The GOP's Dynamic Deception on Debt and Tax Cuts

You can fool some of the people all the time, and that's our target market. On no issue has that time-tested Republican strategy been more consistently applied than the impact of tax cuts on the national debt. But even after oceans of red ink washed away George W. Bush's bogus contention that "You cut taxes, and the tax revenues increase," Republicans in Congress and on the presidential campaign trail are once again trying to dupe the American people about so-called "dynamic scoring." But the repetition of discredited GOP talking points that tax cuts "pay for themselves" and "never have to be offset" doesn't make them any more true.

Despite the fact that supply-siders Ronald Reagan and George W. Bush respectively tripled and doubled the national debt, House Republicans are back with H.R. 3582, the Pro-Growth Budgeting Act. As Ed Kilgore explained in the Washington Monthly, the GOP resolution demands that Congressional Budget Office (CBO) estimates also use dynamic scoring to incorporate "supply-side assumptions about the growth-generating magic of tax cuts into official budget estimates, enabling conservatives to evade the deficit-boosting implications (and various congressional barriers that come along with them) of their pet proposals for reducing the tax burden of 'job creators.'"

As Paul Krugman pointed out in the New York Times Wednesday, that sophistry is behind the budget-busting economic plans of all the Republican White House hopefuls. It's not just that last week's report by the Committee for a Responsible Federal Budget (CRFB) found that "Debt will swell under top GOP hopefuls' tax plans." The real sham is why Republicans pretend it won't:

"Some commenters are declaring that it's all OK because of the voodoo "dynamic" effects of tax cuts for the wealthy. I guess my question is, what on earth would make anyone believe in that old nonsense at this point?...What conceivable evidence would convince people that supply-side magic doesn't work?"

If you're Mitt Romney or his water carriers at the Wall Street Journal, the answer to Krugman's question is none.

Facing a primary threat on his right, Romney last week raised the ante on his past proposal to make the Bush tax cuts permanent, eliminate the estate tax and reduce the corporate tax from 35 percent to 25 percent. On top of his previous plan which would deliver nearly 60 percent of its benefits to the top one percent of taxpayers, Mitt unveiled a new, 20 percent across-the-board tax cut and called for the elimination of the Alternative Minimum Tax.

But as ThinkProgress and the Washington Post's Lori Montgomery and Ezra Klein documented, Mitt Romney's gambit would pile up debt while guaranteeing yet another tax cut windfall for the wealthy. At a time when income inequality is at its highest level in 80 years while the total federal tax burden is at its lowest in 60, Mitt Romney's risky new scheme makes George W. Bush look like Karl Marx:

Romney's claim that his plan would promote job and economic growth while reducing the deficit is also likely false. The Bush tax cuts were promoted under the same guise, only to blow a $2.5-trillion hole in the federal budget that was accompanied by worst performance of any post-war expansion" for growth in investment, GDP, and job creation. Romney's tax cuts are even more expensive, clocking in at a cost of more than $10.7 trillion over the next decade and reducing revenue to a paltry 15 percent of GDP, according to Linden. Balancing the budget on those terms, as Romney claims he will do, would be next to impossible.

Impossible, that is, unless President Romney both savaged federal spending and eliminated deductions for workers, families and businesses that cost Uncle Sam over $1 trillion a year. But in typical Romney fashion, his campaign is refusing to say which loopholes it would close while promising to maintain the ones voters care about most. His economic adviser Glenn Hubbard admitted Romney's cowardice, explaining "it is not his intention to take on any specific deduction or exclusion and eliminate it." And as the New York Times reported, Romney promised last Wednesday his plan would somehow be "revenue neutral" and raise the burden on upper-income taxpayers, even as he balanced the budget.

As Erza Klein suggested in "The Dynamic Dodge in Romney's Budget," Mitt would need to resort to magic:

As a matter of theory, stronger economic growth could make Romney's plan work...if Romney really could double or triple the pace of economic growth, it would be much easier to make his numbers add up...

The technical term for the secret sauce that Romney is using in his budget projections is "dynamic scoring." The idea is that tax cuts make the economy grow faster. They make people work harder. They persuade rich people to stop hiding money away. And thus they don't cost as much as a "static analysis" -- one that didn't take into account all these effects -- would suggest.

And that, the Wall Street Journal joyfully declared, is feature and not a bug in the Romney Plan 2.0:

The Romney campaign is also shrewd to say it will assume some dynamic revenue feedback from his marginal-rate cuts. This does not mean that the tax cuts will entirely "pay for themselves" right away. It does mean that it can safely assume that his proposal would recapture about one-third of the revenue loss from the rate reductions through more investment and economic growth.

No, Americans can't safely assume that. In fact, they do so at their peril. We don't merely have the experience of the Reagan and Bush tax cuts which show otherwise.

As it turns out, Romney's 20 percent tax cut plan is basically the same one Bob Dole ran on - and lost on - in 1996. And the architect of that debacle, former Reagan Treasury official Bruce Bartlett, has long since recanted his support for the "dynamic scoring" at the heart of virtually every Republican tax plan. As Bartlett put it three weeks ago:

As the budget deficit increasingly inhibits Republicans' tax-cutting, they are planning ahead for tax cuts that they will insist are costless because they will so massively increase growth. But for that approach to work, the C.B.O. and the Joint Committee on Taxation, Congress's official budget and tax estimators, need to be forced to play along...

My concern is that the Republican effort is just a smokescreen to incorporate phony-baloney factors into revenue estimates to justify unlimited tax cutting...In other words, it is an issue of credibility. Republicans don't really care about accurate revenue estimates; they just want them to show that tax cuts pay for themselves, so they can pass more of them without constraint.

As Klein and Kilgore point out, Republican don't want dynamic scoring used for federal spending which could fuel economic growth. (William Gale, co-director of the Tax Policy Center emphasized, "You didn't hear the Republicans clamoring for dynamic scoring of the stimulus plan.") And it's not just that the Congressional Budget Office estimated the Bush tax cuts of 2001 and 2003 cost the Treasury $3 trillion. Its former head and later chief economic adviser to John McCain already debunked the GOP's dynamic deceit:

In 2003, Doug Holtz-Eakin was appointed by Republicans to lead the CBO during the Bush years, and he came under intense pressure to use more dynamic analyses. But studies he commissioned found that dynamic scoring was devilishly complicated and wouldn't lead to drastically different estimates. As he explained in a 2011 hearing before the House Ways and Means Committee, "it is unlikely to change the bottom line very much over the budget window."

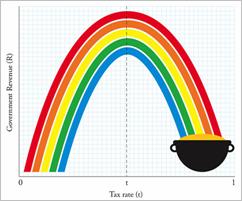

The infamous Laffer Curve, Bartlett now highlights, is literally a laugher. Ultimately, Ezra Klein concludes, "If dynamic scoring is how Romney makes his numbers work, then his numbers don't work." Or as George W. Bush so eloquently put it:

"Fool me once, shame on...shame on you. Fool me -- you can't get fooled again."