Introducing the $1 Trillion Ronald Reagan Platinum Coin

As part of their never-ending campaign to canonize President Ronald Reagan, conservatives three years ago proposed replacing Ulysses S. Grant on the 50 dollar bill with the likeness of the Gipper. But while his hagiographers mercifully failed in that quest, a new and altogether fitting denomination has emerged to memorialize Reagan. The much-discussed one trillion dollar platinum coin, the unfortunate gimmick that may be needed to circumvent the Republicans' dangerously real gimmick on the debt ceiling, would be a perfect home for Reagan's image. After all, President Reagan didn't merely triple the national debt in his eight years in the White House and establish budget-busting tax cuts as a permanent fixture in Republican politics. As it turns out, Reagan excoriated those in Congress who would jeopardize the full faith and credit of the United States by refusing to increase the nation's debt limit.

Reagan came to the Oval Office in 1981 promising to slash taxes by 30 percent, boost Pentagon funding and balance the budget. But as most analysts predicted, Reagan's massive $749 billion supply-side tax cuts in 1981 quickly produced even more massive annual budget deficits. Combined with his rapid increase in defense spending, Reagan delivered not the balanced budgets he promised, but record-setting debt. Even his OMB alchemist David Stockman could not obscure the disaster with his famous "rosy scenarios."

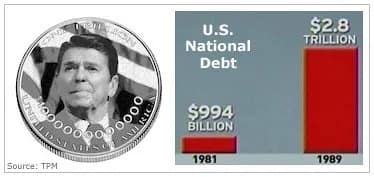

Forced to raise taxes eleven times to avert financial catastrophe, the Gipper nonetheless presided over a tripling of the American national debt to nearly $3 trillion. Federal spending grew several times faster than under President Obama, while the public sector employment expanded much more quickly than any time since. By the time he left office in 1989, Ronald Reagan more than equaled the entire debt burden produced by the previous 200 years of American history. It's no wonder that, almost 30 years after he concluded "the supply-siders have gone too far," former Arthur Laffer acolyte and Reagan budget chief David Stockman lamented:

"[The] debt explosion has resulted not from big spending by the Democrats, but instead the Republican Party's embrace, about three decades ago, of the insidious doctrine that deficits don't matter if they result from tax cuts."

It's also no wonder the Gipper cited the skyrocketing deficits he bequeathed to America as his greatest regret.

Despite the lessons of Reagan's tax-cutting debacle, his Republican heirs have never departed from the completely debunked supply-side orthodoxy that "tax cuts pay for themselves." President Bush, who nearly doubled the national debt, declared in 2004 that "you cut taxes and the tax revenues increase." When Congressional Republicans successfully blocked President Obama's 2010 proposal to end the upper-income Bush tax cuts, Arizona Senator Jon Kyl claimed, "You should never have to offset the cost of a deliberate decision to reduce tax rates on Americans." For his part, Senate Minority Leader Mitch McConnell rushed to defend Kyl's fuzzy math:

"There's no evidence whatsoever that the Bush tax cuts actually diminished revenue. They increased revenue because of the vibrancy of these tax cuts in the economy. So I think what Senator Kyl was expressing was the view of virtually every Republican on that subject."

That may have been a view universally shared by virtually every Republican, but it happens to be wrong. Or as Reagan might have put it, "facts are stupid things."

Analyses by the Center on Budget and Policy Priorities (CBPP) in 2010 found that the Bush tax cuts not only accounted for half the deficits during his tenure, but if made permanent would add more debt over the next decade than Iraq, Afghanistan, the recession, TARP and the Obama stimulus--combined. That may be why President Bush signed seven debt ceiling increases in his eight years. And Congressional Republicans led by Mitch McConnell, John Boehner, Eric Cantor and Paul Ryan voted for them all.

Which is why Ronald Reagan would take his party to task for threatening to destroy the U.S. economy if its debt ceiling ransom is not paid. As he warned Congress in November 1983:

"The full consequences of a default -- or even the serious prospect of default -- by the United States are impossible to predict and awesome to contemplate. Denigration of the full faith and credit of the United States would have substantial effects on the domestic financial markets and the value of the dollar."

To avoid the certain calamity Republicans leaders admit will ensue if they fail to raise the debt ceiling, the safe thing to do would be to mint the $1,000,000,000,000 Ronald Reagan platinum coin just in case. After all, he earned it.

Of course, if all else fails, the United States can always make up a funding shortfall by selling arms to Iran.