No Trump Tax Returns? No GOP Tax Cuts

Over the past week, the White House has been completely overwhelmed by the Trump administration's mushrooming medley of Moscow outrages. But to what Vox labelled the "3 Trump-Russia Scandals"--potential Trump collusion with Russia against the Hillary Clinton campaign, possible Trump lies about Michael Flynn's outreach to the Putin government and purported kompromat Russian intelligence may be holding over the American president--must be added a fourth. What are the conflicts of interest created by the Trump Organization's extensive business ties to Putin's kleptocratic petro-state?

With the Trump empire cut off by American banks, the family business has become dependent on Germany's Deutsche Bank and investors from Russia. As Donald Trump, Jr. summed up in 2008:

"Russians make up a pretty disproportionate cross-section of a lot of our assets. We see a lot of money pouring in from Russia."

That alone provides one powerful reason why President Trump must release his tax returns to the American people. It's not just a matter of following four decades of presidential practice. Simply put, we need to know if our president is being paid in rubles.

But there's another reason President Trump must come clean about his finances. In recent days, Trump has promised he will soon unveil a "phenomenal" tax reform plan that calls for "lowering the overall tax burden of American businesses, big league." But that isn't the only promise The Donald has made to American taxpayers about his reform scheme. The self-proclaimed "voice" of "the forgotten men and women of our country"--the same man praised by family and friends as a "blue-collar billionaire"--made this pledge last year:

"It reduces or eliminates most of the deductions and loopholes available to special interests and to the very rich. In other words, it's going to cost me a fortune -- which is actually true -- while preserving charitable giving and mortgage interest deductions, very importantly." [Emphasis mine.]

To which the only appropriate response to the Pathological Liar-in-Chief is, "Prove it."

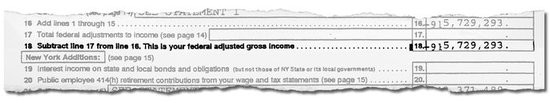

After all, Donald Trump has yet to demonstrate that he pays Uncle Sam anything at all. As the New York Times discovered in October, thanks to tax code advantages for real estate investors like himself Trump may have owed no federal taxes for almost two decades:

The 1995 tax records, never before disclosed, reveal the extraordinary tax benefits that Mr. Trump, the Republican presidential nominee, derived from the financial wreckage he left behind in the early 1990s through mismanagement of three Atlantic City casinos, his ill-fated foray into the airline business and his ill-timed purchase of the Plaza Hotel in Manhattan.

Tax experts hired by The Times to analyze Mr. Trump's 1995 records said that tax rules especially advantageous to wealthy filers would have allowed Mr. Trump to use his $916 million loss to cancel out an equivalent amount of taxable income over an 18-year period.

As Matthew Yglesias explained in Vox, "You don't need 'genius' to pull off Trump's tax avoidance -- you just need to be rich."

Rich, that is, and in the real estate business. The key, as tax expert David Cay Johnston documented, is the manipulation of "net operating losses" on top of the "already liberal tax breaks Congress gives big real-estate owners."

Trump dumped the real costs of all this on investors who saw gold in his brand name, but who lost everything even as he was paid tens of millions of tax-free dollars...

NOLs are incredibly valuable. These tax losses can be used to offset salaries, business profits, and income from, say, a television show or making neckties in China. Thanks to his $916 million of NOLs, Trump could earn much over 18 years in salaries, profits, and interest, but pay no income taxes.

Without Donald Trump's tax returns, there is still much we do not know about the shell game that enabled the reality TV star to stiff Uncle Sam. Still, the most grotesque aspect of Trump's schemes may be that most of them are probably perfectly legal. (Most, but not all. Trump's use of the unlicensed charitable Trump Foundation to pay off legal costs generated by his for-profit businesses almost certainly violate laws on "self-dealing." And Trump apparently used his Foundation to skirt taxes on his appearance and speaker fees by having payments made directly to his "charity.")

