THIS JUST IN: Tax Cuts for Rich Still Don't Drive Economic Growth

When it comes to the subject of taxes, virtually article of faith held dear by Republicans has been proven false. For example, it's not true that "tax cuts pay for themselves" or that they increase revenue. Now, two new studies cut right to the heart of the bogus conservative claim that slashing tax rates for the richest Americans fuels job creation and economic growth. As these data are the just the latest to confirm, cutting taxes for "job creators" doesn't create jobs, but instead only produces a growing chasm of inequality and mountains of debt.

As David Cay Johnston explained in Reuters, a new analysis by University of California graduate student and former staff economist on the Obama White House Council of Economic Advisers Owen M. Zidar undercuts a central argument of Mitt Romney and his GOP allies. (Ironically, Zidar once worked for an arm of Bain Capital.) Johnston summed up Zidar's findings about the top-down versus bottom up benefits of tax rate reductions at the state level:

He reasoned that "if tax cuts for high income earners generate substantial economic activity, then states with a large share of high income taxpayers should grow faster following a tax cut for high income earners." The data show that tax cuts at the top, though, do not result in faster growth in states with more high-earners.

"Almost all of the stimulative effect of tax cuts," Zidar found, "results from tax cuts for the bottom 90 percent. A one percent of GDP tax cut for the bottom 90 percent results in 2.7 percentage points of GDP growth over a two-year period. The corresponding estimate for the top 10 percent is 0.13 percentage points and is insignificant statistically."

(Kansas Republican Governor Sam Brownback is about to learn that the hard way. Brownback recently signed a bill eliminating business taxes for 200,000 companies and slashing upper-income rates by 20 percent. The result isn't merely a dramatic shift of the tax burden onto less well-off Kansans, but will mean lost revenue "equivalent of 36 percent of the state budget within five years.")

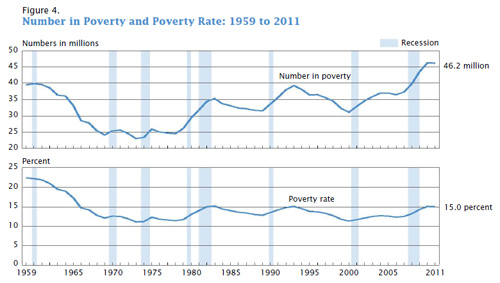

Meanwhile, a new report from the United States Census Bureau is just the latest evidence of the failure of the Bush tax cuts. While the poverty rate held steady at 15 percent in 2011, it increased throughout the previous decade even before the onset of the calamitous Bush recession in late 2007. (And as Sarah Kliff noted in the Washington Post, if not for policies including Social Security, unemployment benefits, food stamps and the Earned Income Tax Credit, the poverty rate would be 10.9 points higher and include 33.6 million more Americans.)

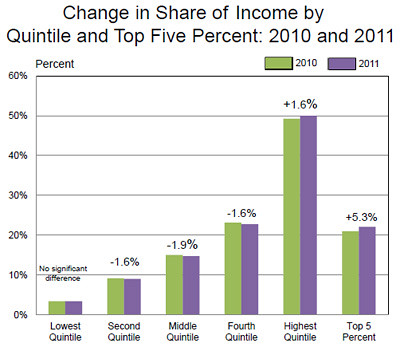

But as the New York Times detailed, "The income gap between the wealthiest 20 percent of American households and the rest of the country grew sharply in 2011, the Census Bureau reported, as an overwhelming majority of Americans saw no gains from a weak economic recovery in its second full year." Fueled by a 5.3 percent jump in the income share of the top five percent of earners, the highest quintile enjoyed a 1.6 percent increase overall. (As explained here, the wealthiest Americans had already recovered from the Great Recession by 2010.) The other 80 percent of Americans either lost ground or made no progress at all. (See chart at top.) As McClatchy summed it up, "the earnings gap between rich and poor logged the largest annual increase since income inequality was first measured two decades ago." By 2010, the wealth of the richest one percent of households reached 288 times that of the median, a stratospheric rise from just three years earlier.)

Those findings offer new support for President Obama's proposal to address the so-called "fiscal cliff" and refill the coffers of the United States Treasury by almost $1 trillion over the next decade by letting the Bush tax cuts for the top two percent of earners expire at the end of 2012. In contrast, Republican presidential nominee Mitt Romney is offering a massive tax cut windfall for those he and his party call "job creators."

Of course, there's only one problem with the Republican approach. The data are clear: lower taxes for America's so called job-creators don't mean either faster economic growth or more jobs for Americans.

That dismal performance prompted David Leonhardt of the New York Times to ask, "Why should we believe that extending the Bush tax cuts will provide a big lift to growth?" His answer was unambiguous:

Those tax cuts passed in 2001 amid big promises about what they would do for the economy. What followed? The decade with the slowest average annual growth since World War II. Amazingly, that statement is true even if you forget about the Great Recession and simply look at 2001-7...

Is there good evidence the tax cuts persuaded more people to join the work force (because they would be able to keep more of their income)? Not really. The labor-force participation rate fell in the years after 2001 and has never again approached its record in the year 2000.

Is there evidence that the tax cuts led to a lot of entrepreneurship and innovation? Again, no. The rate at which start-up businesses created jobs fell during the past decade.

Asked by Johnston to respond to Zidar's study, Romney campaign spokesperson Andrea Saul "urged against publishing a story about Zidar's work because it is preliminary and because of Zidar's connection to the Obama Administration." Or to put it another way, when it comes to taxes, the truth will not set Republicans free.