The Stupidest Debt Chart of 2013

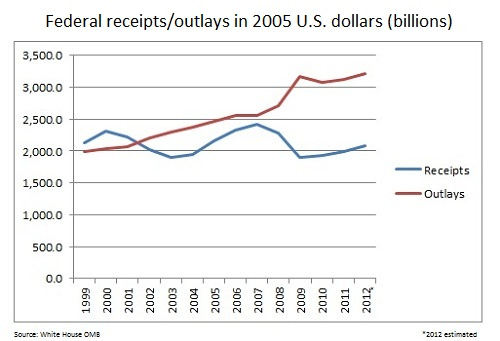

While Congressional Republicans are threatening to trigger a U.S. default if their debt ceiling blackmail is not paid, their allies in the conservative blogosphere are deploying the same chart to attack President Obama's supposedly out-of-control spending. But their horrifying picture of the yawning gap between in federal receipts and outlays between 1999 and 2012 isn't just predictably incomplete. By conveniently ignoring both the years before the budget-busting Bush tax cuts and the rapidly shrinking deficits to come, the duplicitous debt argument of the GOP's right-wing water carriers is, to be kind, completely useless.

Writing in USA Today, Glenn "Instapundit" Reynolds pointed to the chart above to claim that "Obama owns the debt now." Originally featured in the libertarian Reason to make the case for the Bush tax cuts, the graph of federal revenue and spending (in constant 2005 dollars) provided ammunition for this shot across the bow of the White House:

Well, things did start to go south under Bush. But look at that graph more closely. In 2003, when we invaded Iraq (one of those "two wars on the credit card" that Obama likes to blame for the debt), and when we passed the Bush tax cuts (the other thing Obama likes to blame for the debt) revenue actually started to climb. The revenue and spending lines start to converge, and, as they head up to 2006 it actually looks as if the two might cross, with revenue outpacing spending...

Well, things did start to go south under Bush. But look at that graph more closely. In 2003, when we invaded Iraq (one of those "two wars on the credit card" that Obama likes to blame for the debt), and when we passed the Bush tax cuts (the other thing Obama likes to blame for the debt) revenue actually started to climb. The revenue and spending lines start to converge, and, as they head up to 2006 it actually looks as if the two might cross, with revenue outpacing spending.

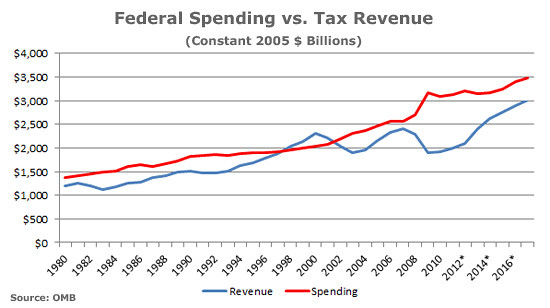

Reynolds' claims are fatally flawed. But to truly appreciate his disingenuousness, it helps to expand the timeline. By going back, say, to 1980, the revenue-draining impact of the Bush tax cuts of 2001 and 2003 becomes much more evident. And looking to ahead to forecasts for the next several years, federal receipts finally start to recover from the calamitous recession that began in late 2007 and as the upper-income tax breaks end.

Reynolds' excited assertion that "when we passed the Bush tax cuts...revenue actually started to climb" is his own variant of the perpetual Republican myth that "tax cuts pay for themselves." In fact, he gives the game away when he says, "Spending keeps going up. Revenues, however, are not." It's not just that individual income tax revenue did not return to its pre-Bush tax cut level until 2006. Measured in constant 2005 dollars, total federal revenue in 2011 ($1.999 trillion) is less than it was I 1998 ($2.040). It's abundantly clear that revenue was much lower than it otherwise would have been in the absence of the Bush tax cuts.

The extent of the right-wing fraud becomes even clearer by looking at federal revenue and spending as a percentage of the total American economy. And over the next decade, the federal deficit will shrink as spending returns to its Reagan-era level of around 22 percent and revenues reach the 19 percent level. (It should be noted, as Ezra Klein does, that the last five times Uncle Sam had a balanced budget, tax revenue were around 20 percent.)

As it turns out, the American tax burden hasn't been this low in generations. Thanks to the combination of the Bush Recession and the latest Obama tax cuts, the AP reported, "as a share of the nation's economy, Uncle Sam's take this year will be the lowest since 1950, when the Korean War was just getting under way." In January, the Congressional Budget Office (CBO) explained that "revenues would be just under 15 percent of GDP; levels that low have not been seen since 1950." That finding echoed an earlier analysis from the Bureau of Economic Analysis. The Center on Budget and Policy Priorities concluded, "Middle-income Americans are now paying federal taxes at or near historically low levels, according to the latest available data." As Michael Ettlinger, head of economic policy at the liberal Center for American Progress put it:

"The idea that taxes are high right now is pretty much nuts."

Or as one-time Reagan Treasury official Bruce Bartlett explained it in the New York Times two years ago:

In short, by the broadest measure of the tax rate, the current level is unusually low and has been for some time. Revenues were 14.9 percent of G.D.P. in both 2009 and 2010. Yet if one listens to Republicans, one would think that taxes have never been higher, that an excessive tax burden is the most important constraint holding back economic growth and that a big tax cut is exactly what the economy needs to get growing again.

It's no wonder Reuters global editor Chrystia Freeland concluded, "Like an Anorexic, U.S. Sees Itself Fat with Taxes."

Now, it is true that measured in both dollars and as a percentage of GDP, U.S. spending has fattened up as recession-battered tax receipts plummeted since 2008. But the surge in federal outlays that began with President Bush's $700 billion TARP program in the fall of 2008 and including the 2009 stimulus program is both temporary and countercyclical.

As the nation's economy recovers, spending on assistance programs like food stamps and unemployment insurance will begin to decline. So while Reynolds frets that "the debt is up about 60% since Obama took office, this can't go on forever," it won't. As Paul Krugman explained in December:

Right now, given reasonable estimates of likely future growth and inflation, we would have a stable or declining ratio of debt to G.D.P. even if we had a $400 billion deficit. You can argue that we should do better; but if the question is whether current deficits are sustainable, you should take $400 billion off the table right away.

That still leaves $600 billion or so. What's that about? It's the depressed economy -- full stop.

As for the causes of the "ballooning debt" Instapundit decried, these charts from the Center on Budget and Policy Priorities and the Washington Post suggest a different culprit than the current occupant of the White House.

Ronald Reagan tripled the national debt, while President Bush almost doubled it again. But as CBPP found in 2010, the Bush tax cuts accounted for half of the deficits during his tenure, and if made permanent, over the next decade would cost the U.S. Treasury more than Iraq, Afghanistan, the recession, TARP and the stimulus--combined. (It is worth noting that the expiration of all the Bush tax cuts would have eliminated most of the deficits over the next decade. Instead, the CBO estimates, the fiscal cliff deal just concluded will add about $4 trillion.) As Ezra Klein explained:

What's also important, but not evident, on this chart is that Obama's major expenses were temporary -- the stimulus is over now -- while Bush's were, effectively, recurring. The Bush tax cuts didn't just lower revenue for 10 years. It's clear now that they lowered it indefinitely, which means this chart is understating their true cost. Similarly, the Medicare drug benefit is costing money on perpetuity, not just for two or three years. And Boehner, Ryan and others voted for these laws and, in some cases, helped to craft and pass them.

Or, as Glenn Harlan Reynolds says, "Obama owns the debt now."