But the self-proclaimed "blue-collar billionaire" supposedly devoted to "the forgotten Americans" isn't content to rest with the gains--ill-gotten and otherwise--he has withheld from the IRS. Donald Trump has promised that as President, he would implement a new set of windfalls for himself and his children.

Over the past year, Trump has released not one, but three tax plans. In each, the top income tax rate is lowered. (In its current incarnation, that top marginal rate would drop from 39.8 to 33 percent.) But even bigger winnings for the Trump Organization will come from his proposed reduction in business taxes. As he summed it up during his disastrous debate against Hillary Clinton:

Under my plan, I'll be reducing taxes tremendously, from 35 percent to 15 percent for companies, small and big businesses.

As Trump spokesman Steven Cheung confirmed, that same 15 percent rate will also apply to so-called "pass-through" businesses which pay taxes on revenue as personal income. Businesses, that is, like Donald Trump's.

That one change to the tax code wouldn't just drain an estimated $1.5 trillion from federal coffers over the next decade. That pass-through payday for plutocrats would also redirect millions of dollars from Uncle Sam to Donald J. Trump and family--every year. As Trump's tax attorneys explained in his campaign's March 2016 required financial disclosure:

"You hold interests as the sole or principal owner in approximately 500 separate entities. These entities are referred to and do business as The Trump Organization. ... Because you operate these businesses almost exclusively through sole proprietorships and/or closely held partnerships, your personal federal income tax returns are inordinately large and complex for an individual."

And that would mean really YUGE savings for The Donald.

As the Center on Budget and Policy Priorities (CBPP) recently explained, "Pass-through income is claimed by business entities that aren't subject to the corporate income tax, which currently has a top statutory rate of 35 percent (though most corporations pay an effective tax rate considerably lower than 35 percent). Pass-through income is business income that "passes through" the business and is instead reported on the individual tax returns of the business owners and taxed at the owners' tax rates."

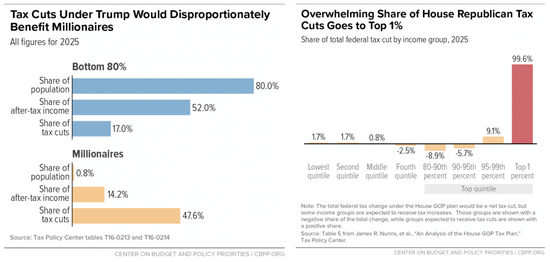

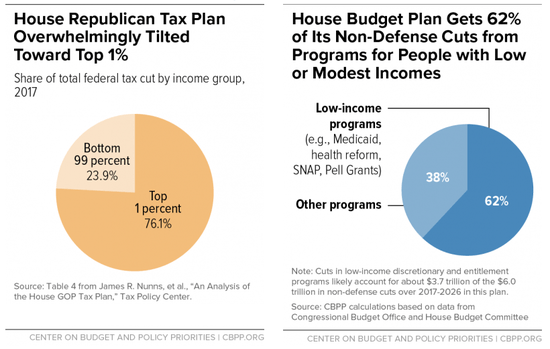

But as CBPP also documented, "'pass-throughs' are not synonymous with 'small businesses' and "pass-through income is highly concentrated at the top:"

Mr. Trump, who has proposed a 15 percent corporate tax rate, proposes a pass-through rate of 15 percent as well. The Trump pass-through proposal would be an expensive tax cut that would flow primarily to the wealthiest Americans. That's because more than two-thirds of pass-through business income flows to the highest-income 1 percent of tax filers.

Many businesses, such as law firms, and groups of wealthy investors choose to be taxed as pass-through entities instead of as corporations and often do so to lower the overall taxes they owe. In recent decades, many businesses and their owners have reaped sizable tax savings by doing so. A special 15 percent tax rate on pass-through income such as the Trump tax plan proposes would offer them another large tax cut.

