GOP to Elderly Rich: Watch Your Backs

Last month, Florida Republican Senator George Lemieux summed up the impact of his party's successful effort to kill the estate tax in 2010. "The joke is don't go hunting with your children because right now there's no estate tax in this country this year." But the billions lost to the U.S. Treasury so that the heirs of billionaires could reap a staggering one-year windfall is no laughing matter. So now in an article titled, "Too Rich to Live," the Wall Street Journal laments that the GOP has literally created a target rich environment.

Well, not exactly. Through its heart-rending stories of the tragically rich, the Journal describes "a perverse calculus: end it all - or leave a massive bill for your heirs to deal with." The subtext, of course, is not that the temporarily lapsed estate tax should be reinstated for 2010, but that it should be done away with altogether.

It has come to this: Congress, quite by accident, is incentivizing death.

When the Senate allowed the estate tax to lapse at the end of last year, it encouraged wealthy people near death's door to stay alive until Jan. 1 so they could spare their heirs a 45% tax hit.

Now the situation has reversed: If Congress doesn't change the law soon--and many experts think it won't--the estate tax will come roaring back in 2011.

Not only will the top rate jump to 55%, but the exemption will shrink from $3.5 million per individual in 2009 to just $1 million in 2011, potentially affecting eight times as many taxpayers.

The math is ugly: On a $5 million estate, the tax consequence of dying a minute after midnight on Jan. 1, 2011 rather than two minutes earlier could be more than $2 million; on a $15 million estate, the difference could be about $8 million...

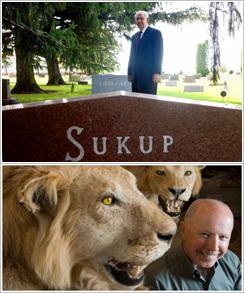

You don't know whether to commit suicide or just go on living and working," says Eugene Sukup, an outspoken critic of the estate tax and the founder of Sukup Manufacturing.

Which makes Senate Republicans the real "death panel."

Here's how the GOP came to create an incentive for the heirs of the fortunate few to "pull the plug on grandma" over the next six months.

In 2009, only 1 in 500 American estates paid taxes. In 2008, the tax produced $25 billion for the U.S. Treasury even in a year when the stock market was battered. But barring new legislation in Congress, in 2011 the estate tax rate will jump back up to its pre-2001 level of 55%, starting at $2 million per couple. In December, the House voted 225-200 to maintain 2009's rate of 45% beginning at $3.5 million per person or $7 million per couple. But as 2009 ended, Jon Kyl led the successful GOP effort to block the bill, ensuring the temporary one-year expiration of the estate tax on January 1st, 2010:

"It's a problem that doesn't have to exist if they'll just leave the existing law alone and let the rate go to zero, which is where everyone wants it to be."

Well, not everyone. Just, as the numbers show, the very, very rich.

Under the 2009 rate, 99.8% of estates owe no estate tax at all. And as the Center on Budget and Policy Priorities (CBPP) showed, over 62% of estate tax revenue comes from the "extreme wealthy" with fortunes greater than $20 million. "Only three percent of taxes owed" are paid by estates under $5 million. But as the Washington Post explained in April 2009, those are precisely the pockets Jon Kyl aided and abetted by Democrat Blanche Lincoln wants to line:

The estate tax is scheduled to disappear in 2010, only to be resurrected the following year at its 2001 level, when it applied only to estates worth over $2 million per couple at a rate of 55 percent. In fact, no one expects it to return to that level -- although letting it do so would be a far more rational response to the current crisis than the Lincoln-Kyl approach. Rather, President Obama has proposed holding the tax at this year's level: an exemption of $7 million per couple, with a 45 percent rate for amounts beyond that; this would cost $484 billion over 10 years. Senate Finance Committee Chairman Max Baucus (D-Mont.) has endorsed this solution, with indexing for inflation. This would hardly be punitive. At that level, 99.76 percent of estates would incur no tax whatsoever. Those who owe would pay, on average, $2.25 million less than they would have paid at the 2001 exemption level. Why in the world should these folks get more of a tax cut?

