The Republicans' Trillion-Dollar Obamacare Repeal Scam

On March 23, 2010--the very day President Barack Obama signed the Affordable Care Act into low--then-Senate Minority Leader Mitch McConnell (R-KY) announced his party's objective would be to "repeal and replace" Obamacare. But now, almost 7 years later, McConnell and Congressional Republicans finding it extremely hard to do either. And soon the task for Majority Leader McConnell, House Speaker Paul Ryan and President-elect Donald Trump will get about a trillion dollars harder.

Developments over just past few weeks show why. For starters, a complete repeal of Obamacare now would leave an estimated 23 million more Americans without health insurance. Delaying it by up to four years past the 2020 election--as some Republicans are now contemplating--would be even worse, with a staggering 30 million people losing coverage as the individual market would enter a real "death spiral." With the repeal of the ACA's consumer protections like the ban on insurers' refusing to issue policies to those with pre-existing conditions, roughly 52 million Americans (27 percent of those under age 65) could find themselves at risk. As a result, millions currently insured under Obamacare would face the prospect of postponed care and possible financial ruin. The GOP's body count would be a gruesome one, too: tens of thousands of those left uninsured would needlessly die each year. It should come as no surprise that Donald Trump's own supporters, a group that will be disproportionately hit by the Obamacare repeal, are increasingly worried that the 45th President will effectively become a one-man death panel. And it's no wonder that organizations of doctors, hospitals and insurers have issued warnings about euthanizing the ACA without a replacement plan in place.

But Republicans don't have an Obamacare replacement plan. Even as Senate Budget Committee Chairman Mike Enzi (R-WY) introduced a resolution Wednesday calling the elimination of the ACA's spending and revenue-raising provisions, Speaker Ryan could only promise the GOP would not "pull the rug out from anybody" so that "so that no one is left out in the cold, so that no one is worse off." Trump spokesperson Kellyanne Conway was more specific about the GOP's nonexistent plan, pledging "we don't want anyone who currently has insurance not to have insurance." But those guarantees will cost money. And as it turns out, the Republicans have already promised the $1 trillion in savings from cancelled Obamacare outlays for something and someone else: a massive tax cut windfall for the wealthy.

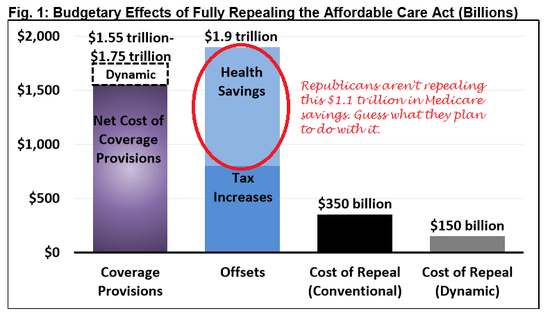

Congressional Republicans have been playing this shell game since before the Affordable Care Act became the law of the land. From its earliest estimates in 2009, the nonpartisan Congressional Budget Office (CBO) has always forecast that Obamacare would reduce the national debt. The math has always been straight-forward. The ten-year cost of Obamacare (for Medicaid expansion, insurance subsidies, etc.) has always been less than revenue generated by new taxes imposed by the ACA and the significant savings extracted from Medicare insurers and providers. (See the chart at the top of the page.) That's why CBO in June 2015 explained that repealing Obamacare would add "at least $137 billion or as much as $353 billion" in new deficits over the ensuing decade. As Sarah Kliff summed it up at the time:

"No matter how CBO scores it, Obamacare reduces the deficit."

(It was that inconvenient truth which prompted then House Majority Leader Eric Cantor (R-VA) Eric Cantor in 2011 to denounce the agency's supposed "budget gimmickry." Former Speaker and 2012 GOP White House hopeful Newt Gingrich went even further, declaring "if you are serious about real health reform, you must abolish the Congressional Budget Office because it lies.")

For Republicans, the flip-side is also true. No matter how CBO scores it, repealing Obamacare increases the deficit.

