Taxpayers and Patriots

Four years ago, then vice presidential candidate Joe Biden was pilloried by Republican politicians and their media water carriers (for example, here and here) for telling wealthier Americans "it's time to be patriotic" by paying the slightly higher tax rates of the Clinton boom years. But with the renewed debate over ending the Bush tax cuts for the rich, the recent departures of former U.S. citizens Eduardo Saverin and Denise Rich and, most of all, Mitt Romney's AWOL tax returns and mysterious foreign shelters, the issue of taxes and patriotism is back on the front-burner. And now, the GOP's best and brightest tell us, stiffing Uncle Sam is American as apple pie.

That was the conclusion of South Carolina Republican Senator Lindsey Graham. Last week, Graham explained that Mitt Romney's labyrinthine finances and tax bill shrunken by the notorious carried interest exemption, a $100 million IRA and accounts in Bermuda, Switzerland and the Cayman Islands should not only be expected, but lauded. "It's really American to avoid paying taxes, legally," Graham announced, adding:

"It's a game we play. Every American tries to find the way to get the most deductions they can. I see nothing wrong with playing the game because we set it up to be a game."

A game, that is, which will be won by the well-to-do, since apparently the only ones qualified to play it. In rejecting a small increase in gilded class tax rates, President George W. Bush summed up the rules by explaining that "the really rich people figure out how to dodge taxes anyway." Supply-side snake oil salesman Arthur Laffer agreed:

"You really can't collect much money from upper-income people. They know how to get around taxes."

For some in the Republican amen corner, Uncle Sam shouldn't even try. Defending Mitt Romney's puny 14 percent payment to the U.S. Treasury (a rate lower than many middle class families), James Pethokoukis of the American Enterprise Institute protested that "actually, Mitt Romney's tax rate is too high":

It's real simple: If you think the biggest problem facing the United States today is income inequality, then you should be outraged that Mitt Romney's income tax rate isn't higher. But if you instead think America's biggest problem is high unemployment and a lack of economic growth, then you should be outraged that Romney is paying any income taxes at all. Really.

Of course, to believe that, you have to pretend that today's historically low 15 percent capital gains tax rate and the staggering income inequality it produces also fuels investment in the U.S. economy. And as the data show, that simply is not true. (For more on the "job creators," capital gains and other right-wing myths, see "10 Things the GOP Doesn't Want You to Know about Taxes.")

For others on the right, Mitt Romney's contortionist act on taxes pales in comparison to the real heroes like fleeing Facebook co-founder Eduardo Saverin. As John Tamny explained in his Forbes paean to that American turncoat:

Indeed, Saverin's U.S. "de-friend" is great for economic growth on its face, and then the political implications of his move will hopefully pay future taxation dividends that accrue to entrepreneurialism and advancement... Assuming nosebleed rates of taxation were a driver of Saverin's decision, politicians will hopefully see that if too greedy about collecting the money of others, they'll eventually collect nothing.

If those whose creative accounting has dramatically slashed their tax bills are the heroes, then the people Americans have entrusted to collect those funds must be the villains. And for the Republicans, that of course is the IRS.

Back in the 1990's, Congressional Republicans successfully used that kind of demagoguery to undermine both the Internal Revenue Service itself and the tax revenue it is supposed to collect. They haven't stopped since.

As the Los Angeles Times reported in 1998, "Americans are failing to pay $195 billion annually in taxes owed to the federal government, the highest estimate ever of the so-called tax gap." But that was before the full force of the anti-IRS jihad led by Phil Gramm and his Republican allies was brought to bear.

As David Cay Johnston explained in his 2003 classic Perfectly Legal, the GOP during the Clinton administration waged an all-out war on the IRS, turning the priorities for auditing Americans upside-down. Then as now, GOP spinmeister Frank Luntz framed the issue for his Republican allies, "Which would you prefer: having your wallet or purse stolen or being audited by the IRS?" As Senator William Roth's Finance Committee held hearings in 1997 and 1998, Mississippi's Trent Lott decried the IRS' "Gestapo-like tactics" while Alaska's Frank Murkowski protested, "You don't need to send in armed personnel in flak jackets" Former Senator Don Nickles of Oklahoma raged, "The IRS is out of control!" Congress went on to pass and Bill Clinton signed the IRS Reform and Restructuring Act in 1998.

