President Trump Promises the Next Great Depression

In Pennsylvania on Tuesday, Republican White House hopeful Donald Trump delivered a blistering attack on U.S. trade policy. Unfortunately, he chose the wrong week to proclaim, "We Are Going To Make America Great Again For Everyone--Greater Than Ever Before." Just the day before, the deficit-hawks at the Committee for a Responsible Federal Budget (CFRB) offered just the latest analysis showing Trump's massive tax cut windfall for the wealthy would fuel $11.5 trillion in additional national debt over the next decade. That dire forecast arrived hot on the heels of a study by former John McCain adviser and current Hillary Clinton donor Mark Zandi of Moody's Analytics which found that if all of Trump's proposed policies became reality "the U.S. economy would plunge back into recession, losing millions of jobs."

But as horrifying as the predicted numbers would be under President Trump--a long recession from 2018 through 2020, 3.5 million jobs lost, unemployment catapulting to 7.4 percent and the U.S. economy-shrinking by 2.4 percent--America's future could actually be much worse. That's because there's one other Trump pledge neither analysis took into account. As he explained it to Bob Woodward on March 31, Trump proclaimed he could eliminate the entire national debt "fairly quickly." Just how how quickly?

"Well, I would say over a period of eight years."

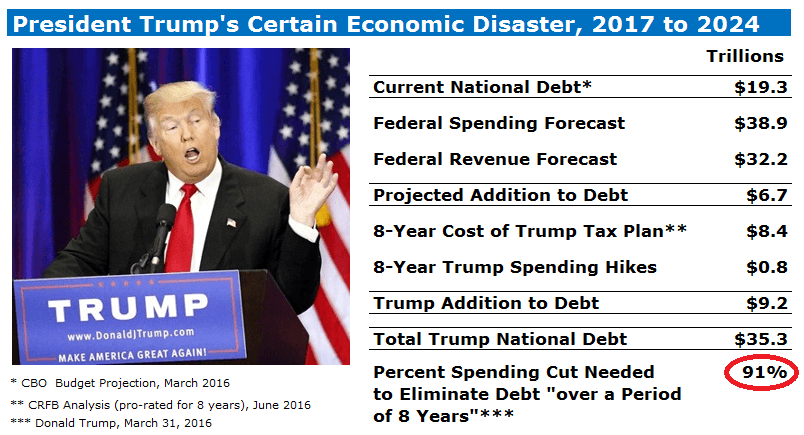

You read that right. To erase all of Uncle Sam's red ink current and projected by the end of his second term, President Donald Trump would have to slash federal spending by over 90 percent. (See chart above.) That's not just the budgetary equivalent of causing the sun to rise in the west or switching off gravity on Earth. Trump's ax would trigger a global economic calamity leaving Americans nostalgic for the Great Depression.

If the road to hell is paved with good intentions, Trump's is a superhighway constructed from bullshit. And it starts with upper-class tax cuts so large they make Ronald Reagan and George W. Bush look like Karl Marx and Friedrich Engels.

During the Republican primaries, the nonpartisan Tax Policy Center (TPC) estimated the 10-year cost of the Trump tax plan at between $9.5 trillion and $12 trillion dollars. By cutting the top income tax rate from 39.6 to 25 percent, capping the dividend and capitals gains rate at 20 and allowing "pass-through" businesses and partnerships to pay only a 15 percent rate, Trump would deliver a huge payday to the top one percent of earners. Businesses, too, would benefit as the statutory corporate tax rate was slashed from 35 to 15 percent. (On top of that, the elimination of the estate tax, paid by less than a quarter of one percent of all fortunes, would on paper at least redirect billions of Trump's supposed $10 billion wealth from the United States Treasury to his heirs.) At the end of the day, the richest 0.1 percent of households--those earning at least $3.7 million a year--would on average pocket $1.3 million annually. As TPC concluded:

These are tectonic shifts in tax policy.

Tectonic shifts, too, for Uncle Sam's bottom line. As McClatchy reported on Tuesday:

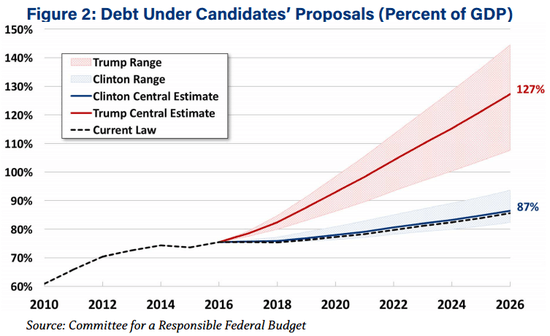

The Committee for a Responsible Federal Budget, which analyzed the plans of all the main presidential candidates, found that Trump's plans would add $11.5 trillion over the next 10 years, causing the debt to rise to 127 percent of the gross domestic product by 2026. The plan of his Democratic rival, Hillary Clinton, would also increase the national debt, but by less, adding $250 billion to the debt over a decade, bringing it to 87 percent of the GDP by 2026 -- which closely mirrors current projections.