As the Washington Post reported, "Trump would tax pass-through income at a rate of 15 percent, compared to the 40 percent personal income tax rate a wealthy business owner would pay today." And as the Post's Jim Tankersley explained, one of those wealthy business owners is Donald Trump himself:

A little-noticed provision in Donald Trump's tax reform plan has the potential to deliver a large tax cut to companies in the Republican presidential nominee's vast business empire, experts say.

Trump's plan would dramatically reduce taxes on what is known in tax circles as "pass-through" entities, which do not pay corporate income taxes, but whose owners are taxed at individual rates on their share of profits. Those entities are the most common structure for small businesses and increasingly popular for larger ones as well. They are also a cornerstone of the Trump Organization. On his 2015 presidential financial disclosure report, Trump listed holdings of more than 200 limited liability corporations, which is a form of pass-through.

It's no wonder Roberton Williams, a senior fellow at the nonpartisan Tax Policy Center, said "It's a really nice deal" for Trump and pass-through owners like him. It was with good reason Hillary Clinton called it "the Trump Loophole."

But it's not the only one The Donald is proposing for himself, Ivanka, Eric, Donald Junior and his other offspring.

As you might recall, his campaign finance disclosures claim he has a net worth of $10 billion and earned $557 million between January 2015 and May 2016. While his income sources are no doubt diverse, President Trump would surely reap millions from candidate Trump's income tax and capital gains tax rate reductions alone. And if he is telling the truth about his net worth, The Donald's heirs could pocket over $7 billion from his promise to do away with the estate tax now paid by only the richest 0.2 percent of family fortunes.

Now, that $270 billion in lost revenue over the next decade from the estate tax repeal will have to be made up somehow. But the plans currently in discussion by the Trump administration and House Republicans led by Paul Ryan would make that hemorrhage of red ink far, far larger. As I noted in November:

The man who apparently hasn't paid Uncle Sam a penny in 20 years has proposed a tax cut scheme that will enrich him, his businesses and his children for years to come. Whether based on The Donald's own outline or House Speaker Paul Ryan's "Better Way" budget blueprint, the Trump Tax Cuts of 2017 will drain roughly $6 trillion from the United States Treasury over the next 10 years. Unfortunately for those forgotten men and women who supported him, decades of evidence show that Trump's massive supply-side windfall for the wealthy won't make him "the greatest jobs president that God ever created." What the 45th President and his Republican allies will accomplish, however, is the greatest expansion in income inequality since Ronald Reagan ambled into the White House.

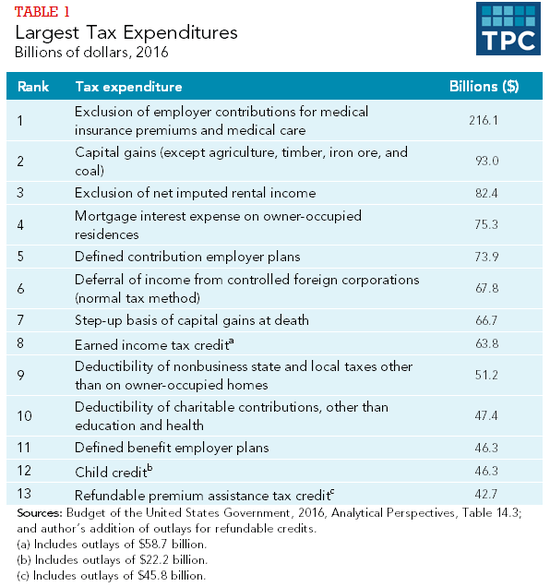

To help offset the dramatic increase in national debt their tax cut windfalls for the wealthy would inevitably produce, President Trump and Speaker Ryan are turning to three tactics. Each is now touting a 20 percent "border adjustment tax" optimistically forecast to raise $1.2 trillion over the next decade. (This de facto tax on importers (and consumers) faces a lot of pushback from Senate Republicans.) In addition, previous proposals from Trump and Ryan have called for draconian cuts in spending, nearly 70 percent of which would come from programs for low and modest income Americans. And then there is the perennial Republican promise to "close loopholes" and "end tax breaks" which now cost the United States Treasury almost $1.5 trillion a year.

