Triple Whammies, Double Dips and Job One

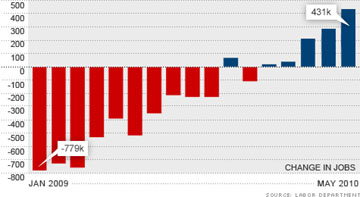

If creating new jobs is Job One for the Obama administration, then the past 24 hours have been a mixed blessing. Thursday brought good news of a continued if slow decline in first-time jobless claims, while a drop in the productivity rate suggested businesses are poised to expand hiring. But today's word that the 431,000 new jobs added in May included only 41,000 in the private sector has renewed fears of a double-dip recession. And a triple whammy of crisis in Europe, fragility in the housing market and inaction in Congress has a lot to do with it.

As David Leonhardt wrote in the New York Times, today's otherwise good report has "two dark linings." First, while May beat April's new jobs number of 290,000, temporary hiring for the 2010 Census accounted for most of it. The private sector, which produced 218,000 new jobs in April and 158,000 in March, added far fewer in May. The second caveat, Leonhardt noted, "is that even if private-sector job growth picks up again next month, the economy is a very long way from being healthy."

"You never want to read too much into a single month of data. This may just be just a blip. But it also could be something more -- a slowdown in hiring because businesses are worried about the state of the economy."

For his part, former Clinton Labor Secretary Robert Reich agreed, but offered a more dire assessment. Looking at the slow drop in unemployment, uneven work force participation, anemic private sector job creation, sluggish retail sales and continued trauma in the housing market, Reich warned, "We're falling into a double-dip recession."

And behind that risk of a double-dip is a triple whammy.

The meltdown of Greece and the crisis of the Eurozone was strike one. Just as the U.S. economy seemed poised to roar back to life, the uncertainly in the EU and the prospect of fiscal austerity across Europe threatened the fragile global economic recovery. Over the past two months, the Dow dropped well over 10% of its value, in large part due to the European financial fall-out.

Strike two comes from the still-troubled American housing market. As Reich put it:

"Why are we having such a hard time getting free of the Great Recession? Because consumers, who constitute 70 percent of the economy, don't have the dough. They can't any longer treat their homes as ATMs, as they did before the Great Recession."

As the Washington Post reported in May, "The number of U.S. homeowners who are behind on their mortgages rose to a record level in the first quarter." (The one bright spot: while about 10 percent of borrowers were delinquent on their mortgages during the first three months of this year, the percentage who missed a payment dropped from 3.3% to 3.1% last year). And potentially making matters much worse, as the New York Times, the Wall Street Journal and CBS among others documented, in the worrying rise in strategic defaults. Hundreds of thousands of "underwater" homeowners whose mortages now exceed the value of their houses are simply choosing to walk away. As 60 Minutes described the trend last month:

Despite some indications that the economy is recovering, the housing market remains a disaster area. Currently, about seven million homeowners are behind on their mortgages and that number is only getting worse...In the past year it is estimated that at least a million Americans who can afford to stay in their homes simply walked away.

The third and final blow to the economic recovery is the winding down of the successful if too small Obama stimulus program. Two weeks ago, the Congressional Budget Office (CBO) confirmed the overwhelming consensus of economic analysts in finding that as many as "3.7 million American jobs could be attributed to the Recovery Act by the end of the September" and that GDP was up to 4.1% higher than it would have otherwise been.

But thanks to joint effort of Republican obstructionists and timid Democrats branded the "deficit crazies" by Reich and "the pain caucus" by Paul Krugman, progress on a new jobs bill in Congress is now stalled. Even in its scaled back form, Leonhardt concluded, the jobs bill would do some real good:

Among other things, it would cut taxes for businesses, expand summer jobs programs and temporarily extend jobless benefits for some of today's 15 million unemployed workers.

Sadly, as Reich bemoaned today, "But the deficit crazies in the Senate, who can't seem to differentiate between short-term stimulus (necessary) and long-term debt (bad) last week shot it down." And that, Krugman warned on Sunday, could smother the nascent recovery:

What's the greatest threat to our still-fragile economic recovery? Dangers abound, of course. But what I currently find most ominous is the spread of a destructive idea: the view that now, less than a year into a weak recovery from the worst slump since World War II, is the time for policy makers to stop helping the jobless and start inflicting pain.

And from the beginning, Paul Krugman has been prescient about the political path the recovery from the Bush recession would take. On January 5th, 2009, Krugman warned then President-elect Obama about the stimulus plan, "Look, Republicans are not going to come on board. Make 40% of the package tax cuts, they'll demand 100%." The next day on January 6th, Krugman warned that the $787 billion recovery package was not only too small, but would pose dire political consequences for President Obama:

I see the following scenario: a weak stimulus plan, perhaps even weaker than what we're talking about now, is crafted to win those extra GOP votes. The plan limits the rise in unemployment, but things are still pretty bad, with the rate peaking at something like 9 percent and coming down only slowly. And then Mitch McConnell says "See, government spending doesn't work."

In October, Krugman updated his grim assessment. "I went back to my first blog post -- January 6, 2009 -- worrying that the Obama economic plan was too cautious...Alas, I didn't have it wrong -- except that unemployment will, if we're lucky, peak around 10 percent, not 9." A second stimulus would almost surely be required, an economic necessity that politically would be almost impossible to produce.

As the CBO and others have pointed out, the undersized American Recovery and Reinvestment Act worked as designed. ("Imagine," the Times' Leonhardt asked in February, "if one year ago, Congress had passed a stimulus bill that really worked...what would the economy look like today? Well, it would look almost exactly as it does now.") But since then, the continued struggles of the U.S. housing market, the teetering of the Eurozone and political intransigence in the face of President Obama's own caution has made the nascent recovery a tenuous one.

On Friday, the Dow reacted to the disappointing employment picture by dropping 324 points. But one group at least was no doubt cheering, as Paul Krugman suggested they would 15 months ago:

"Conservatives really, really don't want to see a second New Deal, and they certainly don't want to see government activism vindicated."