Even as then-IRS Director Charles Rossotti warned Congress about an epidemic of tax cheating, Senator Gramm in May 1998 denounced the agency. Peddling myths of jack-booted IRS agents tormenting American taxpayers, Gramm called on Rossotti to fire his 50 worst employees. Gramm concluded:

"I have no confidence in the Internal Revenue Service of this country. You do not have a good system. This agency has too much unchecked power."

As the New York Times recounted that spring, the plan to gut the IRS advocated by Phil Gramm and his allies was a popular political gambit, but almost certain to create incentives for tax evasion:

Mr. Gramm spoke at length of how he had ''no confidence'' in the I.R.S., remarks that were in sharp contrast to those of every other senator, who emphasized that the majority of I.R.S. workers were honest and most taxpayers law-abiding.

A variety of tax experts have said in recent weeks that attacks on the I.R.S., which polls show are a potent device to win votes and contributions for Republicans, give comfort to tax cheats and discourage honest taxpayers.

Which, of course, is exactly what happened. IRS staffing was slashed and audits of the wealthy dropped precipitously. As Johnston explained:

In 1999, for the first time, the poor were more likely than the rich to have their tax returns audited. The overall rate for people making less than $25,000 a year was 1.36%, compared with 1.15% of returns by those making $100,000 or more...Over the previous 11 years audit rates for the poor had increased by a third, while falling 90 percent for the top tier of Americans.

By 2006, as the New York Times reported, "Over the last five years, officials at both the I.R.S. and the Treasury have told Congress that cheating among the highest-income Americans is a major and growing problem." By 2010, estimates put the tax gap, that is, revenue lost to evasion, fraud and underreporting, as high as $500 billion a year.

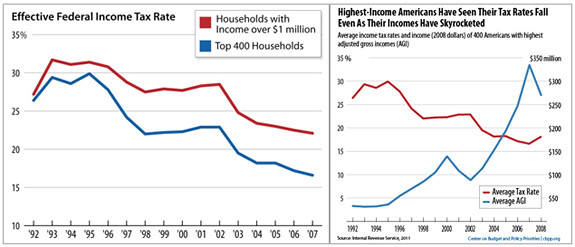

To put that number in context, keep in mind that the annual federal budget is about $3.6 trillion dollars and the deficit in the neighborhood on one trillion. Remember, too, that the CBO has concluded that as a share of their income, Americans' effective tax rates are at the lowest in 30 years. As a percentage of the U.S. economy, in 2010 the total federal tax burden hit its lowest level since 1950. For the top one percent of earners, their real tax rate has plummeted over the past two decades.

And still the Republican demonization of the underfunded and understaffed IRS won't stop. In the wake of the U.S. Supreme Court decision ruling that the Affordable Care Act's individual insurance mandate represented a tax, Maine GOP Governor Paul LePage called the Internal Revenue Service "the new Gestapo" which is "headed in the direction of killing a lot of people." And after Joseph Stack flew his airplane into an Austin, Texas IRS building and killed public servant and Vietnam veteran Vernon Hunter two years ago, it wasn't just right-wing extremists who suggested the murder was somehow justified. As newly minted Massachusetts Senator Scott Brown put it:

"Well, it's certainly tragic and I feel for the families obviously that are being affected by it. And I don't know if it's related but I can just sense not only in my election but since being here in Washington people are frustrated. They want transparency. They want their elected officials to be accountable and open and talk about the things affecting their daily lives. So I am not sure if there is a connection, I certainly hope not, but we need to do things better."

Iowa Rep. Steve King offered an even darker lesson from Stack's murderous terror attack on a U.S. federal building:

"It's sad the incident in Texas happened, but by the same token, it's an agency that is unnecessary and when the day comes when that is over and we abolish the IRS, it's going to be a happy day for America."

No, it will be a happy day in America when public servants like Vernon Hunter are viewed with respect and gold-plated tax scammers are treated with the derision and scorn they deserve. To borrow from that tribune of Republican wisdom, Barry Goldwater, extremism in the defense of low taxes for the rich is no virtue and the dedicated pursuit of their just payments is no vice. Especially when the United States is fighting a war with an all-volunteer military, the very least Americans can do is vote and pay taxes. For those who want to be real patriots, that's a good place to start.