Polls Show GOP Duping Americans on Debt Ceiling Hike Again

During their rare moments of candor, Republicans leaders agree with President Obama that failing to raise the U.S. debt ceiling would be "catastrophic." Two years ago, Speaker John Boehner acknowledged "that would be a financial disaster, not only for our country but for the worldwide economy." Senator Lindsey Graham concurred, warning that not lifting the debt limit would trigger "financial collapse and calamity throughout the world." As failed GOP vice presidential candidate Paul Ryan put it simply, "you can't not raise the debt ceiling."

Yet for the second time in less than two years, the GOP leadership is once again threatening to do just that. And just as sad, recent polling shows a majority of Americans once again seem to agree.

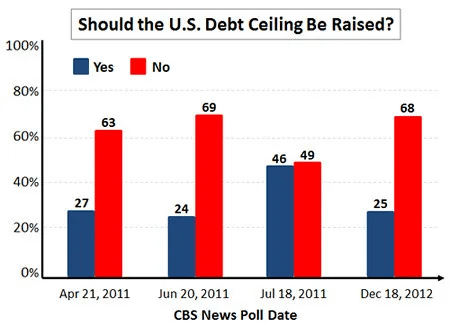

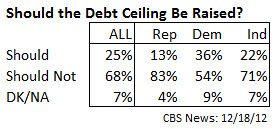

That disturbing nugget was largely buried in the wave of surveys showing disdain for Republican handling of the "fiscal cliff" deadlock. As the final question of a CBS News poll released on December 18, 2012 revealed 68 percent of respondents said the debt ceiling should not be raised:

Congress will soon decide whether or not to raise the federal debt ceiling, which is the legal limit on how much the federal government can borrow to pay for the budget deficit. Some people say the debt ceiling should be raised, because otherwise the country could default on its loans, causing severe problems for the U.S. economy. Other people say the debt ceiling should not be raised because the country owes too much money already, and raising it will cause long term economic problems. In general, do you think Congress should or should not raise the federal debt ceiling?

That result is both frightening and ironic. After all, CBS headlined its findings with "most predict 'major problems' if 'fiscal cliff' isn't averted," challenges which would pale in comparison to the economic calamity following a first-ever default. More depressing still, the results suggest a "Flowers for Algernon" moment in which Americans are unlearning the lessons of the last Republican debt ceiling hostage taking in the summer of 2011.

As the chart of CBS polling data above shows, two years ago large majorities (63 percent in April 2011, 69 percent that June) of Americans were against raising the debt ceiling. But as the crisis reached a boiling point--and the public learned more about the dire global consequences of a U.S. default--Americans began to back away from the rhetorical brink. On July 18, 2011, about two weeks before the sequestration deal that ended the impasse, a CBS survey showed that "support for debt ceiling increase doubles." Pew Research reported a similar dynamic. Its own poll released that same day found that by a 40 to 39 percent margin, the public was "split evenly on urgency of debt limit debate."

It was that July 2011 Pew survey which produced what Ezra Klein of the Washington Post called, "the scariest debt-ceiling poll I've seen."

Klein's fright was well-founded. Already worried about a default that would produce a "global financial panic that makes 2008 look like a warm-up," he lamented "a plurality of independents and a majority of Republicans think everything will be just dandy if we blow through Aug. 2 without raising the debt ceiling. Terrific."

And now even that meager process appears to reversing. In the spring of 2011 GOP all-stars like freshman Senator Pat Toomey (R-PA), Michele Bachmann and Sarah Palin mocked such "doomsday predictions", "outright blatant lies" and "scare tactics." But as the debt ceiling deadline loomed on August 2, 2011, about half of American came to understand the disaster certain to unfold if the United States did not pay its bills on time. As I noted that June:

A new analysis by the Bipartisan Policy Center concluded that failure to boost the debt ceiling by the August drop-dead window would force the U.S. Treasury to immediately slash spending by 44%. As The Hill reported, "On an annualized basis, the cut in spending alone is a 10 percent cut in GDP, BPC scholar Jay Powell told reporters."

Even a brief default, former McCain economic adviser Mark Zandi explained to TPM, would be cataclysmic:

If Congress fails to raise the national debt limit by early August, the Obama Treasury Department will have to choose between defaulting on obligations to the country's creditors--triggering higher interest rates and perhaps damaging the country's credit rating for months and years to come--or freezing outlays to contractors, entitlement beneficiaries and others who are also expecting prompt payment as well. In either case, the macroeconomic impact will be staggering, according to Zandi.

Now, thanks in large part to Republicans grandstanding and misinformation, a dangerous new veil of confusion is once again enveloping the American people. (It should be noted that Americans' confusion is even more profound than the recent CBS numbers show; other polls show that the public rejects cuts to entitlements and wants federal spending increased in most areas of the budget.) Once again, almost 70 percent believe the debt ceiling, the borrowing authority which must be raised, should not be increased. Or to put the Party of Lincoln's strategy another way, you can fool some of the people all of the time, and that's their target market.

If you need a reminder about what will actually transpire if the United States breaches the debt ceiling, Ezra Klein has a helpful--and horrifying--one here.

People also blame the GOP for obstruction, which is more important. What the public thinks is not as important in this case as it is that the business community an DC understand. It only makes it that much worse for Republicans if they default, and everyone sees they've been lied to and Obama was telling the truth. The more the GOP promotes this idea, the greater the consequences for them both if they default and burst their bubble like the assured Romney victory, and when they fold because they have to because they're lying- it would be very bad for the economy.The major risk here is that it weakens Obama and the Dems resolve and cave. That's the only way the GOP escapes the consequences of promoting this misinformation and benefits from it.

I wish for once, that Obama would just stand up to the GopTea Party and invoke the 14th Amendment and abolish the unconstitutional debt ceiling and get this over with. It is a bookkeeping artifact anyway and we do not need it.

When it was passed, it was useful as a mechanism to stimulate actual important discussions about budget priorities going forward. We should be having those discussions. We are not. Its usefulness is over, obviously, so get rid of it.