REMINDER: President Trump Would Have to Raise the Debt Ceiling, Too

To my Republican friends willing to trigger a global economic catastrophe by refusing to raise the federal government’s debt ceiling, let’s engage in a little thought exercise. Imagine for the moment that Donald Trump actually won reelection in November 2020. (That shouldn’t be hard, given polling that shows that 66% of Republicans already wrongly believe it to be true.) Now ask yourself: Would President Trump seek to raise the debt limit and would the Congress controlled by Democrats vote to pass it?

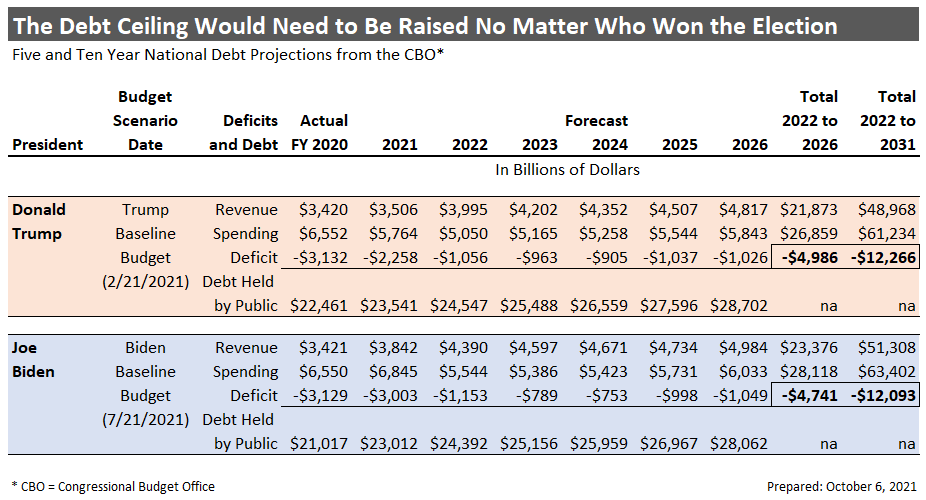

The answer to both questions is obviously “yes.” Some basic budgetary math and a little bit of history show why. In a nutshell, the numbers from the nonpartisan Congressional Budget Office (CBO) show that whoever won in November, Uncle Sam would need to borrow roughly $5 trillion over the next five years and over $12 trillion over the next decade.

That’s right. The CBO already did the math for you.

Going to back to our “what if” scenario, assume Donald Trump won reelection and sought no new spending programs. Well, on February 11, 2021, the Congressional Budget Office did just that. In its regularly updated “10 Year Budget Projection” of that month, CBO published its forecast for the next decade based on “legislation enacted through January 12, 2021, as well as information available as of that date.”

What CBO found is that a reelected “President Trump” would have to raise the debt limit early and often. After running up annual deficits topping $3.1 trillion in fiscal year 2020 and $2.2 trillion in the current FY 2021, “annual deficits average $1.2 trillion a year from 2022 to 2031” even after the end of counter-pandemic programs like the CARES Act. All told, from the five years including FY 2022 though FY 2026, CBO projected President Trump would add almost $5 trillion to America’s national debt. For the decade from 2022 through 2031, the combined annual deficits would hit $12.3 trillion in new red ink.

As it turns out, America’s real debt picture is little different under the man who actually won the 2020 presidential election, Joe Biden. CBO’s next 10-year budget projection released on July 21, 2021 tells the tale. Even with the higher near-term spending due to the “American Rescue Plan” passed in March, the five-year deficit forecast is slightly lower at $4.7 trillion. The 2022 to 2031 projection is also reduced, coming in at $12.1 trillion. Increases in projected tax revenues explain the improved annual deficit picture over the ensuing decade. (It should be noted that Biden’s proposed spending plan over the next decade would add to the national debt, though most of its $3.5 trillion cost will be offset by new tax revenues and other budgetary savings.)

Now, there’s no doubt Donald Trump would request the needed increases to the debt ceiling and that Congress would grant them. Why? Because in his first (and only) term, Trump added $7.8 trillion to the national debt by virtue of his increased spending and budget-busting tax cuts. Congress obliged by raising or suspending the debt ceiling three times, the last time in August 2019 when the Democratic House led by Speaker Nancy Pelosi (D-CA) gave its blessing. As CBS News reported at the time:

The bill passed the Senate on a bipartisan basis with 67 yeas to 28 nays.

