GOP's "Servants of the Rich" Block Debt Deal

Two weeks ago, House Speaker John Boehner protested that the characterization of his Republican Party as "servants of the rich" was "very unfair." But after the GOP torpedoed any debt reduction deal from the Congressional super committee including "any penny" in new tax revenue from the richest Americans, Boehner's complaint seems all the more pathetic. After all, the debt panel's GOP members didn't merely refuse to end the expiring Bush tax cuts for the wealthy, but demanded another massive windfall for the gilded class.

As the New York Times recalled, on October 25 "Democrats offered a proposal to reduce deficits by $3 trillion over 10 years through a combination of spending cuts and $1.3 trillion of revenue, largely from tax increases." But when Republicans responded with a $2.2 trillion plan, Democrats did not object because the $640 in new tax revenue was, in the Times' words, "too modest." Rather, as the Washington Post explained at the time, the GOP's supposed new revenues were illusory:

Republicans, instead, have offered more than $2 trillion in savings over 10 years, highlighted by nearly $700 billion in spending reductions to Medicare and Medicaid. According to lawmakers and aides familiar with the GOP proposal, it includes an offer of more than $600 billion in savings from new tax revenue. But the two sides are in deep dispute because Republicans want to count these increased receipts based on the expectation of surging economic growth -- a standard that neutral budget observers have declined to use in the past.

Declined with good reason. After all, the Republicans' magic asterisk of surging economic growth helped supply-side tax cutters Ronald Reagan triple the national debt and George W. Bush double it again.

Undeterred by simple math, super committee Republicans led by Senator Pat Toomey (R-PA) two weeks ago offered "to raise federal tax collections by nearly $300 billion over the next decade as part of a plan to tame the national debt."

But as Steve Benen, Kevin Drum, Brian Beutler and Greg Sargent (among others) quickly pointed out, the Republicans' proposal to raise "overall tax collections by $250 billion, mainly by limiting the value of itemized deductions such as write-offs for home mortgage interest, state and local taxes and other expenses" comes with a very big catch. As the Washington Monthly's Benen explained:

Republican want to trade nearly $300 billion in new revenue for "permanently extending the George W. Bush-era tax cuts past their 2012 expiration date, a move that would increase deficits by about $4 trillion over the next decade."

And what would wealthier taxpayers get in exchange for "capping write-offs on charities, state and local taxes, and mortgage interest payments as a percentage of each tax filer's gross income?" As Sargent explained:

The highest tax rate would be reduced from 35 percent to 28 percent under the emerging GOP tax code overhaul proposal...And the reduction would actually be even bigger than this. After all, if the Bush tax cuts were allowed to expire, as they're set to do, the high end rate would go up to at least 39 percent. In other words, the aide says, under the proposal Republicans are pushing, the drop down to 28 percent would be at least 10 percentage points from what it would be if the cuts are allowed to expire.

Even if the limited deductions would cost (as right-wing talking point regurgitator Stephen Moore claimed in the Wall Street Journal) the gilded-class $560 billion over the next decade, the lower income tax rates would still yield an estimated $670 billion in savings for the upper crust.

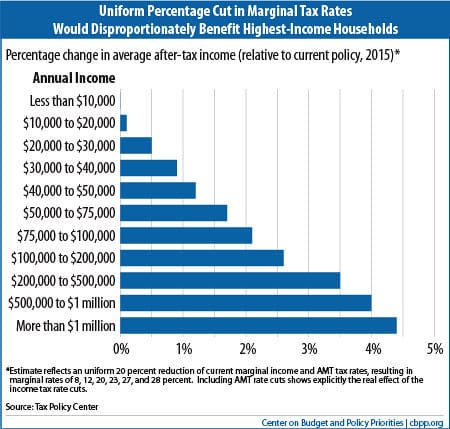

Like the Bush tax cuts of 2001 and 2003, this new Republican payday for the privileged would deliver virtually all of its benefits to the top-earning taxpayers. As the Center on Budget and Policy Priorities explained:

The Urban-Brookings Tax Policy Center recently estimated the effects of a 20 percent reduction in current marginal tax rates in the manner of the Toomey proposal. (The TPC analysis examines the rate cuts by themselves; it does not include accompanying changes in tax expenditures.) The Tax Policy Center found that the average individual who makes more than $1 million a year would receive an average tax cut of $92,000 -- 100 times as much as the benefit that the average family earning between $50,000 and $75,000 would receive. The proposal would boost the average millionaire's after-tax income by 4.4 percent, compared to a 1.7 percent increase for the average family earning between $50,000 and $75,000 (see chart). (These amounts are in addition to the tax cuts that people would receive from extension of the Bush tax cuts.)