Unfortunately, neither Donald Trump nor Paul Ryan have ever provided much detail on just which loopholes they'd be willing to close. But what Ryan and Trump Treasury Secretary Steven Mnuchin have both done is to lie about who will bear the burden. As Ryan comically put it in 2012, "We're proposing to keep revenues where they are, but to clear up all the special interest loopholes, which are uniquely enjoyed by higher income earners, in exchange for lower rates for everyone." For his part, Mnuchin promised during his confirmation hearings that "I think we want to make sure that tax reform doesn't increase the size of the deficit." But that's not all he promised:

"Any tax cuts for the upper class will be offset by less deductions that pay for it."

But as James Kwak documented in "The Deduction Fairy," Mnuchin's December pledge simply isn't mathematically possible. "When it comes to the truly rich, however, there just aren't enough deductions out there to eliminate." This is precisely the trap Mitt Romney fell into during the 2012 election, when he guaranteed that "for high-income folks, we are going to cut back on that, so we make sure that the top 1 percent keeps paying the current share they're paying or more." As Ezra Klein documented that August, the nonpartisan Tax Policy Center tried their best to make Romney's promise work:

They even tested the plan under a model developed, in part, by Greg Mankiw, one of Romney's economic advisers, that promises "implausibly large growth effects" from tax cuts. The fact that they couldn't make Romney's numbers work even when they stacked all these scenarios on top of one another shows just how impossible Romney's promises are...

The reason Romney's plan doesn't work is very simple. The size of the tax cut he's proposing for the rich is larger than all of the tax expenditures that go to the rich put together. As such, it is mathematically impossible for him to keep his promise to make sure the top one percent keeps paying the same or more.

Fast forward to 2017. Now, President Donald Trump isn't, as he boasted, the exception to the rule. He is the rule. If he pays any federal taxes at all, his check to Uncle Sam will only get smaller under his own plan. After all, he calls for cutting the top income tax rate from 39.6 to 33 percent and limiting the capital gains tax rate to 20 percent from 23.8 percent now. Paul Ryan would go even further by dropping the top rate on investment income to 16.5 percent. And in his biggest win of all, President Trump will slash the business tax rate from 35 percent to 15 percent for all companies, including pass-through businesses like the Trump Organization.

Two days after his inauguration, Donald Trump's serial fabulist Kellyanne Conway informed the American people that they would not be seeing the new President's tax returns. As she lectured George Stephanopoulos of ABC's This Week:

"The White House response is that he's not going to release his tax returns. We litigated this all through the election. People didn't care. They voted for him, and let me make this very clear: Most Americans are very focused on what their tax returns will look like while President Trump is in office, not what his look like. And you know full well that President Trump and his family are complying with all the ethical rules, everything they need to do to step away from his businesses and be a full-time president."

Of course, what Conway said then was neither true nor acceptable. (At the time she spoke, a poll showed 74 percent of Americans wanted Trump to release his tax returns.) But now, Donald Trump isn't just a full-time president. He may also be a full-time Russian stooge and Vladimir Putin business partner. Which is why the 23 Republicans on the House Ways and Means Committee who voted down New Jersey Democratic Rep. Bill Pascrell's motion to use a 1924 law to require President Trump to release 10 years of tax returns aren't just stonewalling the American people. His GOP aiders and abettors are preventing Donald Trump from making good on his promise that his tax plan "is going to cost me a fortune."

At the end of the day, whatever tax scheme emerges from the Republican-controlled Congress will be horrible public policy. But by using the budget reconciliation process, the GOP majority will need only a simple majority of 51 votes to pass the Senate. Regardless, the message from Americans of all political stripes should be the same.

No Trump tax returns, no GOP tax cuts.