UK Triple Dip is Latest Blow for Reinhart-Rogoff Austerity Crowd

Thanks to graduate student Thomas Herndon, economists Kenneth Rogoff and Carmen Reinhart are now the stuff of pop culture legend. (Even Stephen Colbert is getting in on the act.) But the epic failure of their Excel spreadsheets is no laughing matter. In the United States and across Europe, austerity advocates have seized on their dubious conclusion that when national debt hits the magical tipping point of 90 percent of GDP, economic growth slows dramatically. But the draconian budget cutting their infamous 2010 paper helped encourage hasn't just brought real human suffering. In the UK, the reality that slowing economic growth is increasing the debt suggests Reinhart and Rogoff may have cause and effect reversed.

Tomorrow, the UK will release GDP numbers for the first quarter of 2013. While the sluggish American economy grew by 3.1 percent in 2012 (though by just 0.4 percent in the last quarter), many analysts worry that the British economy may have entered a triple dip recession. As The Independent reported:

The economy shrank by 0.3 per cent in the final three months of 2012. A further contraction between January and March would imply six months of falling output, meeting the technical definition of a recession. Economic analysts say that there is a 50/50 chance that the economy shrank again in the first quarter, when retailers and the construction industry were hampered by freezing weather. This would be the third time that the UK has been in recession since the 2008 global financial crisis.

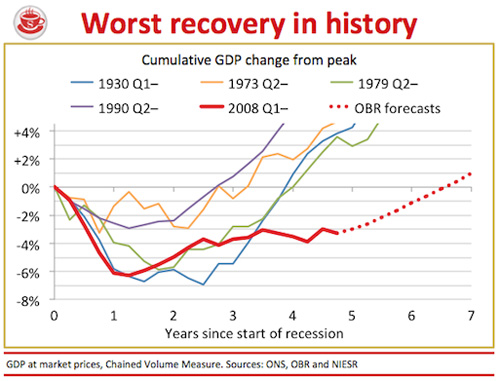

It's not just that the UK economy has not yet returned to its pre-calamity, 2007 peak (a milestone the U.S. reached long ago). As it turns out, the growth-killing austerity program of Tory Prime Minister David Cameron and his Chancellor of Exchequer George Osborne launched in 2010 is actually making the debt problem worse:

The economy has stagnated since the autumn of 2010, with the lack of growth serving to push up public borrowing. Yesterday the Office for National Statistics said that the full deficit for 2012-13 came in at £120.6bn - £300m lower than the previous financial year. This enabled the Government to claim that the deficit is still falling.

But tax receipts were much weaker than projected a year ago and the Chancellor only managed to bring down the overall borrowing figure by slashing departmental spending in the final few months of the financial year and resorting to other unorthodox measures such as delaying various UK subscription payments to international organisations such as the World Bank.

While the Congressional Budget Office and analysts including Goldman Sachs report that the U.S. budget deficit is falling fast, London has hit a brick wall. As Reuters warned in December:

Last month's public sector net borrowing figure of 17.5 billion pounds exceeded economists' expectations. They had forecast it would come in just below the 16.3 billion pounds reached in November 2011.

Borrowing since the start of the tax year in April is now nearly 10 percent higher than at the same point in 2011.

This calls into question forecasts issued earlier this month by the government's budget watchdog which estimated borrowing will fall 11 percent to total 108.5 billion pounds in the 2012-13 tax year.

The sadly ironic result of Cameron's painful budget cutting is that ratings agencies including Moody's and Fitch nevertheless downgraded the UK earlier this year, the very outcome Osborne sought to avoid. Fraser Nelson of The Spectator explained why:

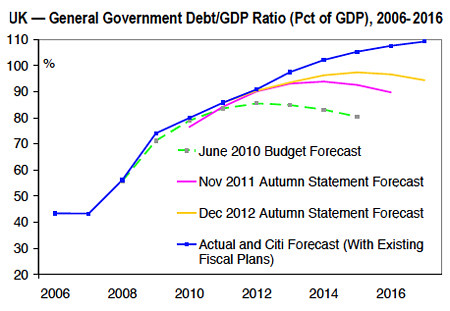

The below graph, released earlier today from Citi, shows how things have gone pear-shaped. It shows debt as a share of GDP, which has risen as growth has evaporated. The green line shows how Osborne first promised to handle the debt. The dark blue line is how it's now likely to go. The failure of this thick blue line of debt to level out, let alone descend, is why the credit rating agencies are so worried.

To be sure, Tory policy is not the only cause of the flat-lining British economy. The deep Euro zone recession has had a major impact across the channel as well. But dismal growth, worsening unemployment and the concomitant hit to government tax revenue are leading the IMF and others to push the UK to open the spigots and ease up on its austerity regime. Because in this case, slow growth is only making the debt picture worse--and not the other way around.

(For more comparisons to the U.S., see "The Fiscal Cliffs of Dover.")