Last week, the House passed the two-year spending and debt limit deal 284 to 149, with 219 Democrats voting in favor and 16 voting against.

That bipartisan suspension is expiring now.

As you will recall, the uniquely American debt ceiling sets the limit to the Treasury’s ability to borrow money to pay the bills the United States has already incurred. Since the United States has only record four balanced budgets since 1960, hiking the debt limit has been a regular feature of American governance in the sixty-plus years since. Regardless of which party controls Congress and the White House, the debt ceiling has been raised when the time arrives for the U.S. Treasury to borrow more money. That’s why Ronald Reagan lifted the debt ceiling 11 times as he was tripling the national debt and George W. Bush boosted the limit 7 times as he nearly doubled America’s ocean of red ink again.

Until 2011, at no time had an American political party had both the intent and the votes to block a debt ceiling increase. But in 2011 and again in 2013, Congressional Republicans led by House Speaker John Boehner (R-OH) and GOP Senate Leader Mitch McConnell (R-KY) threatened to trigger a sovereign default if their ransom of draconian spending cuts wasn’t paid by President Obama. In 2011, Obama buckled to the GOP’s extortion and accepted the spending cuts. Fresh off his reelection victory, in 2013 Obama did not.

Now, many of the GOP blackmailers were willing to execute their debt ceiling hostage. In December 2010, then-Congressman and future Trump budget chief Mick Mulvaney (R-SC) was firmly in the “default denier” camp, claiming:

"I have heard people say that if we don't do it it will be the end of the world. I have yet to meet someone who can articulate the negative consequences."

Mulvaney could have just asked his GOP colleague on Capitol Hill. Wisconsin Rep. Paul Ryan warned, “You can't not raise the debt ceiling,” adding, “Default is the unworkable solution.” Incoming House Speaker Boehner agreed, cautioning that failure to raise the debt ceiling “would be a financial disaster, not only for our country but for the worldwide economy.” South Carolina GOP Senator Lindsey Graham concurred declaring in January 2011, “Let me tell you what's involved if we don't lift the debt ceiling: financial collapse and calamity throughout the world.” Even Mitch McConnell acknowledged of the catastrophe that could ensue if the debt limit wasn’t increased in the summer of 2019:

“I certainly don’t think any senators are rooting for a debt limit crisis that would put our full faith and credit at risk. So, I believe that every one of our colleagues wants this agreement to pass. That means every one of our colleagues should actually vote for it.”

And just what does the failure McConnell warned of look like? Mark Zandi of Moody’s Analytics (the same Mark Zandi who advised John McCain in 2008) issued a dire forecast, warning a GOP blockade of the debt ceiling “would cost the U.S. economy up to 6 million jobs, wipe out as much as $15 trillion in household wealth, and send the unemployment rate surging to roughly 9 percent from around 5 percent.” The Fitch ratings agency declared such a scenario would lead it to downgrade U.S. credit, much as S&P did in 2011.

And remember, the United States didn’t default in August 2011, though it came close. Nevertheless, just the threat of a failure to raise the debt ceiling that summer drove down American consumer confidence and temporarily crushed job creation. In what many rightly came to regard as the “Tea Party Downgrade,” Standard & Poor’s lowered America’s AAA rating. Why?

A Standard & Poor's director said for the first time Thursday that one reason the United States lost its triple-A credit rating was that several lawmakers expressed skepticism about the serious consequences of a credit default -- a position put forth by some Republicans. Without specifically mentioning Republicans, S&P senior director Joydeep Mukherji said the stability and effectiveness of American political institutions were undermined by the fact that "people in the political arena were even talking about a potential default," Mukherji said. "That a country even has such voices, albeit a minority, is something notable," he added. "This kind of rhetoric is not common amongst AAA sovereigns."

That kind of rhetoric is certainly not common among AAA sovereigns. But with a Democrat in the White House, Mitch McConnell and his GOP extortionists want to force Democrats to use the reconciliation process in the evenly divided Senate just to pass the debt ceiling. By doing so, passage of the Biden Building Back Better package wouldn’t have to votes to succeed. For that objective, McConnell’s Kamikaze Conservatives would destroy the American economy.

Of course, they would never do this if Donald Trump had won the election in 2020. Mercifully, he didn’t. No matter what two-thirds of Republicans may think.