The Wealthy are the Biggest Mortgage Defaulters

While Republicans continue to block jobless benefits for those they deem undeserving, a different morality play is at work in the nation's foreclosure crisis. As the New York Times reported this morning, the biggest defaulters on mortgages are the rich. Even as U.S. income inequality hit levels not seen since 1929, wealthier Americans, whose recovery from the recession is already well underway, are walking away from their homes at far greater rates than everyone else.

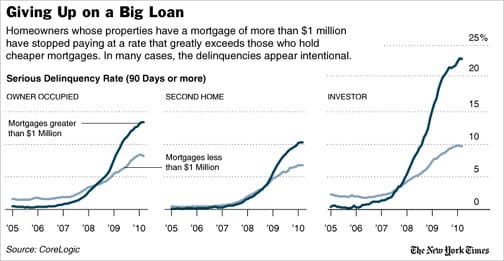

Last month, the Los Angeles Times announced in "Millionaires Make a Comeback" that wealthy Americans in 2009 recouped most of their losses the previous year. (As Timothy Smeeding of the University of Wisconsin put it, while everyone has taken a hit in the recession, "the wealthy alone have bounced back.") Now, the New York Times suggests, "many of the well-to-do are purposely dumping their financially draining properties, just as they would any sour investment." While that conclusion is "hard to prove," the numbers tell the tale of the wealthy casually turning to strategic default. According to data compiled from CoreLogic:

Whether it is their residence, a second home or a house bought as an investment, the rich have stopped paying the mortgage at a rate that greatly exceeds the rest of the population.

More than one in seven homeowners with loans in excess of a million dollars are seriously delinquent...By contrast, homeowners with less lavish housing are much more likely to keep writing checks to their lender. About one in 12 mortgages below the million-dollar mark is delinquent.

While lenders and many analysts predictably warn that walking away could trash communities by undermining home values, "The CoreLogic data suggest that the rich do not seem to have concerns about the civic good uppermost in their mind, especially when it comes to investment and second homes." Their ample assets make them largely immune to the consequences of choosing "jingle mail," such as lawsuits from lenders and being frozen out of future credit:

The delinquency rate on investment homes where the original mortgage was more than $1 million is now 23 percent. For cheaper investment homes, it is about 10 percent.

"Those with high net worth have other resources to lean on if they get in trouble," said Mr. [Sam] Khater, the [CoreLogic] analyst. "If they're going delinquent faster than anyone else, that tells me they are doing so willingly."

To be sure, the foreclosure crisis in the housing market, one little impacted by the Obama administration's efforts to date, is a major brake on the acceleration of the economic recovery. As Robert Reich put it in June:

"Why are we having such a hard time getting free of the Great Recession? Because consumers, who constitute 70 percent of the economy, don't have the dough. They can't any longer treat their homes as ATMs, as they did before the Great Recession."

As the Washington Post reported in May, "The number of U.S. homeowners who are behind on their mortgages rose to a record level in the first quarter." (The one bright spot: while about 10 percent of borrowers were delinquent on their mortgages during the first three months of this year, the percentage who missed a payment dropped from 3.3% to 3.1% last year). And potentially making matters much worse, as the New York Times, the Wall Street Journal and CBS among others documented, in the worrying rise in strategic defaults. Hundreds of thousands of "underwater" homeowners whose mortgages now exceed the value of their houses are simply choosing to walk away. As 60 Minutes described the trend two months ago:

Despite some indications that the economy is recovering, the housing market remains a disaster area. Currently, about seven million homeowners are behind on their mortgages and that number is only getting worse...In the past year it is estimated that at least a million Americans who can afford to stay in their homes simply walked away.

And apparently, it is the richest of all who are leading that march. As CoreLogic's senior economist Sam Khater summed it up:

"The rich are different: they are more ruthless."

And in Washington, they have friends in the Republican Party. While recent surveys revealed that over half of Americans have been impacted by the recession and almost thirty percent of the jobless have been unemployed for over NNN weeks, Republicans like John Linder (R-GA) deemed extended unemployment benefits "too much of an allure." Meanwhile, the GOP and its Tea Party shock troops continues to push for making permanent the Bush tax cuts for the wealthiest Americans who need them least. More obscene still, Republican obstruction has produced a temporary suspension of the estate tax, creating a potential one-year windfall for the heirs of billionaires.

And what will the gilded class to do with all the extra cash the GOP is showering upon them? Apparently, it's a great time to buy a second house.