It's Time to Pay the Bin Laden Tax

While all eyes this week were focused on the killing of Osama Bin Laden in Pakistan, back in Washington Vice President Biden met with Democratic and Republican budget negotiators in search of a compromise to reduce the U.S. national debt. As it turns out, the two events are related. Because almost 10 years after President Bush vowed to get Bin Laden "dead or alive," the $3 trillion tab for that now completed quest remains unpaid. As it turns out, real progress in slashing America's chronic deficits isn't possible until it is. Whether you call it the Freedom Fund, the Liberty Levy or just the Bin Laden Tax, it's time for Americans to pay that bill.

This week, the National Journal estimated that the total cost to the U.S. economy of the hunt for Bin Laden will reach $3 trillion. (In 2008, Nobel Prize-winning economist Joseph Stiglitz put the price of the Iraq conflict alone at $3 trillion.)

But by 2020 and beyond, the direct cost to U.S. taxpayers could reach $3 trillion. In March, the Congressional Research Service put the total cost of the wars at $1.28 trillion, including $806 billion for Iraq and $444 billion for Afghanistan. For the 2012 fiscal year which begins on October 1, President Obama asked for $117 billion more. (That war-fighting funding is over and above Secretary Gates' $553 billion Pentagon budget request for next year.)

But in addition to the roughly $1.5 trillion tally for both conflicts through the theoretical 2014 American draw down date in Afghanistan, the U.S. faces staggering bills for veterans' health care and disability benefits. Last May, an analysis by the Center for American Progress estimated the total projected total cost of Iraq and Afghanistan veterans' health care and disability could reach between $422 billion to $717 billion. Reconstruction aid and other development assistance represent tens of billions more, as does the additional interest on the national debt. And none of the above counts the expanded funding for the new Department of Homeland Security.

But that two-plus trillion dollar tab doesn't account for the expansion of the United States military since the start of the "global war on terror." As a percentage of the American economy, defense spending jumped from 3.1% in 2001 to 4.8% last year. While ThinkProgress noted that the Pentagon's FY 2012 ask is "the largest request ever since World War II," McClatchy explained:

Such a boost would mark the 14th year in a row that Pentagon spending has increased, despite the waning U.S. presence in Iraq. In dollars, Pentagon spending has more than doubled in 10 years. Even adjusted for inflation, the Defense Department budget has risen 65% in the past decade.

Even with the proposed $78 billion in cuts and troop reductions advocated by Gates and Obama over the next five years, "the bottom-line figure would still go up during that time, with projected spending totaling $643 billion in 2015 and $735 billion in 2020."

Even with the reduction in staffing forecast for 2015, the Army and Marine Corps would be larger than they were when the Iraq and Afghanistan wars began.

All in all, Americans are on the hook for about $3 trillion to the U.S. Treasury. But if the GOP gets its way, we won't have to pay it back. Not now. Not ever.

As Politico described the Biden bipartisan debt meeting this week, "Virginia Rep. Eric Cantor, along with Arizona Sen. Jon Kyl, immediately insisted that tax hikes be taken out of the discussions altogether." Reiterating the GOP's threat of national fiscal suicide over the debt ceiling, House Speaker John Boehner was blunt:

"Let me make this clear: When it comes to increasing the debt limit and the need to have reductions in spending, nothing is off the table except raising taxes."

Sadly, that kind of grandstanding has been going on for a decade.

Even as the World Trade Center site was still smoldering, Republicans insisted Al Qaeda represented an existential threat to the United States. President Bush repeatedly compared 9/11 to Pearl Harbor and his war on terror to World War II. But he never asked Americans to join the military or sacrifice at home. Instead, Bush told us to go shopping and "get down to Disney World."

From a public policy standpoint, post-9/11 America in no way resembles FDR's response to Pearl Harbor. George W. Bush was the first modern president to cut taxes during wartime. (Barack Obama was the second.) But the self-inflicted fiscal hemorrhaging hardly ends there. An analysis by the Center on Budget and Policy Priorities found that Bush tax cuts accounted for almost half of the mushrooming deficits during his tenure; increased defense, DHS and international aid spending represented only 35% of the additional red ink. And as another CBPP analysis revealed that over the next 10 years, the Bush tax cuts if made permanent will contribute more to the U.S. budget deficit than the Obama stimulus, the TARP program, the wars in Afghanistan and Iraq, and revenue lost to the recession - combined.

For their part, Republicans want to make a bad situation much worse. Not content to block a return the top 39.6% tax rate of the booming Clinton years, the GOP only wants to make the Bush tax cuts permanent. The Ryan budget passed by the House this month would slash the top individual tax rate from 35% to 25% in a move that would cost the Treasury $4 trillion (including yet another $1 trillion for the wealthy) over 10 years.

More important is a point which can't be stressed enough: the American tax burden hasn't been this low in generations.

Thanks to the combination of the Bush Recession and the Obama tax cuts, the AP reported, "as a share of the nation's economy, Uncle Sam's take this year will be the lowest since 1950, when the Korean War was just getting under way." In January, the Congressional Budget Office (CBO) explained that "revenues would be just under 15 percent of GDP; levels that low have not been seen since 1950." That finding echoed an earlier analysis from the Bureau of Economic Analysis. Last April, the Center on Budget and Policy Priorities concluded, "Middle-income Americans are now paying federal taxes at or near historically low levels, according to the latest available data." As USA Today reported last May, the BEA data debunked yet another right-wing myth:

Federal, state and local taxes -- including income, property, sales and other taxes -- consumed 9.2% of all personal income in 2009, the lowest rate since 1950, the Bureau of Economic Analysis reports. That rate is far below the historic average of 12% for the last half-century. The overall tax burden hit bottom in December at 8.8% of income before rising slightly in the first three months of 2010.

