because it doesn't include sufficient details is not a plan. It's a gesture towards a plan, or a statement of intended direction, or perhaps an unusually wonky daydream. But it's not a plan."

Or as Michael Linden described Ryan's version, "If the president put out a budget with this level of detail and these kinds of assumptions, people would be up in arms about how ridiculous it is."

Ending Medicare as We Know It

Last April, 235 House Republicans and 40 GOP Senators voted for Paul Ryan's plan to convert Medicare into a system of under-funded vouchers in which millions of seniors would be left to the devices of the private insurance marketplace. But when Americans learned that the Ryan scheme would inevitably lead to massive cost-shifting to - and rationing for - the elderly, Paul Ryan went back to the drawing board.

Today, he's back with an updated version of the Ryan-Wyden plan, which would continue a government Medicare as one option. As ThinkProgess explained

Beginning 2023, the guaranteed Medicare benefit would be transformed into a government-financed "premium support" system. Seniors currently under the age of 55 could use their government contribution to purchase insurance from an exchange of private plans or traditional fee-for-service Medicare. But the budget does not take sufficient precautions to prevent insurers from cherry-picking the healthiest beneficiaries from traditional Medicare and leaving sicker applicants to the government. As a result, traditional Medicare costs could skyrocket, forcing even more seniors out of the government program. The budget also adopts a per capita cost cap of GDP growth plus 0.5 percent, without specifying how it would enforce it. This makes it likely that the cap would limit the government contribution provided to beneficiaries and since the proposed growth rate is much slower than the projected growth in health care costs, CBO estimates that new beneficiaries could pay up to $2,200 more by 2030 and up to $8,000 more by 2050. Finally, the budget would also raise Medicare's age of eligibility to 67.

Again, the specifics may vary, but Mitt Romney's prescription for Medicare is essentially the same poison pill as the "Ryden" model. As the New York Times documented in November:

Mr. Romney's proposal would give beneficiaries the option of enrolling in private health care plans, using what he, like Mr. Ryan, called a "premium support system." But unlike the [original] Ryan plan, Mr. Romney's would allow older people to keep traditional Medicare as an option. However, if the existing government program proved more expensive and charged higher premiums, the participants would be responsible for paying the difference.

Shredding the Safety Net

When it comes to Medicaid, food stamps and other key components of the American social safety net, Paul Ryan and Mitt Romney see eye-to-eye. Each would slash Medicaid spending (Ryan by a third) over the next decade, and send the reduced funds to the states in the form of block grants. Those budget cuts would merely result in millions of poor, elderly and disabled Americans losing health insurance, but guarantee a nationwide race to the bottom. As Jonathan Cohn explained:

If the law changes and Medicaid becomes a block grant, then every year the federal government would simply give the states a lump sum, set by a fixed formula, and let the states make the most of it. Conservatives claim block grants would give states the flexibility they need to make their programs more efficient. But, as Harold Pollack has noted in these pages, states already have some flexibility. And because demand for Medicaid tends to peak during economic downturns, when state tax revenues fall, the likely impact of a block grant scheme would be to make Medicaid even less affordable at the time it is most necessary.

That's not to say plenty of governors wouldn't take advantage of block grant status to change their Medicaid programs in ways they cannot now. They surely would--by capping enrollment, thinning benefits, increasing co-payments, and so on.

Nevertheless, as Matthew Yglesias documented, Paul Ryan insists that his plan "strengthens the safety net by returning power to the states, which are in the best position to tailor assistance to their specific populations."

Of course, this simply isn't true, as Mitt Romney found out the hard way several weeks ago. Romney explained his devil-may-care attitude towards the 46.2 million Americans now living in poverty and the 51 million more with incomes less than 50 percent above the poverty line:

"I'm not concerned about the very poor. We have a safety net there," Romney told CNN. "If it needs repair, I'll fix it. I'm not concerned about the very rich, they're doing just fine. I'm concerned about the very heart of the America, the 90 percent, 95 percent of Americans who right now are struggling."

That's an odd statement for Mitt Romney to make, and not merely because he previously declared himself part of "the 80 to 90 percent of us" who are middle class. Romney's own economic plan says otherwise. Romney's isn't worried about fixing the safety net; he wants to shred it. And in December, Chris Wallace of Fox News called him on it.

WALLACE: But you don't think if you cut $700 billion dollars in aid to the states that some people are going to get hurt?

ROMNEY: In the same way that by cutting welfare spending dramatically, I don't think we hurt the poor. In the same way I think cutting Medicaid spending by having it go to the states run more efficiently with less fraud, I don't think will hurt the people that depend on that program for their healthcare.

The Congressional Budget Office says otherwise. Looking at Ryan's new version of shredding the safety net, the CBO estimates 48 million Americans would lose health insurance (32 million from repeal of the Affordable Care Act, 15 million from Medicaid cuts, and another one million from the voucherization of Medicare). It's with good reason Ezra Klein asked, "Should the poor pay for deficit reduction?"

Increased Defense Spending

To add insult to injury, both Mitt Romney and Paul Ryan would break the terms of last year's Congressional debt deal by increasing defense spending. As ThinkProgress summed it up:

The Ryan budget protects defense spending from automatic cuts agreed to in last year's debt deal, then boosts defense spending to $554 billion in 2013 -- $8 billion more than agreed upon in the deal. At the same time, it asks six Congressional committees to find $261 billion in cuts. That includes $33.2 billion from the Agriculture Committee, meaning food stamps and other social safety net programs are likely to face cuts, all while the Pentagon remains untouched.

Romney's defense build-up is even more nonsensical. As the Boston Globe noted, Romney not only fails to realize savings from the end of the U.S. war in Afghanistan, but promises Pentagon increases that simply don't square with his pledge to "Cut, Cap and Balance" the federal budget:

Under next year's budget, defense spending is projected to be about 3.2 percent [of GDP] - yet Romney has stuck by his 4 percent vow. Put another way, that means Romney proposes spending 61 percent more than Obama at the end of a decade-long cycle, according to the libertarian Cato Institute.

Enacting such an increase at the same time that Romney wants to slash taxes and balance the budget could cost trillions of dollars and require huge cuts in domestic programs. As Romney's website puts it matter-of-factly, "This will not be a cost-free process.''

Far from it. While the richest Americans, biggest corporations and largest defense contractors will be feeling no pain as a result of the Ryan-Romney budget, for almost everyone else the process will be quite painful, indeed. Paul Ryan's "Path to Prosperity" and Mitt Romney's hauntingly similar plan to "Restore America's Promise" would provide neither.