Trailing Again, Romney Changes Tax Plan Again

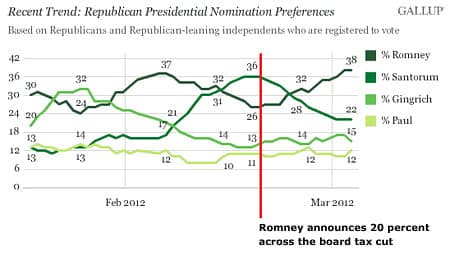

Back in February, Mitt Romney's campaign to win the Republican nomination was in crisis. As the crucial Michigan and Super Tuesday primaries approached, polls showed that Pennsylvania Senator Rick Santorum surged to the front of the GOP pack. Meanwhile, the Wall Street Journal and other voices on the right were blasting Romney for a tax plan deemed too timid. So on February 22, Governor Romney unveiled his 20 percent across the board tax cut scheme, one which along with an avalanche of negative advertising put an end to the threat from Santorum.

Now on the eve of the first presidential debate Tuesday in Denver, history is repeating. Romney is trailing President Obama in the polls both nationally and in most of the key battleground states. Making matters worse, analysts across the political spectrum have been savaging his detail-free tax plan, one certain to hit middle class Americans and provide a massive windfall for the wealthy, all while adding trillions more to the national debt. So on Monday, Mitt Romney announced a clever dodge to the question of which loopholes he would close by proposing a $17,000 cap on personal deductions.

One day after his running mate Paul Ryan protested that "It would take me too long to go through all the math," Romney added a new wrinkle. As ABC reported Monday:

When confronted and asked for specifics - which loopholes, in particular - both Romney and Ryan have demurred, telling interviewers that they'd negotiate those details with Congress after the election.

Romney hinted Monday night, with a bit more detail, at how he'd manage the tax code.

"As an option you could say everybody's going to get up to a $17,000 deduction; and you could use your charitable deduction, your home mortgage deduction, or others - your healthcare deduction. And you can fill that bucket, if you will, that $17,000 bucket that way," he said during a visit with Denver's FOX31. "And higher income people might have a lower number."

Of course, Romney had put himself in a general election box by making a series of promises which were literally impossible to keep. He pledged to boost defense spending by $2 trillion and cut taxes by $5 trillion over the next decade, all while keeping the tax system revenue neutral. At the same time, would-be President Romney insists his plan to lower rates while "broadening the base" is "revenue neutral" while "we make sure that the top 1 percent keeps paying the current share they're paying or more." Yet, neither Romney nor Ryan would publicly name a single loophole they'd close in order to simultaneously achieve those contradictory objectives.

If that sounds impossible, that's because it is. As the Tax Policy Center and most other analysts concluded, the numbers simply did not add up. TPC forecast that President Romney would effectively cut taxes only for the richest five percent of earners while increasing the tax bill for the other 95 percent of Americans. As Klein summed it up in August:

"The size of the tax cut he's proposing for the rich is larger than all of the tax expenditures that go to the rich put together. As such, it is mathematically impossible for him to keep his promise to make sure the top one percent keeps paying the same or more."

Lagging President Obama in the polls and getting pilloried even by the conservative press, by the end of September Romney was desperate to change the conversation. As the Wall Street Journal fretted:

"Mr. Romney's pre-existing political calculation seems to be that he can win the election without having to explain the economic moment or even his own policies. As this flap shows, such vagueness carries its own political risks."

Enter the "Cap."

With this still-vague formula, Romney is trying to kill two birds with one stone. A set dollar cap on the total value of individual deductions lets the Republican continue to sidestep the thorny question of which of the $1 trillion in annual deductions, loopholes and credits he would curtail. Just as important, Mitt could counter the accurate charge that his current proposals represent a multi-trillion payday for the rich. As Ezra Klein noted Tuesday, Romney's cap would in theory hit upper-income taxpayers hardest by limiting their sizable deductions for charitable giving and state and local tax payments. And to be sure, there's still a lot we don't know, including which deductions or exclusions are included, details that impact which Americans will get hit hardest and how much revenue Romney could raise.

Regardless, we've seen Romney's M.O. before. As first Newt Gingrich and then Rick Santorum surged past him during the GOP primaries, then as now the Wall Street Journal spoke and Mitt listened.

Mr. Romney's campaign is sometimes timid, in particular on pro-growth tax reform... Amid such generalities, it's hard not to conclude that the candidate is trying to avoid offering any details that might become a political target. And he all but admits as much. "I happen to also recognize," he says, "that if you go out with a tax proposal which conforms to your philosophy but it hasn't been thoroughly analyzed, vetted, put through models and calculated in detail, that you're gonna get hit by the demagogues in the general election."

But what Mitt Romney calls "demagogues" most Americans call voters. Now as in February, he's struggling with them. So after trying to buy them off with a 20 percent tax cut during the Republican primaries, he's claiming he will cap the windfall for the wealthy he proposed just eight months ago.