And those current projections show the full extent of the red ink President Trump would have to mop-up over his two terms in office. According to the March 2016 forecast from the nonpartisan Congressional Budget Office, the next President will inherit a national debt of roughly $19.3 trillion dollars. Under the current baseline forecast--that is, no changes to today's federal policies--the federal government will run up an additional $6.7 trillion over the next years. (As the table at the top shows, spending is projected to exceed tax revenue by $38.9 trillion versus $32.2 trillion.) But on top of that $26 trillion in debt, President The Donald over his 8-year tenure would add yet another $9.2 trillion. (That figure is pro-rated from CRFB's 10 year-forecast.)

So to keep his promise, President Trump would have to eliminate $35.2 trillion in debt "over a period of 8 years." But to that from spending cuts alone would be virtually impossible: Trump would have to slash a mind-blowing 91 percent of all federal spending from 2017 through 2024.

Now, there are still two problems with fulfilling Trump's dangerous and contradictory promises for the government's budget, even for the most ardent of the "drown it in a bathtub" crowd. Assuming he could find a magic wand to make $35.3 trillion in spending disappear from a $38.9 trillion, 8-year budget, the U.S. economy would be a devastated hellscape if President Trump got anywhere close. As ThinkProgress pointed out when a balanced budget amendment was being kicked around Congress four years ago, even those comparatively modest cuts would produce an economic calamity on the scale of the Great Depression:

If the 2012 budget were balanced through spending cuts, those cuts would total about $1.5 trillion in 2012 alone, the analysis estimates. Those cuts would throw about 15 million more people out of work, double the unemployment rate from 9 percent to approximately 18 percent, and cause the economy to shrink by about 17 percent instead of growing by an expected 2 percent.

But President Trump would never get that far due to a second problem with his kamikaze cuts. Only about 30 percent of the federal budget is "discretionary," that is, subject to changing Congressional appropriations each year. The rest, including Social Security, Medicare, Medicaid, interest on the national debt, is mandatory spending previously set into law by Congress and the President. In fiscal year 2016 which ends on September 30, the Office of Management and Budget (OMB) forecasts that discretionary spending will reach $1.22 trillion dollars, or 31 percent of the $3.9 trillion total. Of those discretionary dollars, defense spending makes up $595 billion, or almost half. Everything else the federal government does--foreign aid, R&D, education, transportation, veterans' services, makes up the rest. So, even if President Trump wanted to commit national economic suicide, he would need Congress to go along and make it happen. Either way, The Donald would have to violate on of his other campaign promises: no cuts to Social Security and Medicare.

Now, there are four Trump and his water-carriers will offer to explain away his utter defeat at the hands of basic math. The first is the latest variation on the old Republican "dynamic scoring" scam. In GOP mythology, the hemorrhaging from the United States Treasury will magically be cauterized by the extra economic growth incentivized by lower tax rates. But this isn't just a case of the last four decades of American history always failing to produce the massive "macroeconomic feedback" that Paul Ryan, Arthur Laffer and their ilk predict. As CRFB's resident deficit scold Maya MacGuineas summed it up:

For Trump, it would take 5.4 percent annual growth to stabilize the debt, and over 10 percent to balance the budget. For some context, we haven't had 5 percent growth since the late 60s and early 70s -- and back then we didn't have nearly as many people about to retire and leave the labor force.

But as a wide array of analysts across the political spectrum have warned, the U.S. would not experience explosive--and unprecedented--economic growth under a President Trump. Far from it. Even before his speech outside Pittsburgh this week, the Washington Post, the New York Times and CNBC all warned a crippling economic blowback from the trade war which would necessarily ensue from Trump's proposed 35 and 45 percent tariffs on Mexican and Chinese imports. An analysis prepared by Moody's Analytics found that:

They would, in fact, sock it to China and Mexico. Both would fall into recession, the model suggests, if Trump levied his proposed tariffs and those countries retaliated with tariffs of their own.

Unfortunately, the United States would fall into recession, too. Up to 4 million American workers would lose their jobs. Another 3 million jobs would not be created that otherwise would have been, had the country not fallen into a trade-induced downturn.