Unless, of course, you don't actually repeal all of Obamacare. If Republicans cancel all of the Affordable Care Act's spending on Americans' health but pocket all or most of its savings, they can put towards something they really care about. Like tax cuts for rich people.

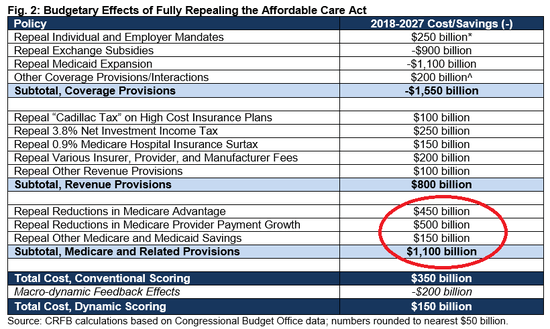

Using data and forecasts from CBO, the Committee for a Responsible Federal Budget (CFRB) this week showed provided a helpful summary of the math behind various scenarios for the repeal of Obamacare. While eliminating its coverage provisions saves $1.55 trillion over 10 years, the fate of the ACA's funding its more complicated:

Revenue Provisions - About half of the $800 billion of revenue loss from repealing ACA's taxes comes from removing the 0.9 percent Medicare payroll surtax on wages above $200,000 ($150 billion) and the 3.8 percent surtax on investment income above the same threshold ($250 billion). Another quarter of the revenue loss comes from repealing various fees on insurance companies, medical device companies, and drug manufacturers. Repealing the "Cadillac tax" on high-cost insurance plans costs $100 billion over a decade; those costs are slated to grow substantially over time, and repealing the Cadillac tax without a replacement would also remove a key tool in helping to slow overall health care cost growth.

Medicare Provisions - Of the $1.10 trillion of costs from repealing the ACA's Medicare (and related) cuts, roughly $450 billion would come from reversing Medicare Advantage cuts and roughly $500 billion would come from ending reductions in the growth of provider payments in fee-for-service Medicare. Our repeal estimates assume that the reductions in Medicare provider payments already implemented under the ACA are retained and repeal only prevents future cuts. If past cuts are also reversed, repeal could cost $200 billion to $250 billion more over a decade.

(It should be noted that doing away with the Obamacare surtax on investment income alone is a major win for the wealthy. Overall, the nonpartisan Tax Policy Center found "that the top 1 percent of earners would get an average tax cut of $33,000 if Obamacare is repealed -- and those in the top 0.1 percent would get an average tax cut of $197,000" as a result of the repeal of the ACA's tax provisions.)

Recently, the Kaiser Family Foundation documented the Implications of repealing the Affordable Care Act for Medicare spending and beneficiaries. The good news is that the GOP has no intention of giving back all of those savings to private Medicare insurers, hospitals and doctors. And we know this, because Republicans told us so in 2015.

As you may recall, it was a year ago today that President Obama vetoed a Congressional budget which included H.R. 3762, also known as the "Restoring Americans' Healthcare Freedom Reconciliation Act." When CBO scored H.R. 3762, it told Chairman Enzi that its Obamacare "repeal" provisions would reduce deficits by $474 billion between 2016 and 2025. Conservatives were overjoyed. As Hot Air's Ed Morrissey ("CBO: Obamacare repeal bill would reduce deficits by half a trillion dollars over 10 years") and the Washington Post's Jennifer Rubin ("The Congressional Budget Office has found that repealing Obamacare is a big money-saver") showed, right-wingers were especially excited that they can now pretend that killing the Affordable Care Act will save Uncle Sam money. In a December article titled, "Obamacare Repeal Would Cut Deficit, Boost Growth - CBO," Investor's Business Daily crowed:

A little-noticed report released Friday afternoon by the Congressional Budget Office shows that the Senate bill to repeal most of ObamaCare would cut the deficit by as much as $474 billion, while boosting GDP, investment and capital stock.

