Two Headlines Say It All About GOP Field's Economic Plans

Everything you need to know about the economic plans of the Republican White House hopefuls is conveniently contained in two headlines. In October, the McClatchy Newspapers revealed, "GOP presidential candidates' tax plans would benefit the rich." Last week, the Washington Post bookended that analysis with another finding, "Debt will swell under top GOP hopefuls' tax plans." Of course, those two conclusions are just flip sides of the same coin. At a time of record income inequality and the lowest federal tax bite since the 1950's, Mitt Romney, Rick Santorum and Newt Gingrich would deliver massive tax cuts to the wealthiest Americans. And because even their draconian spending cuts fall well short of paying for their gilded-class tax cut windfall, all would unleash torrents of red ink as far as the eye can see.

While the economic plans of the Republican presidential contenders differ in kind, the budget disasters they would produce differ only in degree. Each wants to abolish the estate tax that impacts only a quarter of one percent of the richest fortunes in America, a move draining billions from the U.S. Treasury annually. Newt Gingrich wants to eliminate and Rick Santorum wants to slash the capital gains tax. (Aware that ending the capital gains tax would reduce his annual payment to Uncle Sam to almost zero, Mitt Romney wants to preserve the 15 percent capital gains tax on family incomes above $250,000.) All would drastically reduce incomes taxes, either through Gingrich's flat tax, Santorum's two tax brackets, or Romney's recently announced across-the-board 20 percent tax cut.

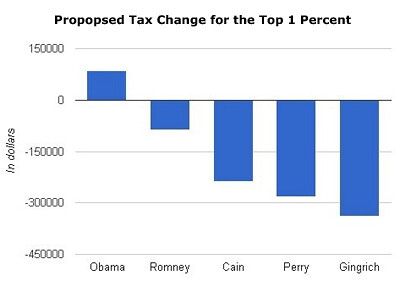

As the chart below shows, in the Republicans' winner-take-all tax cut sweepstakes, those who need it least win the most. (Note that Romney comparatively small average windfall of $82,000 for the top one percent was before he unveiled his new 20 percent tax cut last week.)

As it turns out, the GOP's leisure class lottery winners will get their payouts courtesy of the United States Treasury, which would pile up mountains of new debt over the decade. That's the conclusion of an analysis by the Committee for a Responsible Federal Budget (CFRB), which used the candidates' own numbers to diagnose the hemorrhaging:

According to the report released Thursday by U.S. Budget Watch, a project of the bipartisan Committee for a Responsible Federal Budget, former Pennsylvania senator Rick Santorum and former House speaker Newt Gingrich would do the most damage to the nation's finances, offering tax and spending policies likely to require trillions of dollars in fresh borrowing.

Both men have proposed to sharply cut taxes but have not identified spending cuts sufficient to make up for the lost cash, the report said. By 2021, the debt would rise by about $4.5 trillion under Santorum's policies and by about $7 trillion under Gingrich's plan, pushing the portion of the debt held by outside investors to well over 100 percent of the overall economy, the study said.

It's easy to see why.

Newt Gingrich's scheme for an even larger, budget-busting payout for the gilded class starts with his own flat-tax proposal. Like Rick Perry, taxpayers could choose to pay an optional flat tax rate (15 percent in Newt's case, 20 percent in Perry's proposal). The corporate tax rate would be slashed from 35 percent to 12.5 percent. Like, Perry, Gingrich would eliminate the capital gains tax altogether.

But as Suzy Khimm documented in the Washington Post, Gingrich's plan would produce an ever larger deluge of greenbacks for the upper class than Rick Perry while ensuring the Treasury faces even more red ink:

Gingrich preserves deductions for corporations and rich individuals that Perry eliminates: He preserve deductions for charitable giving and mortgage interest to all Americans, whereas Perry only keeps them for families earning less than $500,000. Perry vows to eliminate all corporate tax deductions, while Gingrich would preserve them. As such, corporations and the richest Americans could stand to benefit even more under Gingrich's plan than Perry's.

Under Perry's plan, those with more than a million in income would save $500,000 in taxes by 2015, due to a 60 percent drop in their tax rate, and those benefits would be even bigger under Gingrich. According to the Tax Policy Center, Perry's plan would lower total projected government revenue by 27 percent--a $1 trillion loss in 2015 alone. Gingrich's plan, accordingly, would result in even bigger revenue loss.

Roberton Williams of the Tax Policy Center concurred with that assessment, concluding, "You would have about three-quarters of the revenue you would have under Perry, so you have a much bigger revenue hole."

Bigger than Rick Santorum proposes, but not by much. As the Quad City Times explained, under Santorum's proposal, "individual tax rates would be either 10 percent or 28 percent." Even more important for denizens of the gilded-class like Mitt Romney, Santorum would trim the rates on capital gains and dividends to 12 percent. With that windfall for the wealthy, it's no wonder, as Forbes concluded, "Rick Santorum's tax plan would blow a huge hole in the budget."

Unfortunately for the CFRB, its analysis was invalidated the day it came out thanks to Mitt Romney's new tax plan. As the Washington Post explained, "until the campaign offers a more specific plan, Budget Watch analysts said Romney's entire framework would add about $2.6 trillion to the debt by 2021." That is likely a conservative estimate. As ThinkProgress and the Washington Post's Lori Montgomery and Ezra Klein documented, Mitt Romney's risky new scheme makes George W. Bush look like Karl Marx:

According to Center for American Progress Tax and Budget Policy Director Michael Linden, Romney's tax plan contains budget-busting tax breaks for the richest Americans in the form of a permanent 20 percent across-the-board cut to marginal rates and a repeal of the Alternative Minimum Tax, which prohibits the wealthy from artificially lowering their tax rates. "The enormity of these tax cuts is mind-boggling," Linden said. "Even more unbelievable is how skewed they are to those the very top of the income ladder."

Romney's claim that his plan would promote job and economic growth while reducing the deficit is also likely false. The Bush tax cuts were promoted under the same guise, only to blow a $2.5-trillion hole in the federal budget that was accompanied by worst performance of any post-war expansion" for growth in investment, GDP, and job creation. Romney's tax cuts are even more expensive, clocking in at a cost of more than $10.7 trillion over the next decade and reducing revenue to a paltry 15 percent of GDP, according to Linden. Balancing the budget on those terms, as Romney claims he will do, would be next to impossible.

And as Klein made clear in his 150 word description of the Romney plan, there's only one place Mitt can look for the money:

Mitt Romney is promising that taxes will go down, defense spending will go up, and old-people programs won't change for this generation of retirees. So three of his four options for deficit reduction -- taxes, old-people programs, and defense -- are now either contributing to the deficit or are off-limits for the next decade.

Romney is also promising that he will pay for his tax cuts, pay for his defense spending, and reduce total federal spending by more than $6 trillion over the next 10 years. But the only big pot of money left to him is poor-people programs. So, by simple process of elimination, poor-people programs will have to be cut dramatically. There's no other way to make those numbers work.

(For the purposes of brevity and sanity, Ron Paul's plan is excluded. Trimming $1 trillion from the federal budget in year one would not merely be impossible, bit catastrophic.)

Which is why The Atlantic's Derek Thompson, who created the chart of debt as a percentage of GDP above, concluded that "every GOP debt plan leaves us with more debt." Of course, you already knew that without reading this tome. Because, as they two McClatchy and Washington Post headlines summed up, for Republicans there are only two certainties in life: debt and tax cuts.