Treasury Wins Big on GM Bailout

Much to the delight of President Obama's conservative naysayers, Politico this morning reported that "the Treasury Department on Wednesday announced plans to sell, almost certainly at a loss, the government's remaining shares of Detroit-based automaker General Motors." Predictably, the right-wing Washington Free Beacon darkly warned "Treasury prepares to lose big on GM bailout" while gloating that the "government will take loss in the billions."

Unfortunately, that dismal and incomplete picture of Uncle Sam's real bottom line couldn't be further from the truth. As it turns out, the rescue of the American auto industry has already added tens of billions of dollars to the coffers of the United States Treasury and will continue to do for years to come.

Of course, you'd never know that from Politico. Sadly, the ESPN of politics did not report the final score:

Treasury plans to sell its 500.1 million shares in the carmaker over the next 12 to 15 months, with GM buying 200 million at $27.50 per share by the end of the year. This sale will bring in $5.5 billion toward the $27 billion that the company still owes.

In an October report, the special inspector general for TARP estimated Treasury would need to sell the remaining 500 million shares at $53.98 per share to break even on its investment.

In reality, Uncle Sam has already more than made back all of his $82 billion bailout of GM and Chrysler. Last year, USA Today explained why the Treasury won big, even with billions in anticipated taxpayer losses on the federal government's sale of the companies' stock:

That loss is nothing to sneeze at. It's a heck of a lot better, though, than the $108 billion to $156 billion the government would have lost over three years if it hadn't intervened, according to the Center for Automotive Research, a Detroit-based think tank. Those losses would have come in the form of lower tax receipts and higher spending for pension guarantees, jobless pay and other benefits.

In September, CNN Money also did the math:

Reduced personal taxes collected and increased safety net payments such as unemployment benefits and food stamps, would have cost the federal government up to about $50 billion to $60 billion in the first year alone, and another $34 billion to $54 billion in the second year.

Republican mythology to the contrary, the U.S. auto industry would almost certainly have collapsed but for the interventions of the Bush and Obama administrations in late 2008 and early 2009. (As the American auto industry teetered on edge of the abyss in December 2008, Vice President Dick Cheney beseeched his GOP allies in Congress to back an aid package, warning, "If we don't do this, we will be known as the party of Herbert Hoover forever.") The loans to GM and Chrysler in 2008 and Obama's massive rescue package (including the ownership stakes) simply could not have been replaced by private equity investors. As USA Today asked in astonishment, "On what planet would the automakers have found private lenders willing to provide tens of billions of dollars in needed bankruptcy financing at the height of a financial panic?" As Obama's auto czar Steven Rattner explained in "Delusions about the Detroit Bailout":

"Without government financing -- initiated by President George W. Bush in December 2008 -- the two companies would not have been able to pursue Chapter 11 reorganization. Instead they would have been forced to cease production, close their doors and lay off virtually all workers once their coffers ran dry."

Just after the disastrous 2010 elections, Timothy Egan explained "How Obama Saved Capitalism and Lost the Midterms":

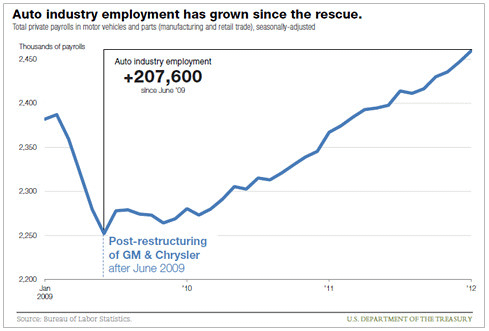

Saving the American auto industry, which has been a huge drag on Obama's political capital, is a monumental achievement that few appreciate, unless you live in Michigan. After getting their taxpayer lifeline from Obama, both General Motors and Chrysler are now making money by making cars. New plants are even scheduled to open. More than 1 million jobs would have disappeared had the domestic auto sector been liquidated.

It's no wonder The Economist, which opposed the $82 billion auto bailout, admitted "an apology is due to Barack Obama: his takeover of GM could have gone horribly wrong, but it has not." And last month, voters in Michigan, Ohio and across the nation reached the same conclusion. Even with likely losses from the government's sale of GM and Chrysler shares, the rescue of Detroit was a very sweet deal for the Treasury--and people--of the United States.