For their part, Lincoln and Kyl want to start at that $5 million individual threshold and adopt a lower 35% tax rate. In response, Vermont Independent Bernie Sanders two weeks ago sponsored a new estate tax overhaul, which at a time of record income inequality and growing fortunes for the wealthy would provide a richer haul for the Treasury. As the Wall Street Journal summed up Sanders' plan:

Mr. Sanders and his co-sponsors said, "It's time for multi-millionaires and billionaires to pay their fair share."

Under the proposal, as in 2009, the exemption would be $3.5 million for an individual, or as much as $7 million for a couple, with a tax rate of 45%. But estates with taxable assets between $10 million and $50 million would pay a 50% rate, and estates valued above $50 million would pay 55%. A further 10% surtax would apply to assets above $500 million.

The changes would be retroactive to Jan. 1 of this year.

As Kyl suggested on the Senate floor in December, Republicans want to bury the estate tax once and for all. And to be sure, The Republican scam over the so-called "death tax" is as bogus now as it was when President Bush first perpetrated it nine years ago. (The House GOP budget, fittingly unveiled by Rep. Paul Ryan on April Fool's Day 2009, would eliminate the estate tax altogether. CBPP estimated that ending the estate tax would cost the United States Treasury $1 trillion over 10 years.) While Nevada Senator John Ensign griped, "It destroys a lot of small businesses and a lot of family farms and ranches in America," House Minority Leader John Boehner (R-OH) groused:

"People who aren't wealthy, who may have built up value in land over generations and many family farms find themselves in situations where they've got to sell the farm in order the pay the taxes."

As it turns out, of course, not so much.

While CBPP estimated that only 1 in 500 estates is impacted by the current law, the Tax Policy Center quantified last year just how few family farms or small businesses are actually impacted by the estate tax proposals under consideration:

We estimate that under the Obama proposal, 100 family farms and businesses would owe tax. (We define such estates as those where farm or business assets are valued at under $5 million and comprise the majority of estate assets.) The Lincoln-Kyl proposal would cut the number to 40. Even under current law, fewer than 2,700 family farms and businesses would owe tax.

Sadly, right now no one is paying the estate tax. And in the case of the heirs of Texas billionaire Dan L. Duncan, a man who passed away in March, that literally means a multi-billion dollar pay day at the expense of everyone else.

Especially the 1.2 million increasingly desperate Americans whose unemployment benefits just came to an end, courtesy of the Republican Party. As Rhode Island Democratic Senator Sheldon Whitehouse rightly noted, with their trade-off Senate Republicans made very clear whose side they are on:

"What's particularly galling about this is that the Republicans cut this lifeline for middle class families, unemployed through no fault of their own, in the same month the first multi-billion estate passed tax free through to the heirs of a tycoon because of the Bush tax cuts, which weren't paid for. So, if you are concerned about the deficit, it's very selective concern about the deficit when you are letting billionaires' estates go through to their heirs untaxed, and cutting off the lifeline for unemployed families."

Thanks to the Republican effort to euthanize the estate tax, the Treasury is being emptied of billions while creating chaos for thousands of families across the country. As tax law professor Michael Graetz of Columbia University put it, "Enough very wealthy people have died whose estates have the means to challenge a retroactive tax, and that could tie the issue up in the courts for years." 78-year old IBM retiree Art Nickel described his quandary:

"I plan to keep living, but I don't know how to plan until Congress straightens this mess out."

The response from Republicans is a simple one. Watch your back.

The inheritance tax was introduced by Teddy Roosevelt to prevent people and businesses from becoming too strong or from becoming oligarchs. He especially did not like people that basically did not work hard to earn their money. Unfortunately, too many people, especially on the right, believe they will be affected by the estate tax.