How Bain is Bilking Taxpayers and Making Americans Sick

Last week, Attorney General Eric Holder and HHS Secretary Kathleen Sebelius sent a letter to five hospital trade organizations warning against the abuse of electronic medical record systems to seek inflated Medicare reimbursements. The Obama administration's concern is well-founded. Earlier this month, both the Washington Post and New York Times documented the use of techniques including "code inflation" and "cloning" by some hospitals, clinics and physicians to extract overpayments from the government and private insurers alike for office visits, patient treatment and especially emergency room visits. According to one study from the Center for Public Integrity, the cost to U.S. taxpayers for Medicare overbilling reached $11 billion over the past decade.

But in a less noticed twist, the story involves the dark nexus where presidential politics, the private equity industry and some of the leading lights of the Republican Party meet. As it turns out, HCA, one of the nation's largest for-profit hospital firms, is facing scrutiny for suspect billing practices, unnecessary procedures and questionable profit-taking that increased following its 2009 buyout by private equity firms including Mitt Romney's former firm, Bain Capital.

If the name HCA sounds familiar, it should. Before the giant chain came to operate 163 hospitals nationwide, it was owned by the family of former Republican Senate Majority Leader Bill Frist. In the 1990's, the Hospital Corporation of America founded by Frist's father merged with Columbia Healthcare Corporation, a group then led by current Florida Governor Rick Scott. Scott was later forced off the board after HCA was forced to pay a staggering $1.7 billion penalty for Medicare fraud. For his part, in 2007 Doctor Frist was eventually cleared of insider trading involving his supposedly blind trust's sale of HCA stock.

But now, the New York Times reports, HCA 's business practices are once again being viewed under the microscope. And as it turns out, the company's laser-focus on profit maximization followed its 2006 buyout by a group of private equity firms including Bain:

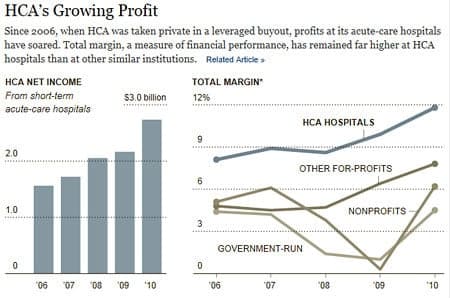

In fact, profits at the health care industry giant HCA, which controls 163 hospitals from New Hampshire to California, have soared, far outpacing those of most of its competitors.

The big winners have been three private equity firms -- including Bain Capital, co-founded by Mitt Romney, the Republican presidential candidate -- that bought HCA in late 2006.

HCA's robust profit growth has raised the value of the firms' holdings to nearly three and a half times their initial investment in the $33 billion deal.

The secret to HCA's success, now sadly a model for the entire industry, appears to be a formula that drains the U.S. Treasury and puts patients at greater risk. As the Times explained:

It figured out how to get more revenue from private insurance companies, patients and Medicare by billing much more aggressively for its services than ever before; it found ways to reduce emergency room overcrowding and expenses; and it experimented with new ways to reduce the cost of its medical staff, a move that sometimes led to conflicts with doctors and nurses over concerns about patient care.

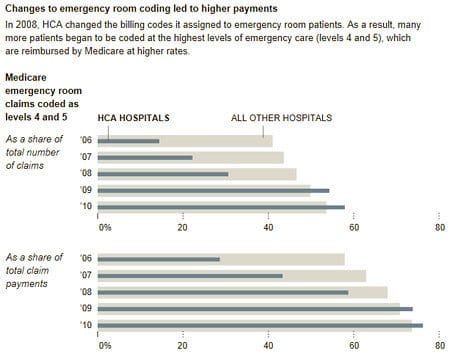

Like other hospital groups that "cloned" patient records to collect payments from Medicare and other insurers for procedures and treatments not actually delivered, beginning in late 2008, "HCA changed the billing codes it assigned to sick and injured patients who came into the emergency rooms. Almost overnight, the numbers of patients who HCA said needed more care, which would be paid for at significantly higher levels by Medicare, surged."