All of which destroys Trump's second defense of his comically calamitous budget. As he boasted to Woodward, tearing up existing U.S. trade deals will make it rain for the Treasury:

"The power is trade. Our deals are so bad...I'm renegotiating all of our deals, Bob. The big trade deals that we're doing so badly on. With China, $505 billion this year in trade. We're losing with everybody."

Leave aside for the moment that Trump has the number wrong (it's $366 billion) and that he appears to be confusing America's annual trade deficit with the federal budget deficit. As the overwhelming consensus of economists argue, Trump's draconian tariff barriers would reverse economic growth, cost millions of jobs and drive down federal tax collections. Far from reducing the national debt, Trump's program of protectionism would make it worse.

Which is why Donald "Orange Crash" Trump briefly flirted with a third defense of his hallucinogenic budget. President Trump will deal with his rapidly growing mountain of debt by simply refusing to pay it all back. "I would borrow, knowing that if the economy crashed, you could make a deal," he explained in May, "And if the economy was good, it was good. So, therefore, you can't lose." But as the New York Times pointed out to the very confused Mr. Trump:

Such remarks by a major presidential candidate have no modern precedent. The United States government is able to borrow money at very low interest rates because Treasury securities are regarded as a safe investment, and any cracks in investor confidence have a long history of costing American taxpayers a lot of money.

Experts also described Mr. Trump's proposal as fanciful, saying there was no reason to think America's creditors would accept anything less than 100 cents on the dollar, regardless of Mr. Trump's deal-making prowess.

"No one on the other side would pick up the phone if the secretary of the U.S. Treasury tried to make that call," said Lou Crandall, chief economist at Wrightson ICAP. "Why should they? They have a contract" requiring payment in full.

That's why Matthew Yglesias warned last month, "Donald Trump just threatened to cause an unprecedented global financial crisis." But you don't have to take his word for it--or mine. As now Speaker Paul Ryan put it before the debt ceiling crisis of 2011, "You can't not raise the debt ceiling." His predecessor, John Boehner, explained why:

"That would be a financial disaster, not only for our country but for the worldwide economy."

Standard & Poor's certainly agreed during its Tea Party downgrade of the U.S. credit rating in the summer of 2011. After Republican debt ceiling hostage-taking hammered American job creation and consumer confidence, an astonished S&P senior director Joydeep Mukherji warned:

"[P]eople in the political arena were even talking about a potential default. That a country even has such voices, albeit a minority, is something notable. This kind of rhetoric is not common amongst AAA sovereigns."

No, it is not. And that's why Team Trump deploys its fourth and last line of defense whenever the would-be President scares the bejesus out of global financial markets. The Donald, they'll argue, either just didn't mean what he said or never said it at all. "People said I want to go and buy debt and default on debt, and I mean, these people are crazy," Trump told CNN's Chris Cuomo. "First of all, you never have to default because you print the money, I hate to tell you, OK?" As for that March promise to erase the national debt "over a period of 8 years," Trump insisted to Stephen Gandel of Fortune less than a month later that it never happened:

FORTUNE: You've said you plan to pay off the country's debt in 10 years. How's that possible?

TRUMP: No, I didn't say 10 years...

FORTUNE: How much of the debt could you pay off in 10 years?

TRUMP: You could pay off a percentage of it.

FORTUNE: What percentage?

TRUMP: It depends on how aggressive you want to be. I'd rather not be so aggressive.

The kindest interpretation of this and other similar episodes is that businessman, CEO and Republican presidential candidate Donald Trump simply doesn't know anything about the federal budget and the U.S. economy. A more cynical reading is that Trump is a pathological liar, the most venal kind of profit-seeking con man. Judging from the polls, more and more people apparently believe both.

So, too, do more and more of his fellow tycoons. A recent survey of Fortune 500 CEO's found that the leaders of America's largest companies clearly prefer Democrat Hillary Clinton over The Donald by a 58 to 42 percent margin. They are joined by former Bush Treasury Secretary Henry Paulson, now a Clinton supporter because "a Donald Trump presidency is unthinkable." (For his part, Trump now claims he never heard of Paulson.) And then there's Paul Singer, the Republican bag man who helped funnel tens of millions of dollars to Mitt Romney's Super PAC in 2012. As he put it to CNBC:

"I think if he [Trump] actually stuck to those policies and gets elected president, it's close to a guarantee of a global depression, widespread global depression."

Back in April, economists were surprised and confused by Donald Trump's prediction that the United States is headed for a "very massive recession." It most certainly is, but only if Donald J. Trump is elected President of the United States.