John McCain Was Right: Rich Feel Wealthy Starting at $5 Million

During the 2008 presidential campaign, Republican John McCain famously struggled to explain at what point an American could be considered rich. When Pastor Rick Warren asked McCain at the Saddleback Church presidential forum "where do you move from middle class to rich," the $100 million man who had lost count of how many homes he owned answered, "How about $5 million?"

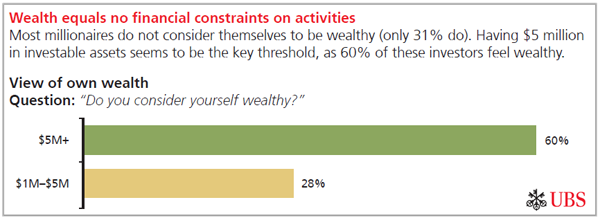

As it turns out, John McCain was right. As ThinkProgress reported, a new survey by UBS of 4,450 investors with at least a quarter-million dollars in investable assets suggested that $5 million is indeed the line they draw between being wealthy or not.

Two-thirds of millionaires don't consider themselves to be wealthy.

They also define being wealthy not as having a certain amount of money, but having "no financial constraints on what they do." That does indeed likely come with a large price tag.

The good news for the uber rich is that less than 20 percent have a pessimistic view of the long-term economic outlook. That differs sharply from the general population, as half of Americans say the economy is getting worse.

The gilded class is justified in its optimism. After all, recent studies show the top 1 percent didn't just recoup their losses from the great recession of 2008. As it turns out, between 2009 and 2011 their incomes rose by 11 percent even as the other 99 percent of American households saw theirs decline. And even with higher income and capital gains tax rates that kicked in on January 1, the Congressional Budget Office found (as both it and the Congressional Research Service had predicted) that higher taxes were not impacting spending, investment or charitable giving by the rich.

Those results were in keeping with a mountain of evidence that low capital gains tax rates fuel income inequality, not investment. As the Washington Post explained in 2011:

While it's true that many middle-class Americans own stocks or bonds, they tend to stash them in tax-sheltered retirement accounts, where the capital gains rate does not apply. By contrast, the richest Americans reap huge benefits. Over the past 20 years, more than 80 percent of the capital gains income realized in the United States has gone to 5 percent of the people; about half of all the capital gains have gone to the wealthiest 0.1 percent.

All of which means policy makers in Washington shouldn't hesitate to ask likes of John McCain and friends in the 1 percent (a group who would have reaped the 60 percent of the benefits from his 2008 plan) to pay higher taxes. Even if it they don't feel wealthy.