Health Reform Law Brings Insurance to Millions This Year

This week, House Ways and Means Committee Chairman Dave Camp (R-MI) admitted that the Republican effort to repeal the 2010 health care law is "dead." But while all eyes are now focused on the lawsuit by 26 states to overturn the law and its individual insurance mandate, hundreds of thousands of Americans are already getting coverage thanks to the Affordable Care Act. While the law's provisions enabling 32 million people to obtain insurance don't kick in until 2014, families and small businesses nationwide are already adding coverage.

As an analysis by McClatchy revealed, an estimated 1.2 million young adults will get health insurance coverage this year thanks to the Affordable Care Act's provision enabling parents to keep their children on their policies until age 26. The early indications suggest the number covered this year could be much more. While the ACA didn't require insurers to start covering enrollees' adult children until the start of the next plan year, dozens of firms already have. The results are dramatic:

WellPoint, the nation's largest publicly traded health insurer, with 34 million customers, said the provision on dependents was responsible for adding 280,000 members. That was about one-third of its total enrollment growth in the first three months of this year.

Other large insurers said they'd also added tens of thousands of young adults.

Aetna, for example, added fewer than 100,000; Kaiser Permanente, about 90,000; Highmark Inc., about 72,000; Health Care Service Corp., about 82,000; Blue Shield of California, about 22,000; and United Healthcare, about 13,000.

The Health and Human Services Department estimated that about 1.2 million young adults would sign up for coverage in 2011. The early numbers from insurers show that it could be much more, said Aaron Smith, the executive director of the Young Invincibles, a Washington-based nonprofit group that advocates for young adults.

That bit of good news comes on the heels of another. Despite the sluggish economic recovery, surprising numbers of the nation's small business owners are already taking advantage of the Affordable Care to offer coverage to their employees.

As the Los Angeles Times explained in January, major insurers are reporting that thanks to the incentives in the Affordable Care Act, "a growing number of small businesses are signing up to give their workers health benefits."

Writing in that "Capitalist Tool" Forbes. David Ungar concluded, "Obamacare might just be working to bring health care to working Americans precisely as promised...Because the tax cut created in the new health care reform law providing small businesses with an incentive to give health benefits to employees is working." While 99% of firms with over 200 employees offer some kind of coverage, only three-quarters of those with 10 to 24 workers and half of companies with less than 10 employees do. And as the Los Angeles Times explained, the ACA's new tax credit for companies with fewer than 25 employees and moderate-to-low pay scales to help offset the cost of providing benefits is already having a significant impact:

Now some insurers are reporting significant jumps in coverage.

In the six months after the law was signed in March, UnitedHealth Group Inc., the country's largest insurer, added 75,000 new customers who work for companies with fewer than 50 employees. The Minnesota company called the increase notable but declined to reveal further details.

Coventry Health Care Inc., an insurer in Maryland that focuses on small businesses, signed contracts to cover 115,000 new workers in the first nine months of this year, an 8% jump.

In California, Warner Pacific Insurance Services in Westlake Village, a major servicer of insurance brokers, has seen business grow more than 10% this year, a company executive said.

And Blue Cross Blue Shield of Kansas City, the largest insurer in the Kansas City, Mo., area, is reporting a 58% jump in the number of small businesses buying insurance since April, the first full month after the legislation was signed into law.

As Ron Rowe of Blue Cross Blue Shield put it, "One of the biggest problems in the small-group market is affordability. We looked at the tax credit and said, 'This is perfect.'" He said that 38% of the businesses it is signing up had not offered health benefits before." Gary Claxton, who oversees an annual survey of employer health plans for the nonprofit Kaiser Family Foundation, summed up the promising results:

"We certainly did not expect to see this in this economy. It's surprising."

Surprising, and very welcome.

After all, a study released in March by the Commonwealth Fund found that since the start of the Bush recession in late 2007, almost 60% of Americans who lost a job and their health insurance- 9 million people - could not afford to regain coverage. Medical costs pushed four million more into bankruptcy. (Mercifully, as the analysis also showed, "When fully implemented in 2014, the Affordable Care Act will bring relief: nearly all of the 52 million working-age adults who were without health insurance for a time in 2010 will be covered.")

And as Kaiser and other analyses revealed, the deep Bush recession only accelerated the deterioration of employer-provided health care coverage. Last fall, the U.S. Census Bureau announced that the number of uninsured in America jumped to 50.7 million (16.7%) in 2009 from 46.3 million (15.4%) just the year before. But the Bush recession which began in December 2007 accounts for only a portion of that dramatic drop-off. A September 2010 analysis by the Economic Policy Institute found that employer-sponsored coverage plummeted from 68.3% of those under 65 years old in 2000 to just 58.9% in 2009. (A Thomson Reuters survey last year put the figure for 2009 at a stunning 54.6%.) It was only the expansion of government programs including SCHIP and Medicaid which offset the erosion of employer coverage over the last two years.

And that's just the beginning of the health care nightmare for employees that Republicans are determined to prolong. As the New York Times reported this fall, the Employer Health Benefits 2010 Annual Survey produced by the Kaiser Family Foundation found:

Since 2005, while wages have increased just 18 percent, workers' contributions to premiums have jumped 47 percent, almost twice as fast as the rise in the policy's overall cost.

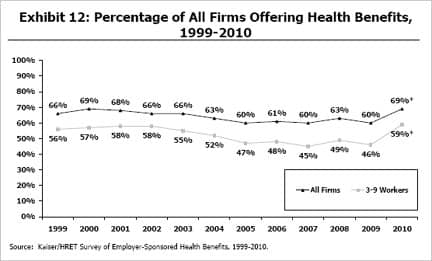

But the one bright spot in the Kaiser survey was expanded coverage among small businesses. As the chart below shows, from 2009 to 2010 companies with 3 to 9 employees providing workers with insurance jumped by 13 points to 59%.

That finding was echoed by the not-for-profit advocacy group, Small Business Majority:

Small Business Majority commissioned a survey of 619 small business owners with fewer than 50 employees from Nov. 17-22, 2010. We wanted to gauge their opinions on two key provisions of the Patient Protection and Affordable Care Act: healthcare tax credits and insurance exchanges. For employers who don't offer health insurance, one-third said they are more likely to do so because of the tax credits, and 31% of employers who currently offer it said the tax credits will make them more likely to continue offering it. The credits, which are available now, allow businesses with fewer than 25 employees that have average annual wages under $50,000 to get a tax credit of up to 35% of their health insurance costs.

The numbers were nearly identical when respondents were asked if the exchange will make them more likely to provide benefits: 33% of respondents who don't provide insurance said the exchange would make them more likely to do so, and 31% who do provide insurance responded that the exchange would make them more likely to continuing providing it. The insurance exchanges are online marketplaces where small businesses and individuals can band together to buy insurance.

Evaluating those incentives to purchase insurance for her employees, Kiersten Firquain of Kansas City-based Bistro Kids responded, "We said, 'How could we not do this?'"

The same might be said of the health care reform law itself. Adding roughly two million to the ranks of the insured this year and ultimately 30 million more all while trimming the national debt, how could we not do this?