"The idea that taxes are high right now is pretty much nuts," says Michael Ettlinger, head of economic policy at the liberal Center for American Progress.

Which is why it's time for Americans - the rich above all - to pay their fair share. And during this time of war, paying half what the Greatest Generation ponied up seems like a good starting point.

As it turns out, that's precisely what a number of Democrats in the House and Senate have called for. Earlier this month, Senator Al Franken (D-MN) proposed the "Pay for War" resolution, which would require Congress to offset any costs for military operations that go beyond the Defense Department's base budget with either new tax revenue or corresponding spending cuts. In March, Franken's colleague from Vermont Bernie Sanders called for a 5.4% tax surcharge on Americans earning over $1,000,000 a year. Then just days later, Congresswoman Jan Schakowsky (D-IL) introduced the "Fairness in Taxation Act." Her plan, which would add an estimated $78 billion in annual tax revenue starting this year, would boost the current top 35% rate for millionaires and billionaires. As her web site explained:

The current top tax bracket begins at $373,000 in income and fails to distinguish between the "well off" and billionaires - like the top 20 hedge fund managers whose average income last year was over $1 billion.

The Fairness in Taxation Act asks enacts new tax brackets for income starting at $1 million and ends with a $1 billion bracket. The new brackets would be:

$1-10 million: 45%

$10-20 million: 46%

$20-100 million: 47%

$100 million to $1 billion: 48%

$1 billion and over: 49%

The bill would also tax capital gains and dividend income as ordinary income for those taxpayers with income over $1 million.

Schakowsky's suggested individual tax rates aren't just in the ballpark of the "Half-a-World War II" solution. They also happen to be the centerpiece of the People's Budget proposed by the Congressional Progressive Caucus. As it turns out, the Grijalva/Elliison document is the only proposal from either party which would erase annual budget deficits by 2021. And as voices as diverse as Paul Krugman and The Economist point out,

Mr. Ryan's plan adds (by its own claims) $6 trillion to the national debt over the next decade, but promises to balance the budget by sometime in the 2030s by cutting programmes for the poor and the elderly. The Progressive Caucus's plan would (by its own claims) balance the budget by 2021 by cutting defence spending and raising taxes, mainly on rich people. Mr. Ryan has been fulsomely praised for his courage. The Progressive Caucus has not.

What the Progressive Caucus also hasn't done is ask all Americans - as FDR did 70 years ago - to pick up some of the tab for the nation's wars. That's one of the three pillars of any Bin Laden tax: everyone pays, the rich pay more, and raise at least $3 trillion over 10 years.

Here's how it could work:

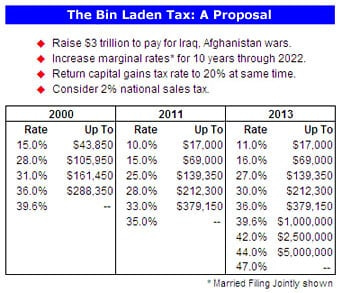

For ten years starting in 2013, income tax rates could be rolled back to something like their pre-2001 levels, but with some important exceptions. First, given the record income inequality and declining average household income now plaguing the United States, rates for the lowest brackets should not return to their Clinton-era levels, but instead rise by only 1% to 2%. The current top two family of brackets starting at $212,300 and $379,100 would go back to 36% and 39.6%, respectively. Importantly, in keeping with the wartime tradition that the rich pay substantially more, new brackets at $1,000,000 (42%), $2,500,000 (44%) and $5,000,000 (47%) should be introduced. (As this New York Times graphic above shows, those levels would still be half of their World War II peaks.) In keeping with the "everyone pays" principle, the capital gains tax rate would return to its 1990's boom-era level of 20%.

These proposals should produce the needed revenue to offset the $3 trillion in past and future costs surrounding the wars in Afghanistan and Iraq. (By way of comparison, letting all of the Bush tax cuts expire would have added in $3.8 trillion in new revenue to the Treasury over ten years.) Other steps, like reigning in Medicare and Medicaid costs, raising the threshold for annual income exempted from Social Security taxes to $250,000 would more than meet the Obama Deficit Commission's goal of trimming the $14 trillion national debt by $4 trillion over the next decade. To boost revenue further, the Bin Laden War Tax could also include a 2% national sale tax. Call it a "Victory VAT."

Many observers - and doubtless all Republicans - will object that the United States can't absorb tax increases of this magnitude. But economic history and the American notion of shared sacrifice say otherwise. After all, as Franklin Roosevelt put it just two days after Pearl Harbor on December 9, 1941:

"It is not a sacrifice for the industrialist or the wage earner, the farmer or the shopkeeper, the trainman or the doctor, to pay more taxes, to buy more bonds, to forego extra profits, to work longer or harder at the task for which he is best fitted. Rather is it a privilege."

As Americans were reminded by the operation which eliminated Osama Bin Laden this week, we are also privileged to be protected by all an-volunteer military which endures enormous sacrifices to fight our wars around the globe. The least we can do is pay for them.