Employers Accelerate Shift of Health Care Costs to Workers

A new study by the Kaiser Family Foundation forecast that family health insurance premiums will rise by only 3% in 2010. Sadly, the good news from the Employer Health Benefits 2010 Annual Survey ends there. Coming on the heels of several reports showing financially-strapped Americans dramatically cutting back on needed medical treatment, the Kaiser survey found that workers' share of the cost of a family policy jumped by a staggering 14 percent, an increase of about $500 a year.

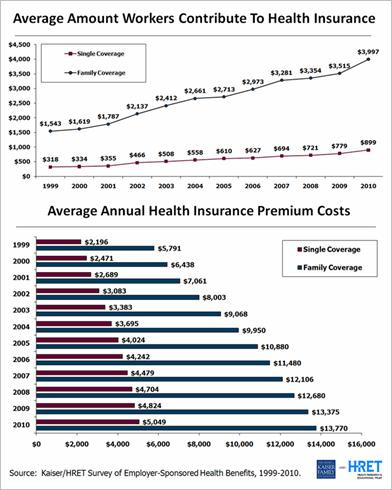

As the New York Times reported, of the total $13,770 average tab, "workers are now paying nearly $4,000 for family coverage, according to the survey, and their costs have increased much faster than those of employers." How much faster?

Since 2005, while wages have increased just 18 percent, workers' contributions to premiums have jumped 47 percent, almost twice as fast as the rise in the policy's overall cost.

With companies instituting higher deductibles or even capping their share to a fixed dollar contribution, a grave situation for employees is growing grimmer still. As Kaiser noted, "in past years, employers typically have shared the increase in health costs with worker," but this year, "employers' contribution to the premium remained flat on average." The result is a record-setting burden for American workers:

The share of the premium paid by workers jumped 3 percentage points to 30 percent. In the dozen years the survey has been conducted, the employee share of family coverage has never topped 28 percent and has never risen more than 2 percentage points in a single year.

As Drew E. Altman, the chief executive of the Kaiser foundation put it, "The long-term trend is pretty clear. Insurance is getting stingier and less comprehensive."

The KFF analysis is just one of many in recent months which document employers' stepped-up efforts to shed health care costs even as the private insurance market punishes individual policy seekers. In March, a Goldman Sachs analysis documented insurance rates for individuals jumping by up to 50% in some markets. That same month, a survey of large employers found that 56% will hold workers responsible for a greater share of health care costs next year. Coming on the heels of studies showing companies dropping workplace coverage altogether, the data reveal a system of employer-provided health insurance teetering on the brink of collapse.

As the Washington Post reported this spring, a study by the National Business Group on Health of 507 companies with over 1,000 employees found that:

Many say they may charge more to cover spouses, tighten eligibility standards for their health plans and dispense financial rewards or penalties based on the results of certain lab tests. At some companies, overweight employees could be excluded from the most desirable plans.

Meanwhile, employees at many companies can expect significantly higher premiums, deductibles and co-payments.

That cost-shifting will take a number of forms. Twenty-eight percent of employers plan to use spousal surcharges next year, up from 21 percent this year. Meanwhile, 12 percent of employers plan to offer only high-deductible coverage next year. And the percentage of firms considering employee biometric screening and health care appraisals to incentives for hitting weight, blood pressure and cholesterol targets is growing rapidly.

The NBGH survey is just the latest symptom of the rapidly deteriorating system of employer-provided health insurance coverage. A 2007 report from the Economic Policy Institute showed a dramatic decline in employer-provided health care. That drop-off from 64.2% of Americans covered through workplace insurance in 2000 to just 59.7% in 2006 alone added 2.3 million more people to those without coverage. Census data since showed workplace coverage dipped further in 2007, down to an alarming 59.3%. A Thomson Reuters survey last year put the figure for 2009 at a stunning 54.6%. (Data from the U.S. Census revealed that it was only the expansion of government programs including SCHIP and Medicaid which offset the erosion of employer coverage in 2008.)

And as it turns out, the crisis of the employer-based system is worse than Kaiser predicted even a year ago. Thanks in part to the depth of the Bush recession, employer cost-shifting was more pronounced than anticipated just 12 months ago. As the Washington Post wrote at the time;

Forty percent of employers surveyed said they are likely to increase the amount their workers pay out of pocket for doctor visits. Almost as many said they are likely to raise annual deductibles and the amount workers pay for prescription drugs.

Nine percent said they plan to tighten eligibility for health benefits; 8 percent said they plan to drop coverage entirely. Forty-one percent of employers said they were "somewhat" or "very" likely to increase the amount employees pay in premiums -- though that would not necessarily mean employees are paying a higher percentage of the premiums. Employers could simply be passing along the same proportional share of the overall increase that they did in 2009.

With health care costs spiraling out of control, the provisions of the Affordable Care Act (ACA) can't take effect too soon. Americans' health care expenditures are expanding at triple the rate of wages. Pointing to data from the actuaries at the Centers for Medicare and Medicaid Services, the Center for American Progress warned last year that per capita medical costs are forecast to rise by 71% over the next decade. That would catapult the cost of the average family's insurance policy from $13,000 a year to over $22,000 by 2019.

As the Post detailed in 2009, business groups themselves are also ringing the alarm bell. A new report from the Business Roundtable concluded, "If current trends continue, annual health-care costs for employers will rise 166 percent over the next decade -- to $28,530 per employee." Antonio M. Perez, chief executive of Eastman Kodak and a leader of the Business Roundtable concluded:

"Maintaining the status quo is simply not an option. These costs are unsustainable and would put millions of workers at risk."

Mercifully, the status quo is changing, albeit not enough. The health care reform law passed this spring offers some relief for businesses and workers alike. In addition to federal subsidies for families purchasing insurance in the private market, the Times notes that the ACA will help companies "better afford insurance, including $40 billion in tax credits for small businesses and $5 billion to help companies pay for retiree health benefits." Still, benefits like lower cost exchanges for employees who have to spend more than about 9.5 percent of their income buying health coverage through an employer won't be in place for almost four years. "The new health law, which will expand health coverage to 32 million Americans starting in 2014," Kaiser reported, "will bring no immediate cost relief for most workers getting coverage in the workplace."

As Kaiser's Altman lamented, "The new law helps a lot of people in a lot of ways ... but in general it left employer-based coverage alone. That is what the politics of health care dictated and what the American people asked for."

With the economy continuing to do poorly, the cuts made by employers to their health plans may be what is required for more people to come to understand why the employer mandate is a weak construct. Though unpopular for no reason other than it is a tax, an enforced individual mandate is better because it has more hope of lowering each individual's potential costs by spreading them about. The only problem of course is the dependence on the insurance industry to try to control aspects of costs while providing affordable plans with low rate increases.

The next logic step if everyone has to pay is to standardize the coverage offerings among the insurers or move to socialized medicine.