But at its facilities, HCA isn't merely gouging taxpayers. As the Times reported, lives are sometimes being jeopardized.

Many doctors interviewed at various HCA facilities said they had felt increased pressure to focus on profits under the private equity ownership. "Their profits are going through the roof, but, unfortunately, it's occurring at the expense of patients," said Dr. Abraham Awwad, a kidney specialist in St. Petersburg, Fla., whose complaints over the safety of the dialysis programs at two HCA-owned hospitals prompted state investigations.

One facility was fined $8,000 in 2008 and $14,000 last year for delaying the start of dialysis in patients, not administering physician-prescribed drugs and not documenting whether ordered tests had been performed.

Even more serious, HCA's business practices surrounding cardiac care are being investigated by the Department of Justice. In the summer of 2010, a whistleblowing nurse named C.T. Thompson warned management that a doctor at his HCA hospital "had been performing heart procedures on patients who did not need them, putting their lives at risk." Those allegations were confirmed by an HCA ethics officer. And to be sure, they were harrowing:

At Lawnwood, where an invasive diagnostic test known as a cardiac catheterization is performed, about half the procedures, or 1,200, were determined to have been done on patients without significant heart disease, according to a confidential 2010 review. HCA countered recently with a different analysis, saying the percentage of patients without disease was much lower and in keeping with national averages.

At Bayonet Point, a 44-year-old man who arrived at the emergency room complaining of chest pain suffered a punctured blood vessel and a near-fatal irregular heartbeat after a doctor performed a procedure that an outside expert later suggested might have been unnecessary, documents show. The man had to be revived. "They shocked him twice and got him back," according to the testimony of Dr. Aaron Kugelmass in a medical hearing on the case.

In another incident, an outside expert described how a woman with no significant heart disease went into cardiac arrest after a vessel was cut when a Bayonet Point cardiologist inserted a stent, a meshlike device that opens coronary arteries. She remained hospitalized for several days, according to a person who has reviewed internal reports.

In his 2009 book The Buyout of America, author Josh Kosman documented the shocking tales of profit-maximization and cost-cutting at hospitals acquired in leveraged buyout deals by private equity firms. After saddling the hospitals with massive debt--including hundreds of millions of dollars in fees and dividend payments--PE firms would mandate slashing staff, trimming services and boosting prices to pay it off. As Mitt Romney explained in 1985, his Bain Capital would "invest in startup companies and ongoing companies, then to take an active hand in managing them and hopefully, five to eight years later, to harvest them at a significant profit." In the case of HCA, Bain and its PE partners are apparently harvesting significant profits from human beings:

In 2010, buoyed by robust growth in profit, HCA was able to issue billions of dollars in debt that was used to pay funds overseen by the three buyout firms nearly $1 billion in dividends -- each. In the spring of 2011, in one of the most closely watched public offerings since the financial crisis, HCA became a public company once again. Its three buyout owners each sold another $500 million worth of stock, allowing them to recoup all their initial investment.

Last fall, HCA agreed to buy back the stake held by Bank of America, which had purchased Merrill Lynch in 2009, for $1.5 billion, giving the bank a return of two and a half times its initial investment. And earlier this year, HCA paid out $900 million in dividends, of which $360 million went to K.K.R. and Bain.

The 40 percent stake in HCA still held by K.K.R. and Bain is worth about $4.8 billion at current levels, giving them a potential profit, with the dividends they have received, of three and a half times their initial investment of $1.2 billion each.

In Mitt Romney's defense, he left Bain Capital in 1999 (or 2002, depending on whether he's running for Governor of Massachusetts or President of the United States). But thanks to his one-of-a-kind, once-in-a-lifetime severance package, Romney continues to pocket millions annually from Bain's portfolio of investments. Whether Mitt Romney's ongoing windfall includes proceeds from HCA's billing shenanigans, bogus tests, unnecessary treatments and filled ER beds remains a mystery. (Perhaps the answer could be found by putting his tax returns under the microscope.) But at least for now, Bain and its PE partners will continue to get rich at the expense of American taxpayers--and Americans' health.