Tax Cut Cowardice from Both Parties

If Thursday was a test of political courage when it comes to the expiring Bush tax cuts, both parties failed miserably. Despite a raft of polls showing strong public opposition to the GOP's proposed $700 billion, 10-year tax cut windfall for the wealthy, squeamish Democrats in both the House and the Senate decided to push off a vote until after the midterm elections. Not to be outdone, Republicans in their much-hyped "Pledge to America" continued to falsely claim Democrats back an across-the-board tax increase.

As TPM reported this morning, "A senior Senate Democratic aide told TPM today there won't be a vote on extending the Bush tax cuts in the upper chamber before the November election, a blow to party leaders and President Obama who believed this would have been a winning issue." Hours later, House Democrats, too, sadly turned tail and ran:

The Senate's decision not to address the Bush tax cuts until after the election is the strongest indication yet that the game is over...With House Democratic leaders still insisting that they will follow the Senate's lead, it seems more and more likely that they too will drop the tax cut issue until after the election.

Pelosi's effort to wrangle her caucus into voting on middle-income tax cuts before the election appears not have dislodged conservative and politically vulnerable Democrats who either wanted to extend all the Bush tax cuts, including for high-income earners, or to avoid any kind of risky vote s close to the elections.

But if Democrats were afraid to fight for the truth, Republicans as ever refused to tell it.

For months, GOP leaders have been perpetuating the twin lies that with the 2001 and 2003 Bush tax cuts set to expire at the end of the year, Democrats plan "an across the board" tax increase totaling "$3.8 trillion in the next 10 years." But just because Michigan Rep. Dave Camp sent out an email blast warning of the "Democrats' ticking tax time bomb" claiming "Americans to pay higher taxes starting January 1, 2011" and Mike Pence (R-IN) claimed "Should Democrats get their way, every income tax bracket will increase on Jan. 1, 2011" doesn't make it true. It's no wonder the fact-checking web site Politifact in July deemed the charges "False":

"For many months, Democratic officials have consistently said that they intend to let only the tax cuts for the wealthiest individuals lapse. The cutoff they usually suggest is $200,000 for individuals and $250,000 for married couples filing jointly. President Obama campaigned on just such a plan."

Nevertheless, Congressional Republicans continue to lie about President Obama's proposal to extend middle class tax cuts. And in their Pledge to America, they put their fraud in writing:

These looming tax hikes will hurt every family in America...Unless action is taken, a $3.8 trillion tax hike will go into effect on January 1, 2011 that will unravel these policies. A family of four with a household income of $50,000 a year will have to pay $2,900 more in taxes in 2011, according to a new analysis by Deloitte Tax LLP, a tax consulting firm. The same family making $100,000 a year will see its taxes rise by $4,500.

Sadly for the Republicans and the truth, President Obama plans to continue tax relief for 98% of taxpayers. And for them, Democratic proposals deliver greater savings for individuals and families alike.

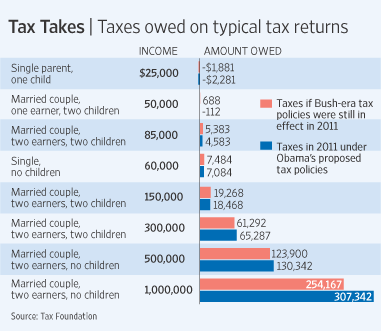

In August, the nonpartisan Joint Committee on Taxation examined the impact of the Democratic proposal to let the Bush tax cuts of 2001 and 2003 lapse for just the top bracket households making over $250,000 year. "Taxpayers with income of more than $1 million for 2011 would still receive on average a tax cut of about $6,300 compared with what they would have paid under rates in effect until 2001", the New York Times reported, adding, "that compares, however, with the roughly $100,000 average tax cut that households with more than $1 million in income would receive under current rates." In words and pictures, The Washington Post explained the payday for the rich if the GOP gets its way:

New data from the nonpartisan Joint Committee on Taxation show that households earning more than $1 million a year would reap nearly $31 billion in tax breaks under the GOP plan in 2011, for an average tax cut per household of about $100,000.

The price tag for Americans' largesse for the wealthiest who need it least? $36 billion in 2011 alone, and $700 billion over the next decade.

In July, the reliably Republican Wall Street Journal offered its own pretty picture of the contending Democratic and Republican tax proposals. Despite GOP mythmaking about a "$3.8 trillion tax increase" and the "ticking tax bomb," President Obama and his Democratic allies are offering middle class Americans greater tax relief at virtually income level:

Of course, the deceptions in today's Republican Pledge hardly end there. President Obama, the GOP blueprint claims, "also wants to raise taxes on roughly half of small business income in America." Just days after Bloomberg, New York Times, the Washington Post, TPM and CBPP joined the long list of those debunking the Republican duplicity, Keith Olbermann in a special report Wednesday destroyed it completely. It turns out that multi-billion dollar firms, including Bechtel, Coors, PriceWaterhouseCoopers and many more, fall into the Republican definition of "small business."

And in this economic and political environment, those are just the kind of enemies President Obama and his allies need during this fight over tax cuts for the rich. But once again, Democrats Thursday showed they have no backbones. As for the Republicans, they have no scruples.