In short, the proposed tax-rate cut would be quite regressive, on top of the already regressive (and costly) Bush tax cuts.

Congressional Democrats suggested the overall Toomey package would even more devastating to working Americans. As TPM explained:

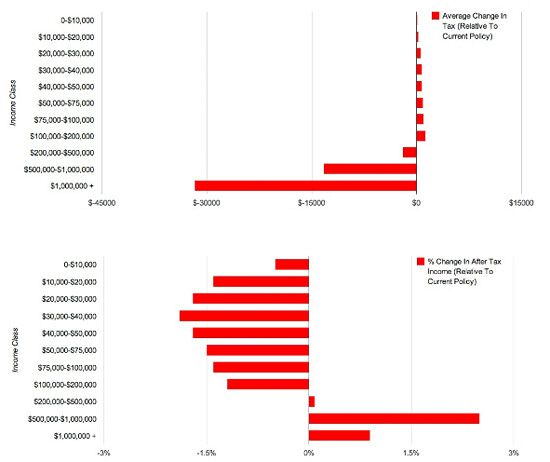

The GOP claims the plan would raise $300 billion in revenue, and also make the newer, lower Bush tax rates permanent. To accomplish this, simple arithmetic implies he'd have to raise a ton of tax revenue elsewhere. But since he objects to raising taxes on capital income, that would require him to slash deeply into credits and preferences that benefit lower and middle income taxpayers.

This chart shows the impact of a plan similar to Toomey's-- one with smaller tax cuts that has been scored by the Joint Committee on Taxation:

It's no wonder Democrat debt panelist John Kerry summed up the Republicans' posturing this way:

The Toomey plan still results in the biggest tax cut since the Great Depression. It would be the biggest tax cut since Calvin Coolidge, and we all know how that turned out. Now, we didn't come here to do another tax cut for the wealthiest people while we're (asking) fixed-income seniors to ante up more, people on Medicaid, who are poor, to ante up more.

But by this weekend, Republican co-chair super committee Jeb Hensarling made clear that his party wouldn't agree to one cent in new revenues from raising rates on the wealthy:

"We have gone as far as we feel we can go. We put $250 billion of what is known as static revenue on the table, but only if we can bring down rates [but] any penny of increased static revenue is a step in the wrong direction. We can only balance that with pro-growth reform and frankly the Democrats have never agreed to that.... if we can't get any type of reforms in health care, which has helped drive the nation towards insolvency, then, no, there's no reason to frankly put any static revenues on the table."

For his part, last week Speaker Boehner called the Toomey plan a "fair offer." But now that the super committee has failed to reach a deal, as The Atlantic explained, "because Republicans can't bring themselves to meaningfully raise taxes," Boehner resurrected an old, debunked talking point to attack President Obama and the Democrats:

"[The committee] was unable to reach agreement because President Obama and Washington Democrats insisted on dramatic tax hikes on American job creators, which would make our economy worse."

Of course, the record shows modest tax increases have virtually no impact on America's supposed job creators: they produce more jobs and the economic grew much faster when their rates were much higher. Having already helped produce the highest income inequality in 80 years and the lowest federal tax burden in 60 even as effective tax rate for the wealthy plummeted, John Boehner and his Republican Party were determined to give them another payday courtesy of the U.S. Treasury.

And the gilded-class' gain means more pain for everyone else. As Ezra Klein lamented on Monday.

The supercommittee was dedicated to deficit reduction, and so naturally, their failure is being seen as a failure to achieve deficit reduction. But that's not the failure that matters. Rather, it's the failure to extend -- and perhaps strengthen -- the unemployment support and tax cuts propping up our fragile recovery that threatens to have the most immediate and devastating economic impact.

All in a day's work for the servants of the rich.

(For more background, see "The Triumph of the One Percent in Pictures" and "10 Epic Failures of the Bush Tax Cuts.")