The findings stand in sharp contrast to promises by President Obama and other Democrats that ObamaCare would accelerate economic growth and lower federal deficits.

But in referring to the repeal of "most of ObamaCare," IBD skipped over what Health Affairs rightly called "the $879 billion footnote." As that magic footnote in the legislation drafted by Rep. Fred Upton (R-MI) and Sens. Orrin Hatch (R-UT) and Richard Burr (R-NC) declares:

All provisions of PPACA and HCERA are repealed except for the changes to Medicare." (Emphasis added). [Note: PPACA and HCERA are the two statutory components of the law now known as the ACA -- or Obamacare.] [Emphasis mine.]

That difference, it turns out, makes all the difference. "Saving that single element," HA explained, "turns the CBO's current deficit raising cost projection for repeal from $137 to $353 billion negative to $449 to $665 billion positive."

A critical element of the ACA's financing involves Medicare payment reductions in title 3 of the law to hospitals, insurance companies, home health agencies, and other health care providers (physician payments in Part B were unaffected) to reduce Medicare's rate of spending growth. The resulting savings help to finance the private insurance and Medicaid coverage expansions in ACA titles 1 and 2. In its first 10 years (2011-2020), CBO estimated these title 3 savings at $450 billion; in its recent June estimate, it projects the savings at $879 billion between 2016 and 2025.

The question, then, is this: What will Republicans do with that $879 billion in savings over 10 years (now estimated to be $1.1 trillion between 2018 and 2027)?

If you guessed "fund an Obamacare replacement program," you'd be wrong. Instead, those savings will go to help pay for the GOP's staggering $6 trillion tax cut. In one form or another, that Treasury draining tax cut has been in every Paul Ryan-authored House GOP budget since 2011. In 2012, Mitt Romney appropriated those same Medicare savings for his gigantic tax rate reduction. In 2016, Paul Ryan in his "Better Way" program put those same dollars towards rewards for the very rich. Donald Trump similarly promised them to the gilded class. And while Now, there are certainly differences between Ryan's and Trump's tax plans, especially regarding their treatment of multinational corporations, the New York Times explained:

There is certainly a significant overlap. Both would cut income tax rates across the board and keep rates low on income from investments, an approach intended to spur savings that effectively guarantees the juiciest cuts for the wealthy.

An analysis of Mr. Trump's latest plan by the Tax Policy Center calculated that the top 0.1 percent of the population, those with incomes over $3.7 million in 2016, would receive an average 14 percent reduction, or about $1.1 million. Households in the middle of the scale -- those earning between about $48,000 and $83,000 today -- would get a 1.8 percent tax cut worth on average $1,010, while the poorest fifth of Americans will gain about $110, or 1 percent of their income.

It's bad enough that the President-elect Trump and Congressional Republicans will make off with Obamacare's Medicare savings to partly offset their windfall for the wealthy. Making matters worse is that in 2016 Paul Ryan, the same Paul Ryan proposing to ration Medicare by turning into an under-funded voucher scheme, has decried the administration's "$800 billion raid of the program" which he summed up this way:

"Obamacare's plan for Medicare was to raid and ration."

If that slander sounds sickeningly familiar, it should. Despite their nefarious uses of those same Medicare dollars saved by Obamacare, Republicans in 2010 and again in 2014 successfully ran against Democrats as supposed "Medicare killers," as this ad attests:

"By voting for ObamaCare, Democrats like Mark Pryor, Kay Hagan, Mary Landrieu and Mark Begich cut $717 billion from Medicare -- including $154 billion from Medicare Advantage -- which will hurt seniors."

Fear-mongering like that helped the GOP capture the House in 2010 and the Senate four years later. Now, Vice President-elect Mike Pence tells us, "The first order of business is to keep our promise to repeal Obamacare and replace it with the kind of healthcare reform that will lower the cost of health insurance without growing the size of government." As for what that what that replacement might be and when it will be unveiled, no one in the GOP has the answer to the trillion-dollar question.