Health Insurers' Stocks, CEO's Feeling Good about Obamacare

For months, Republicans and their amen corner have been warning "Obamacare will destroy the private-insurance market" in order to "make a single-payer, i.e. socialized medicine, system inevitable." Apparently, the conservative prophets of doom forgot to tell the nation's major health insurance companies. As it turns out, even as Republicans decry the Affordable Care Act's mythical bail-out of the carriers, the insurers' CEO's and shareholders are very happy with Obamacare's prognosis for their firms.

As Sarah Kliff recently explained, "Health insurers arguably have the biggest financial stake in the exchanges' success." But as the executives running America's large health insurers look at current enrollment numbers, the demographic mix of their new customers, and their future prospects for individual, business and Medicare Advantage product lines, they are comfortable with what they see.

On Wednesday, Aetna chief executive Mark Bertolini told the audience at the J.P. Morgan Health Care Conference:

"Given the general demographics that CMS released yesterday, I'm not alarmed. They're better than I thought they would have been."

Bertolini is not alone. Despite the troubled roll-out of the ACA's health insurance exchanges, the CEO's of the biggest carriers seem confident that the growing pains for what is a small part of the businesses in 2014 will be overcome. While Cigna chief executive David Cordani reassured the JP Morgan event attendees that "we're still in the early innings," CEO Joe Swedish of Wellpoint declared himself "cautiously optimistic":

"We believe that over time a lot of these bumps will work themselves out. We always expected it to have sort of a lumpiness to it, to the rollout. It's certainly become more lumpy than one would have predicted, and I don't think that's applicable to just us, that's just the nature of how this has evolved. Over time, this will work out."

As it turns out, when it comes to their stock prices, things are working out very well indeed for the CEO's and their shareholders alike. Back in October, the New York Times explained the sunny outlook for insurers even in the face of the ACA's "10 essential requirements" for new policies and the 80/20 rule on "medical loss ratios" that some fretted would limit profits:

Because they face new regulations intended to broaden coverage and limit profit-taking, some analysts have been concerned that profits will suffer. But in the run-up to the Affordable Care Act, stock market prices have told a different story.

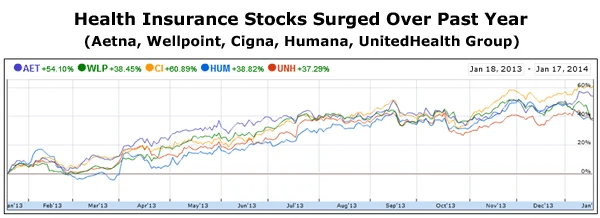

Over the last 12 months, shares of the top five publicly traded health insurance companies -- Aetna, WellPoint, UnitedHealth Group, Humana and Cigna -- have increased by an average of 32 percent, while the Standard & Poor's 500-stock index has risen by just 24 percent.

Three months later, the carriers' year-over-year performance is even more impressive. As the chart above shows, Cigna's share price has jumped by 61 percent since January 18, 2013. Aetna is close behind at 54 percent, while Humana, UnitedHealth Group and Wellpoint all enjoyed gains exceeding 30 percent over the past year.

As Robert Reich detailed in October, Republicans had no grounds to fret over the health of the health insurers:

Last week, after the giant insurer Wellpoint raised its earnings estimates, CEO Joseph Swedish pointed to "the long-term membership growth opportunity through exchanges." Other major health plans are equally bullish. "The emergence of public exchanges, private exchanges, Medicaid expansions ... have the potential to create new opportunities for us to grow and serve in new ways," UnitedHealth Group CEO Stephen J. Hemsley effused.

Now, even for its supporters there are plenty of reasons to be unhappy with the launch of the Affordable Care Act. While the rate of growth for total American spending on health care has slowed to its lowest level in years, the prices actually charged by hospitals, physicians and drug makers remain largely opaque and unregulated. Insurers banned from discriminating based on pre-existing conditions, using "rescission" to drop coverage for the sick and imposing annual and lifetime caps have stepped up other cruel practices like "network narrowing" and policy cancellations to maximize profits at patients' expense.

Still, starting this year millions of Americans are gaining health insurance, and with it the prospect of healthier lives and financial futures. At the same time, the health insurance industry appears very health, indeed.