72 Billion Reasons Not to Vote for Mitt Romney

There are plenty of reasons not to vote for Mitt Romney, but here are 72 billion more. If President Romney gets his way, his massive tax cut for the wealthy would not only produce a huge payday each year for the richest living Americans. As it turns out, Romney's plan to eliminate the estate tax would divert billions from the United States Treasury to their heirs after they're gone. And for 42 billionaire backers of Mitt Romney's Restore Our Future Super PAC, that one change to the tax code could be worth almost $72 billion.

Two weeks ago, Romney's chief economic adviser Glenn Hubbard comically declared, "The rich are taxed enough." Comically, that is, because while income inequality is at its highest level in 80 years and the total federal tax burden at its lowest in 60, the effective tax rates for the richest one percent have been plummeting for almost 20 years. Nevertheless, Governor Romney doesn't merely want to make the Bush tax cuts permanent: he wants to end the AMT and deliver another 20 percent across the board tax cut that could reduce his own future tax bills by half. Combined with Mitt's proposals to rollback regulations and expand tax incentives for energy companies, the annual winnings for his gilded-class supporters will be staggering.

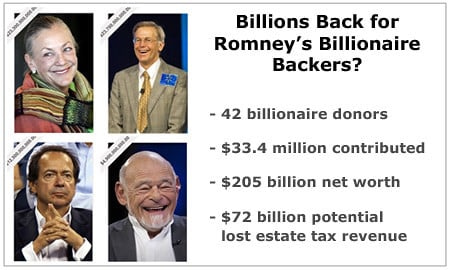

But eliminating the current 35 percent estate tax on family fortunes greater than $10 million (a levy paid by less than one-tenth of one percent of all estates) will mean billions back for Romney's billionaire backers. As this helpful summary reveals, 42 donors collectively worth an estimated $205 billion gave $33.4 million to Mitt's Restore Our Future Super PAC. Under President Romney, their heirs' estate tax savings could potentially reach $71.8 billion. Put another way, Romney's billionaire backers would make 2,150 times their original investment.

(Of course, that back-of-envelope estimate overstates their real ROI, as various shelters, overseas investments and charitable donations reduce the effective estate rate to less than 20 percent. In addition, many of Romney's donors made contribution s to other GOP Super PACs as well. Nevertheless, the payback from President Romney would be jaw-dropping.)

The list of Mitt's moneymen (and women) reads like the invite list for gathering of the vast right-wing conspiracy. Wall Street titans and private equity giants including Henry Kravis, Julian Robertson, John Paulson, Marc Rowan, Sam Zell and Romney investment manager Paul Singer aren't alone in pouring money into his Super PAC. Among the usual suspects (as I explained in June):

The energy industry, too, is proving a gusher for Mitt Romney and his Restore Our Future Super PAC. Hours after being named an oil adviser to the Romney campaign, Harold Hamm of Continental Resources contributed $1 million of his $11 billion net worth to Restore Our Future. Charles and David Koch have pledged $395 million for the 2012 election cycle, which combined with Karl Rove's American Crossroads and Tom Donohue's U.S. Chamber of Commerce could produce a billion-dollar tidal wave of cash to wash Barack Obama out of the White House. (As one Democratic consultant described the operation, "It's just like the Cold War. They're going to force Obama to spend himself into oblivion.")

Former Newt Gingrich sugar daddy and casino mogul Sheldon Adelson has said his donations could be "limitless" and will likely top $100 million. While billionaire investor and Chicago Cubs owner Joe Ricketts may have abandoned his Jeremiah Wright smear campaign, his is bankrolling other projects including the ersatz documentary based on Dinesh D'Souza's book, "The Roots of Obama's Rage." Meanwhile, Texas billionaire Harold Simmons has already delivered $18.7 million to Republican political organizations, a sum which will likely double by November.

Then there's Alice and Jim Walton, who are in a class by themselves. For their combined $400,000 contribution to Romney's Super PAC, their Walmart heirs could get back 81,750 times on Alice and Jim's original investment.

As Forbes first highlighted last year, between them the six Waltons combined have over $90 billion. As Vermont Senator Bernie Sanders explained in his famous filibuster of December 2010, the elimination of the estate tax could potentially save the Walton family $32.7 billion. As it turns out, President Romney's zeroing out of the estate tax would cap a years-long effort for the Waltons. USA Today summed it up in 2005:

Led by Sam Walton's only daughter, Alice, the family spent $3.2 million on lobbying, conservative causes and candidates for last year's federal elections. That's more than double what it spent in the previous two elections combined, public documents show.

The Waltons have joined a coterie of wealthy families trying to save fortunes through permanent repeal of the estate tax, government watchdogs say. The election of President Bush and more conservatives to Congress gave momentum to the long-fought effort. The Waltons add more.

If Mitt Romney wins the presidential election today, Alice and Jim Walton will be one step closer to further shifting the federal tax burden from Walmart's owners to Walmart's customers.

That should be reason enough not to vote for Romney for President. But there are at least 72 billion others.