McCain's New, New Plan: The Rich Get Richer

After days of conflicting rumors from his own campaign, John McCain emerged Tuesday to offer his new, new plan for the economy. While parroting Barack Obama's proposals to Monday to end taxes on unemployment benefits and a temporary reduction in the tax rates on IRA withdrawals, the centerpiece of McCain's latest economic policy spasm is a halving the tax on capital gains. With the latter providing almost 60% of its benefits to families earning over $1 million a year, John McCain's tax-cutting philosophy remains consistent. When the going gets tough, the rich get richer.

As the New York Times reported this morning, McCain's latest package proposes "a reduction in the tax on long-term capital gains to 7.5 percent from 15 percent in 2009 and 2010 at an estimated cost of $10 billion." As ThinkProgress detailed, at a time of economic hardship, McCain's windfall goes overwhelmingly to those who need it least:

Households earning less than $50,000 a year collected a mere 2.5 percent of capital gains in 2005, according to the Tax Policy Center. Families earning more than $1 million a year collected 59 percent of capital gains. Moreover, most middle-class families with capital gains hold their investments in retirement accounts shielded against capital gains taxes.

If McCain's payday for the wealthy sounds familiar, it should. His plan announced this spring to extend and expand the Bush tax cuts makes the current Republican occupant of the Oval Office look like Karl Marx in comparison. As a study by the Center for American Progress revealed:

Our analysis suggests that the McCain plan shares five key characteristics of Bush policies. First, it is enormously expensive, costing more than $2 trillion over the next decade and essentially doubling the Bush tax cuts. Second, the McCain plan would predominantly benefit the most fortunate taxpayers, offering two new massive tax cuts for corporations and delivering 58 percent of its benefits to the top 1 percent of taxpayers. The Bush tax cuts provide 31 percent of their benefits to the top 1 percent of taxpayers.

Third, the McCain tax plan continues the shift of the tax burden from investment income onto earned income. Fourth, the plan not only fails to address current tax shelter problems in the tax code but in fact will lead to increased sheltering. Fifth, McCain cannot pay for his tax cuts without massive reductions in Social Security, Medicare, or other key programs that benefit the vast majority of Americans.

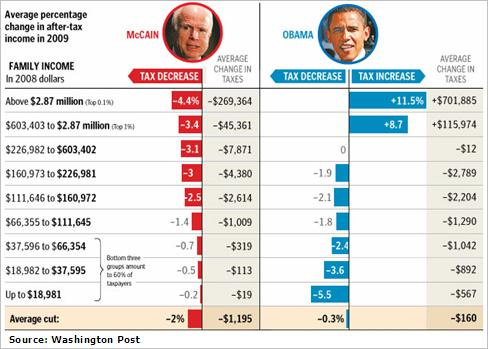

Understandably, as I detailed in August, Americans prefer Barack Obama's tax plan. An analysis by the Tax Policy Center (TPC) demonstrated that Barack Obama's proposals offer working and middle class Americans steeper tax benefits at every income level up to $110,000. As the Washington Post reported in June, the TPC found that:

"Obama's plan gives the biggest cuts to those who make the least, while McCain would give the largest cuts to the very wealthy."

Those whose income is under $67,000 - 60% of all American taxpayers - would see substantially larger tax cuts under the Obama plan. While McCain's plan concentrates 58% of its benefits to the wealthiest 1% of Americans, Obama's rollback of the Bush tax cuts above $250,000 produces tax increases for that group.

And so it goes. Flailing about as they desperately attempt to halt his decline in the polls, McCain's own advisers were confused about when and what - if anything - John McCain would say about the economy this week. Following McCain's speech, campaign spokesperson Nancy Pfotenhauer was stumped when asked how much his new proposals would cost. "Obviously," she said, "it's going to cost some amount of money."

Obviously, hard-working American taxpayers are going to be asked to foot that bill. As for the gold-plated recipients of John McCain's largesse, the answer is always the same - good times or bad.

UPDATE 1: In the "you can't make this up" department, John McCain offered this gloriously ironic sound bite during his speech today, "the hard earned savings of Americans should not be penalized by the erratic behavior of politicians."

UPDATE 2: ThinkProgress summarizes McCain's economic package by simply noting "those making $1 million or more would get two-thirds of the benefit, and an average tax cut of more than $72,000. Those making less than $50,000 would get, on average, nothing."

Great analysis. Thanks.