Mississippi Makes the Case for Boosting IRS Budget

For months, Republicans have been waging a new war on the IRS. Echoing their successful gutting of the Internal Revenue Service back in the 1990's, GOP leaders have been calling the agency "the new Gestapo" and demanding its budget be slashed by a quarter. But with a "tax gap" already nearing $500 billion a year lost to evasion, fraud and cheating, cutting or abolishing the IRS would add tens of billions of dollars to Uncle Sam's budget deficit every year. But if you're skeptical about claims from Democrats, nonpartisan government studies and independent tax analysts that increasing the IRS' enforcement budget will reduce the national debt, just ask the good Republican folks who run the state of Mississippi instead.

As the Washington Post reported Thursday in "How Mississippi turned $3.5 million into $80 million," Magnolia State Republicans were shocked--shocked!--to learn that spending money to actually collect the taxes owed to the government produces an amazing return on investment:

By virtually any standard, a nearly 23-fold return on an investment in a year is really good. It's so good, in fact, that it's almost unbelievable. But in Mississippi that's exactly what legislators got.

When appropriators there gave the state's tax-collection agency an extra $3.5 million in funding for the fiscal year that ended in June, they asked that the agency aim to collect $10 million more in back taxes than it had the year before. The agency, the Mississippi Department of Revenue, said it would try and ultimately achieved the goal. Eight times. The state collected $190.3 million in back taxes last fiscal year, an $80.9 million increase over the year before, playing a role in what turned out to be a surprisingly large overall haul.

The lessons are two-fold. For the other 49 states, most of which have yet to see their tax haul in 2013 return to pre-recession, 2008 levels, allocating more money for tax collection and enforcement means more revenue and saving more jobs. (Since January 2008, state and local governments have slashed 737,000 jobs, an "anti-stimulus" that continued in Friday's disappointing jobs report.) As for Uncle Sam, the path forward should be clear. The United States should be spending more, not less, on the IRS.

A stunned Ezra Klein of the Washington Post summed up the GOP's penny-wise, pound-foolish spending cuts" in March 2011:

"Converting dollar bills into $10 bills is an excellent way to pay off your credit card. Except, it seems, if you're a House Republican...

As the Associated Press reported, "every dollar the Internal Revenue Service spends for audits, liens and seizing property from tax cheats brings in more than $10, a rate of return so good the Obama administration wants to boost the agency's budget." It's an easy way to reduce the deficit: You don't have to cut heating oil for the poor or Pell grants for students. You just have to make people pay what they owe."

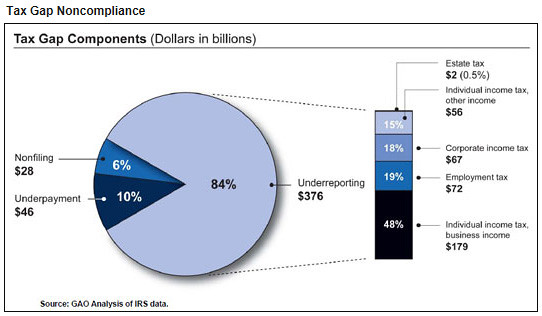

Nevertheless, just nine months after Jonathan Cohn highlighted the Republicans' "pro-tax evasion, pro-deficits" position, National Taxpayer Advocate Nina Olson confirmed the trend underway for years continues to worsen. "Inadequate funding," the agency web site reported, "means the IRS cannot adequately pursue unpaid tax liabilities." By 2006, the IRS estimated it was unable to collect $385 billion in taxes when there were 114 million households, producing an updated "noncompliance surtax" of nearly $3,400 per household. But with the taxpayer population now at 141.2 million, economist Benjamin Harris of the Brookings Institution estimated the total tax gap could range from $410 billion to $500 billion. As Harris concluded, "You could go a long way toward solving our budget mess by closing the tax gap."

But that will never happen if Capitol Hill Republicans get their way and continuing savaging the IRS budget. Its $11.8 billion budget in 2012 was $300 million less than the year before; led by Majority Leader Eric Cantor, the House GOP wants to gut the IRS by another $3 billion next year. That's no way to trim the deficit and no way to run a government.

Just ask Mississippi.